Introduction – has the market stopped caring about value?

The very essence of value investing is the search for securities which are incorrectly priced – where the market price is trading at a substantial discount to the intrinsic value of the underlying business. Sometimes this happens because investors are prone to behavioural biases such as extrapolation, herding and risk aversion, which can lead them to make emotional decisions, such as selling a cyclical stock at the low point of the economic cycle, unable to see how things will ever improve.

Mispricing can also occur when investors are forced – or choose – to invest in a ‘valuation agnostic’ way, without incorporating any fundamental analysis into their decision-making process. For example, UK pension funds have reduced their exposure to UK equities from above 50% in 2000 to around 3% today1, despite the UK equity market appearing to be one of the lowest valued in the world. This shift was largely driven by regulation, so the low valuation of UK equities was completely irrelevant (as was the low yield and high valuation of the fixed income securities they were buying).

For investors like us, who use valuation as a cornerstone of their process, this behaviour is welcome. When investors buy or sell indiscriminately, they push share prices further away from intrinsic value, creating opportunities to purchase significantly undervalued securities.

In this article, we explore how the rise in valuation-agnostic investing is influencing the opportunity set for those investors like us, who remain focused on fundamentals. We consider how the growth of passive investing, fast-trading hedge funds and retail speculation have increased the number of stocks trading far from their long-term value.

