Originally recommended here at 17.6p, as Ironridge Resources its gold interests have since been demerged. Inits new structure as Atlantic Lithium (AIM:ALL) it announced that the fully-funded African focused lithium exploration and development project is on track to become West Africa’s first producing Lithium Mine.

The worlds demand for Lithium is growing due to its role in stored energy the recently the scoping study increased JOC resource to 21.3MT@1.31%Li2O resulting in a significant improvement in project economic and life of mine. Piedmonth Lithium is a £billion Nasdaq...

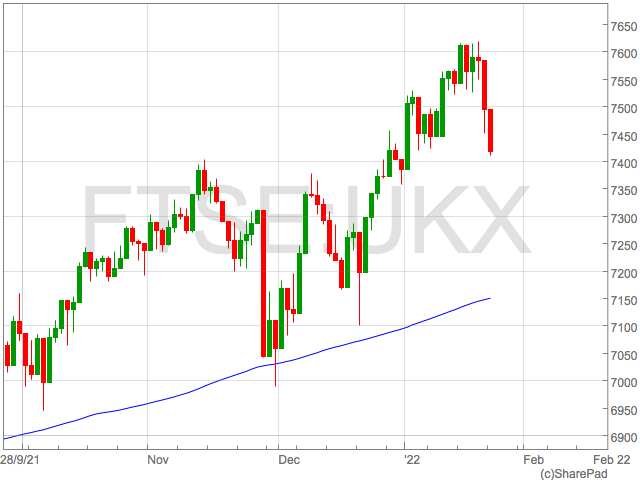

FTSE 100 bounces in dramatic equity volatility

The FTSE 100 staged a recovery on Tuesday as it bounced back from severe selling on Monday sparked by concerns over Ukraine and inflation.

The recovery in the FTSE 100 – and other European indices – started in the US session overnight where major US equity indices staged a remarkable recovery.

Having been 4% down on the session yesterday, the S&P 500 rallied to finish the session positive.

Such a dramatic turn around provided the FTSE 100 with the impetus to open higher to trade as high as 7,376, before falling back.

“Highly unusual movements on the US stock market yesterday are difficult to explain. While it is easy to say that the S&P 500 going from a 4% decline to a 0.3% gain in a single session was investors simply buying on the dip, nothing has changed in terms of the market headwinds. Therefore, we could be looking at a dead cat bounce rather than the start of a market recovery,” said Russ Mould, investment director at AJ Bell.

However, evidence from the US futures market highlights the concerns that drove yesterday’s selling are far from over.

S&P 500 futures were pointing to a lower open on Tuesday as the market faded yesterday afternoon’s sharp rally ahead of the Federal Reserve meeting tomorrow.

One of the key causes of recent volatility is the move away from easy monetary and back to normalisation which is causing problems similar to drug addicts suffering withdrawal symptoms.

“Investors are still bracing for a fresh bout of volatility this week, following the rollercoaster ride on Wall Street and fresh falls in Asia. Although indices lurched haphazardly back into positive territory on the Nasdaq and S&P 500, a heightened sense of nervousness remains about just how tough the Federal Reserve will talk and act to try and get increasingly troublesome inflation under control,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Streeter also underlined the importance of geopolitical tensions around Ukraine on market confidence.

“The deteriorating situation in Ukraine with the stand-off continuing as diplomats moves falter, is adding to heightened tensions on the markets, with fears a conflict could unleash a fresh front of chaos, including making the energy crisis facing Europe even worse.”

The FTSE 100’s rally was driven by cyclical sector including banks and miners – Standard Chartered was the FTSE 100’s top riser.

Marston’s sales dip over Christmas

Marston’s reported a drop in Christmas trading, however, remains confident that trading will strengthen.

In the 16 weeks to 12 January 2022, sales were down 3.9% amid the Omicron wave. In the last eight weeks, sales were down 8.8% as the government advised people to work from home.

Andrew Andrea, Marston’s boss, said he was confident that trading will return to normal. He said: “While the emergence of the Omicron variant and subsequent Government guidance temporarily impacted consumer sentiment, we remain confident that the strong trading momentum which we were experiencing prior to that will resume.”

“Indeed, there is growing evidence over the most recent of weeks of the New Year that consumer confidence is rebuilding, and guests are returning to our pubs in greater numbers, which is encouraging.”

Government borrowing in December almost hits £17bn

The UK government borrowed almost £17 billion in December, making it the fourth highest December total on record.

