Ocado shares are more than 70% down so far in 2022 as the favourable environment created by the pandemic disappears into the rear view mirror and consumers start to tighten their belts in the face of a cost of living crisis.

Investors in the online retailer enjoyed a monumental rally during the pandemic as Ocado customers number soared as a result of lockdowns and consumers spending more on their online weekly shop. Weekly order numbers have continued to grow to a record high of 400,000 per week in May, but the growth rate has slowed and people are spending less.

However, many investors see value in the Ocado solutions and technology business which provides smart platforms to leading food retailers globally including Coles in Australia and Kroger in the US.

The Ocado share price may appear attractive after a quick glance, but here we outline three important factors to consider before buying Ocado shares.

Ocado are loss making

Over the past decade, technology businesses have been able to get away with making a loss during periods of high growth as investors look forward to them eventually turning profit.

There is weight to the argument Ocado is still in this period of high growth – especially in their solutions business – but this may start to wear thin.

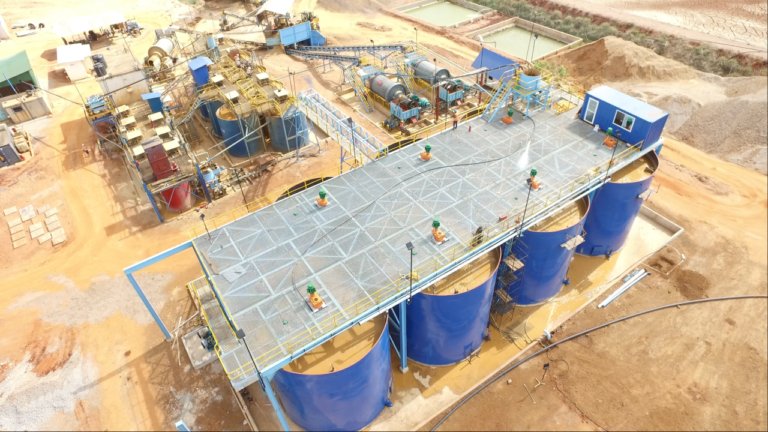

Ocado recorded a £212m loss in the first half of the year, but much of this was depreciation of plant and property associated with the rollout of their Ocado Solutions Customer Fulfilment Centres (CFCs).

Nonetheless, margins across Ocado’s retail business is tight and the rollout CFCs will be a cost for the foreseeable future.

Future revenue visibility

The retail business is highly cyclical and will likely suffer in any economic downturn. This has already been demonstrated in the first half of 2022 as revenue fell 8% to £1.11bn.

However, this is not the main source of future growth and investors will be watching the solutions and technology business mostly keenly.

Six new Customer Fulfilment Centres (CFC) came online internationally in H1 2022 to bring the total to 16 operation centres of 58 committed. Not only does this reinforce Ocado is still in a period of high growth, but provides clear visibility on future revenue growth.

Ocado will earn revenue from each new CFC and has the ability to add new modules to existing centres which would also increase revenue.

Ocado is in the process of establishing unrivalled infrastructure for the distribution food globally and investors will look forward to significant growth in revenue in the coming years as more CFCs go online.

There are also hopes the recent acquisition of Alberston’s by Ocado’s partner Kroger could lead to more CFCs being established.

Ocado is a potential takeover target

US private equity has long been eyeing UK supermarkets as potential takeover targets and Ocado’s partner Morrisons was acquired by CD&R for £7bn last year in a bitter takeover battle.

Although there has not been any specific reports thus far – and we stress ‘potential’ takeover target – the falling pound makes UK supermarkets more appealing to possible US bidders.

Ocado’s place in the UK market and global infrastructure certainly puts them on the wish for any potential acquirers.

Ocado Shares Valuation

As Ocado are loss making their are no earnings available for price-to-earnings multiples. Ongoing construction of CFCs mean next year profits, if any are made, will be minimal.

However, the construction of CFCs adds to Ocado asset base and book value. This makes Ocado’s Price-to-NAV an interesting metric. Trading at 2.3x NAV – which is set to fall as more CFCs come online – the value in Ocado is their infrastructure and value of this infrastructure, as opposed to earnings.