The rise of passive investing

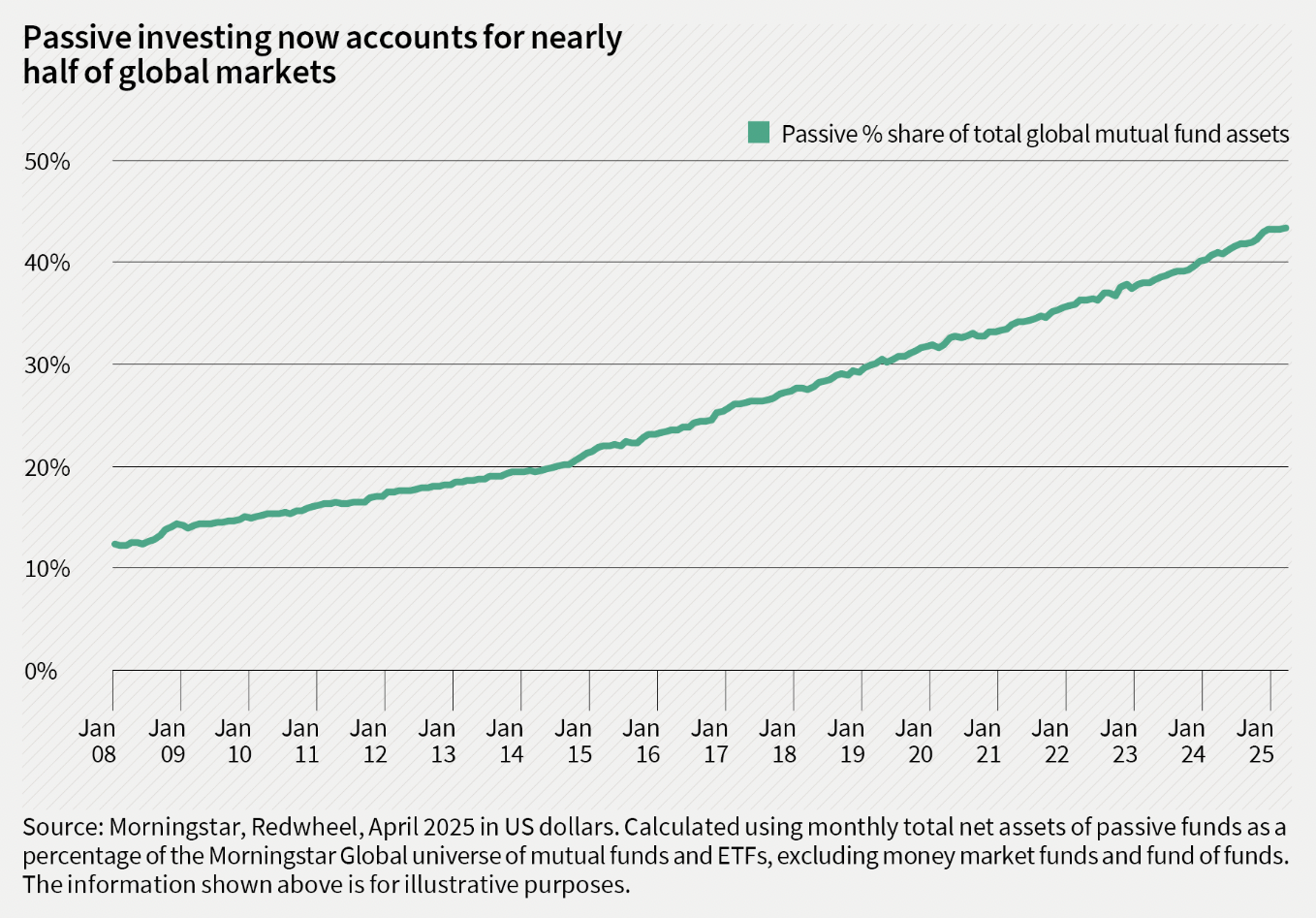

Passive investing has grown very significantly over the last twenty years and now accounts for almost half of all equity invested in mutual funds and exchange-traded funds (ETFs) globally2. Some of the largest index-tracking vehicles are now very big indeed, with the SPDR S&P 500 ETF Trust, iShares Core S&P 500 ETF and Vanguard 500 Index Fund each holding more than $500 billion in assets3.

As the share of market participants who care about fundamentals shrinks and is replaced by those who are indifferent to valuation, it must inevitably lead to mispricing. Mike Green of Simplify Asset Management sums it up as follows:

“Passive is really just the world’s simplest algorithm. Investors who analyse a company’s prospects and attempt to value businesses have been replaced by machines that are simply saying, ‘Did you give me cash? If so, then buy. Did you ask for cash? If so, then sell’.”4