After the sharp rise in inflation, debt interest payments increased to a six-month high.

“We are supporting the British people as we recover from the pandemic through our plan for jobs and business grants, loans and tax reliefs,” said Rishi Sunak.

“Risks to the public finances, including from inflation, make it even more important that we avoid burdening future generations with high debt repayments.”

“Our fiscal rules mean we will reduce our debt burden while continuing to invest in the future of the UK.”

Bethany Beckett, UK economist at Capital Economics, commented: “As it stands, cumulative borrowing in 2021-22 is still on track to hit the OBR’s forecast of £183 billion.

“But we doubt that this will last: we expect RPI inflation to average 2.8 percentage points higher than the OBR’s forecast in 2022-23, which will push up total borrowing in 2022-23 to £105 billion, well above the OBR’s forecast of £83 billion.”

Royal Mail to cut 700 staff

Royal Mail has announced plans to cut 700 manager roles.

As part of a restructure, the group will let go of 700 managers which will lead to savings of £40 million per year.

The cost of restructuring will be an initial cost of £70 million, which will lead to lower profits from the year. Profits will fall from £500 million to £430 million.

“We intend to further simplify and streamline our operational structures to ensure an improved focus on local performance, and devolve more accountability and flexibility to frontline operational managers,” said the group.

Since Covid, there has been a dramatic increase in domestic parcels. According to the Royal Mail, there was a 33% increase in domestic parcels for the last quarter of 2021 compared to 2019 levels.

Five UK Lithium Shares to watch in 2022

Lithium is one of metals at the forefront of the Electric Vehicle revolution and is set to experience booming demand in the coming years. With Lithium prices soaring alongside metals such as Nickel, positioning in lithium shares will provide exposure to increasing adoption of EVs.

According to the International Energy Agency, 8.9kg of Lithium is required in the manufacturer of the average Electric Vehicle. The increased Lithium demand is integral to forecasts by S&P Global Market Intelligence that point to a 5,000 mt deficit in Lithium production in 2022.

This deficit is set to support Lithium prices through 2022 and beyond, presenting a significant opportunity for Lithium shares involved in the exploration and production of the metal.

Rio Tinto

Despite the recent set back of having their mining license revoked by the Serbian government in the wake of the Djokovic Visa debacle, Rio Tinto have not yet said Jadar Lithium project is dead.

If Jadar was to come online in 2029 a previously planned, it would make Rio Tinto one of the world’s largest Lithium miners and would supply around a third of Europe’s demand for Lithium batteries.

Rio Tinto’s inclusion within this selection of Lithium shares may have a giant question market over it with the Serbian government’s decision. However, Rio Tinto’s dividend reliability and exposure to copper makes it a solid choice for more conservative investors seeking EV demand boom exposure.

Cadence Minerals

Cadence Minerals has built a portfolio of metals and mining assets with a significant exposure to Lithium. This includes the Cinovec Lithium mine operated by European Metal Holdings, the Sanora project operated by Bacanora Minerals, and a series of projects operated by Lithium Technologies & Lithium Supplies in Australia.

The Cinovec project in has just received ‘outstanding’ results that saw its output estimate rise from 25,267 tpa to 29,386 tpa. The improvement in output forecasts combined with an upgrade to the quality of the resources meant the NPV of the project increased from $1.108B to $1.938B.

#KDNC – European Metals #EMH @CzechLithium PFS Update:

— Cadence Minerals Plc (@CadenceMinerals) January 19, 2022

~Outstanding Results from Cinovec – NPV8 increases by 74.9% from $1.1bn to $1.938bn (#lithium hydroxide at $17k / tonne)

“adds substantial value to the already exceptional potential”https://t.co/7ilyBiWc7p pic.twitter.com/aK9Gf40Xt9

The Cinovec mine is operated by European Metal Holdings which has a 49% stake in the mine. Cadence Minerals holds 8.7% of the equity in European Metal Holdings.

Cadence’s investment in Lithium Technologies & Lithium Supplies in Australia is currently subject to an option granted to Castillo Copper who are undertaking studies of the projects with a view to acquire 100% of the assets.

Cadence Minerals currently has a market cap of £36m and was recently tipped by Justin Urquhart Stewart in Daily Mail.

Trident Royalties

Trident Royalties is a mining streaming and royalties company with a diversified portfolio of metals including gold, lithium, copper and iron ore.