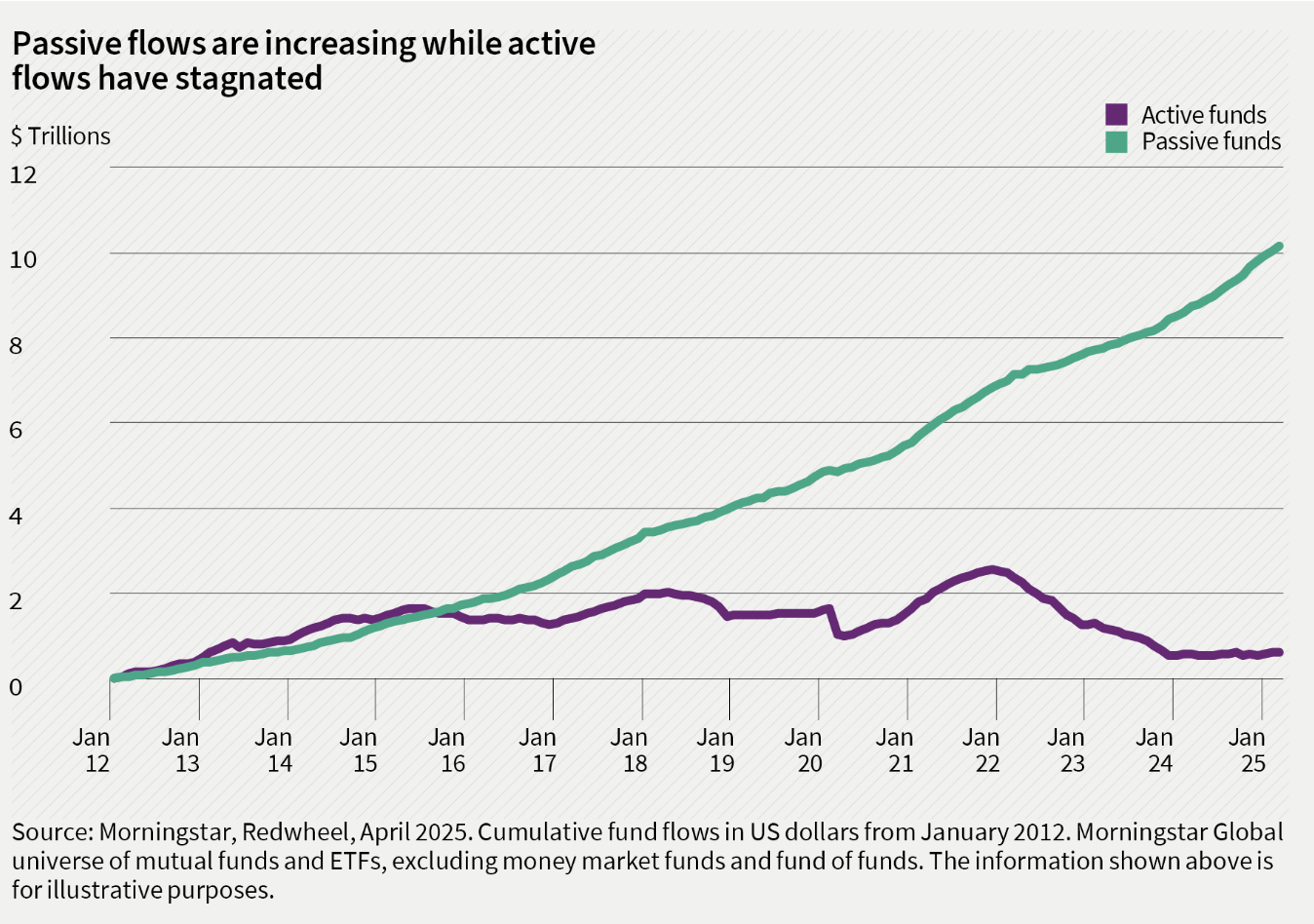

When those with no interest in valuation crowd out investors focused on what a stock is worth, the market’s price discovery mechanism begins to break down. The extent to which this is happening is visible in the chart below, highlighting the huge disparity in funds flowing into passive strategies compared to active strategies. Active managers, particularly those with a value-driven approach, are typically underweight expensive mega caps and overweight smaller, cheaper stocks5. As assets move from active to passive, these undervalued stocks are sold and the proceeds are increasingly allocated to larger more expensive stocks.