Trident Royalties listed on the AIM in 2020 and set about the acquisition of a series of mining royalties that will provide Trident Royalties, and their shareholders, with a source of income long into the future.

After the initial outlay by Trident Royalties, mining royalties provide an attractive benefit of capturing the upside in the price of metals, or increased production, without the need for additional capex.

One of Trident’s most advanced royalties is the Thacker Pass Lithium which is one of the largest Lithium resources in North America.

Trident holds a 60% interest in a 1.75% gross royalty on the asset which is set to produce 80,000 tpa Li2CO3 in Phase 2 of the mine.

Although Trident’s Lithium exposure set within a highly diversified portfolio, the exposure to a range of metals spreads the risk in a fast growing royalties company, and makes Trident one of the most unique Lithium shares on London’s exchanges.

Kodal Minerals

Kodal Minerals operates in West Africa and are currently exploring a raft of gold projects, as well as the Bougouni Lithium Project in southern Mali which Kodal highlight as their primary focus.

The Bougouni Lithium Project is comprised of three prospects with a mineral resource breakdown of:

Sogola-Baoulé: 12.2Mt at 1.1% Li2O

Ngoualana: 5.1Mt at 1.2% Li2O

Boumou: 4Mt at 1.02% Li2O

Having conducted a feasibility study in Q1 2020, Kodal identified the potential for a mining operation with a minimum 8.5-year mine life and a payback period of 1.7 years, and an IRR of 58%.

Kodal have recently received a mining licence and are working towards a final investment decision for the development and construction at the mine.

The #KOD team have been spending the last few days of the successful site visit on the ground in the sun at Bougouni; including CEO, Bernard Aylward and the technical team who are discussing future plans for the lithium development project. #Mining #lithium pic.twitter.com/w91tHzcExe

— Kodal Minerals (@KodalMinerals) January 20, 2022

Given the strong move higher in Lithium prices, Kodal are reviewing their 2020 feasibility study which is eagerly awaited by the market.

One must not discount Kodal’s gold projects as they provide the necessary diversification to reduce the risk of highly protective miners.

Cornish Lithium

Not to be confused with Cornish Metals, Cornish Lithium is still privately held and is yet to IPO.

However, having conducted a number of funding rounds – including a £12m raise on Crowdcube – the company has a significant number of shareholders that would welcome a liquidity event such as an IPO or trade sale.

Cornish Lithium was the first company to identify a significant Lithium deposit in the UK and has formulated to extract the metal.

The company has a number projects focusing on geothermal and granite deposits in Cornwall and recently closed an investment package worth up to £18m in December.

One to watch for a listing in the future, if its not snapped up privately beforehand.

FTSE 100 tanks on geopolitical tensions and inflation fears

The FTSE 100 fell sharply on Monday as geopolitical tensions rose following orders by the US and UK to remove diplomatic staff from Ukraine on concerns a Russian invasion was imminent.

The FTSE 100 was 1.01% at 7,418 at the time of writing in early trade on Monday morning. The German Dax was down 1.28% and French CAC gave up 1.5%.

‘’The threat of conflict breaking out on the doorstep is hanging over European indices, as hopes begin to fade that there will be fresh meaningful moves from diplomats. The tech sector jitters are continuing, unsurprising given the seemingly unstoppable slide of the Nasdaq composite and the march downwards of the S&P 500 on Friday,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

There was also ongoing strife in markets around the impact of interest hikes on technology shares. The Federal Reserve is set to hike a number of times this year and a move away from easy monetary policy has driven a rout in technology shares.

The selling began at the beginning of the year in US tech shares and is now evident in global tech shares that are viewed as being highly valued.

“Amid expectations that inflation appears more entrenched, which could lead to a more aggressive stance to combat soaring in inflation, Scottish Mortgage Investment Trust, which holds a raft of tech stocks, was yet again one of the biggest fallers on the FTSE 100 in early trade,” said Streeter.

UK Housebuilders were also big fallers on Monday as the investors continued to offload the shares in the face of soaring inflation that is eroding household spending and making mortgages less affordable.

Barratt Developments, Persimmon, Berkeley Group and Taylor Wimpey were all down over 4%. Barratt Developments was the FTSE 100’s top faller, down 7%.

Unilever was one the FTSE best performers as activist investor Train Partners takes a stake in the group amid a takeover battle with GlaxoSmithKline.

How Vietnam’s millennials will shape the country’s consumer economy

Though 2021 was painful for Vietnam, its economy is expected to bounce back this year thanks to continued manufacturing growth and a more promising Covid-19 situation as a growing majority of the country’s citizens become fully vaccinated.

Accounting for roughly 35% of the country’s population, Vietnamese millennials – those aged 18 to 38 years – are playing an increasingly more influential role in the economy and Dynam Capital continues to closely monitor their telling consumption trends.

As the first digital-native generation, they are driving widespread use of e-commerce platforms and other planks of the digital economy, and the pandemic has only accelerated this.

Interestingly, 60% of the participants in Dynam Capital’s recent survey on retail investors were in the 18-34 age group indicating further their prominent interest in investing. In addition, about a third of current millennial consumers are expectedto join the middle class by 2030.

This means businesses will have to adapt to the demands of the millennial generation, which has much different needs and expectations than their predecessors.

“There is more sophisticated demand from millennials,” said Nguyen Hai Khoi, head of investment at Digiworld. “Instead of saying ‘I need a laptop,’ it is more common to hear ‘I need a gaming laptop’ or ‘I need a laptop for design purposes’.”

The customer experience has also evolved in this respect, with millennial consumers shying away from products that cost less but have no after-sales service, or that have powerful specs but are hard to use.

“Another aspect of the customer experience means that consumers want to try, touch and feel products before buying them,” Khoi added. “We have seen lots of millennial consumers visit Xiaomi and Huawei stores to try out our new products.”

Hanh Tran wears two important hats on this issue. She is a millennial herself, and over the last 12 years she has worked on marketing campaigns for major brands such as Durex, Dutch Lady, Nivea and Samsung aimed directly at her generation.

“When we talk about young audiences, they’re all about trends and they’re ahead of the curve, and as marketers we have to be 10 steps ahead of them,” she explained. “We look at the time they spend on social media platforms, which tells you the quality of interaction, and we need to understand what would help us to capture their attention and move to action.”

Unsurprisingly, the rise of the millennial consumer has also spurred significant shifts in how companies advertise, with some moving completely away from traditional marketing channels, such as TV.

“Everything now centers around digital,” Hanh emphasises. “TV costs a huge amount of money, and companies are cutting that and moving to digital, where they can do so much more.”

The core relationship between brands and consumers continues to grow these trends. “It used to be that brands talked and consumers listened – a one-way pitch – but now it’s more about allowing the consumer to join a conversation,” she notes.

Hanh referred to the example of Coca-Cola allowing customers to print their name on Coke cans and how it allowed them to be part of a campaign. “You can’t do that with TV. Consumers feel like they identify with the brand, and they start interacting with it more.”

One brand that has had to reimagine its relationship with millennial consumers is Biti’s, the Vietnamese footwear company established in 1982. Through the 2000s and 2010s, Biti’s fell out of favour with younger customers thanks to stiff competition from leading global brands.

According to Nguyen Phu Cuong, marketing director at Biti’s, five years ago the company created a sub-brand – Biti’s Hunter – directly aimed at the new generation of consumers.

“The ultimate goal was shifting the product’s perception of ‘durable, but outdated and cheap’ into ‘international-standard quality, cool, and value-for-money’,” he added. “Achieving that goal led us to a holistic change in our approach to young consumers.”

Biti’s senior management discovered that these consumers are more pragmatic, prefer aspirational brands and have non-linear, multi-touchpoint shopping habits that demand fulfilling experiences.

In an effort to transform their product, brand and system, Cuong and his colleagues took a number of major steps, such as borrowing ‘cool’ equity by partnering with icons of the millennial generation, for example, Marvel, superstar singer Son Tung M-TP, and top fashion designer Cong Tri.

The company also emphasised its Vietnamese values, while also completely overhauling its retail operations to embrace e-commerce and provide more customised shopping experiences.

These moves have paid off. Biti’s Hunter has released a number of hugely popular shoes and is now attracting a younger audience.

Stories like this will be the way forward as millennials take over Vietnam’s consumer economy.

“In 2022, after going through many changes due to the pandemic, millennials will pay more attention to health issues,” Khoi said. “This includes items that help improve the quality of a living space, exercise equipment, and equipment to help make food healthier.”

“This is also the generation that lives with technology, and has the habit of shopping online,” he added. “In the coming years, this will continue to be developed.”