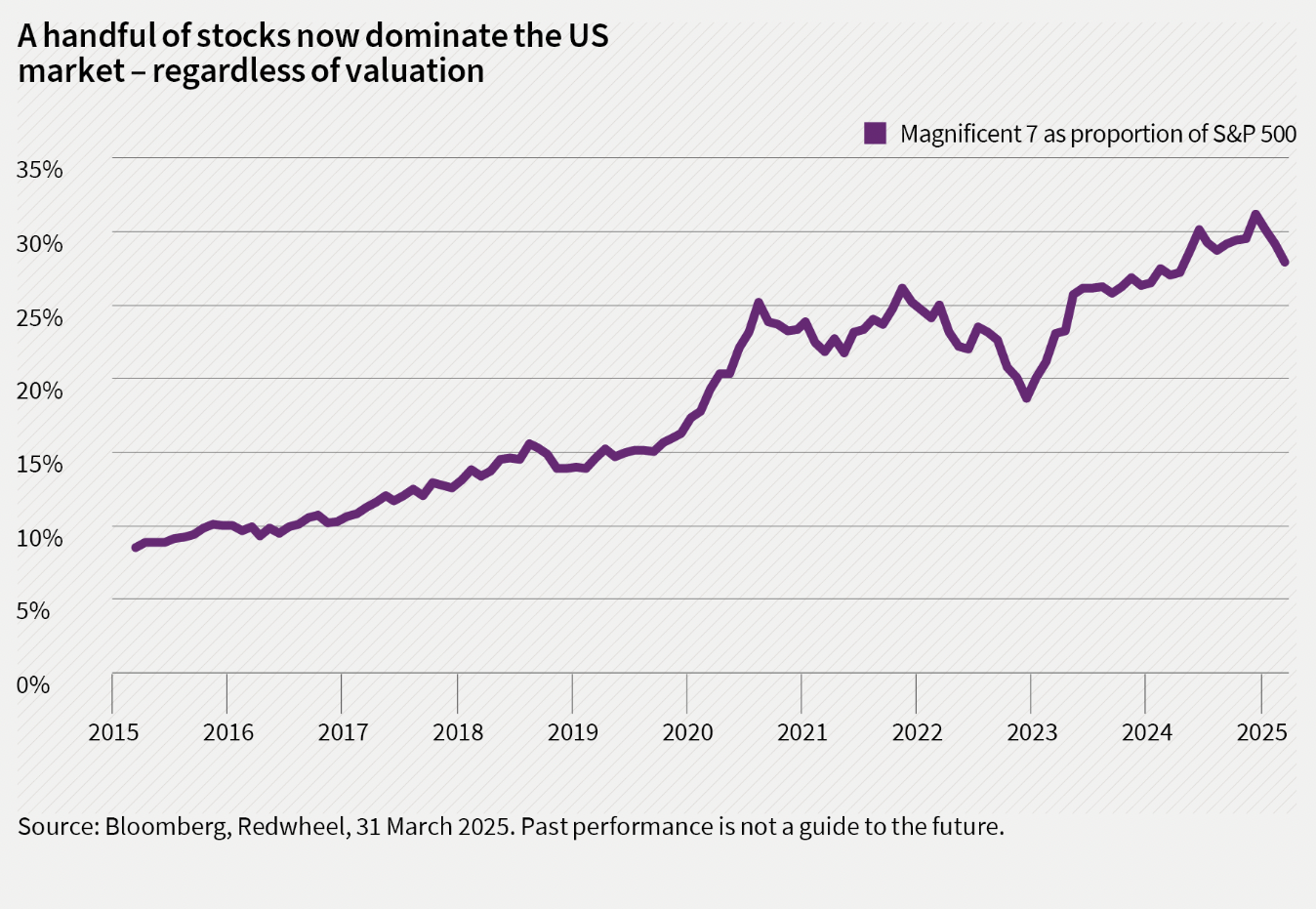

Passive has, in essence, become a giant momentum strategy – rewarding size and valuation indifference. The result is a self-reinforcing cycle where a handful of very large companies have come to dominate the index, regardless of fundamentals.

The growing influence of pod shops

‘Pod shops’ are hedge fund platforms that allocate capital to many independent portfolio managers, or ‘pods’, each running their own strategies, often with a sector or event-driven focus. The parent fund encourages its pods to focus on relative differences between stocks – buying one stock while shorting another (betting that its share price will fall) – rather than taking big bets on where the overall market is heading. This ‘market neutrality’ means they can apply leverage across the strategies while keeping risks tightly controlled. The structure aims to deliver consistent, low volatility returns – a key draw for institutional investors.

The incentive structure within pod shops is built around short-term, risk-adjusted performance. Portfolio manager compensation is closely tied to recent results and many pod shops even penalise managers for holding positions beyond a set period – often just 30 days. This encourages rapid turnover and a focus on near-term catalysts such as earnings releases, guidance updates or analyst revisions.

The scale of pod shops is significant. The two largest firms, Citadel and Millennium, manage $65 billion and $73 billion, respectively6. Their collective headcount has tripled since 20157, and their influence extends far beyond their assets due to high turnover and gearing. Gross leverage across multi-strategy funds has risen from 4x a decade ago to 12x today8. As a result, it is estimated that pod shops now account for more than 30% of US equity trading volume9.

This concentration of capital and trading activity makes them highly influential in determining short-term share price moves. Their activity is particularly visible around earnings season, where the reaction to results has become faster and more extreme. Positive surprises can trigger sharp rallies as the pods pile in, while disappointments often spark steep falls as they race to exit or take short positions.

The effect is particularly pronounced in the most liquid, widely followed stocks where pod shop activity is most concentrated. But, more broadly, the result is a market increasingly shaped by short-term flows and rapid reaction, rather than long-term fundamentals – further contributing to the mispricing of securities.

Retail day traders

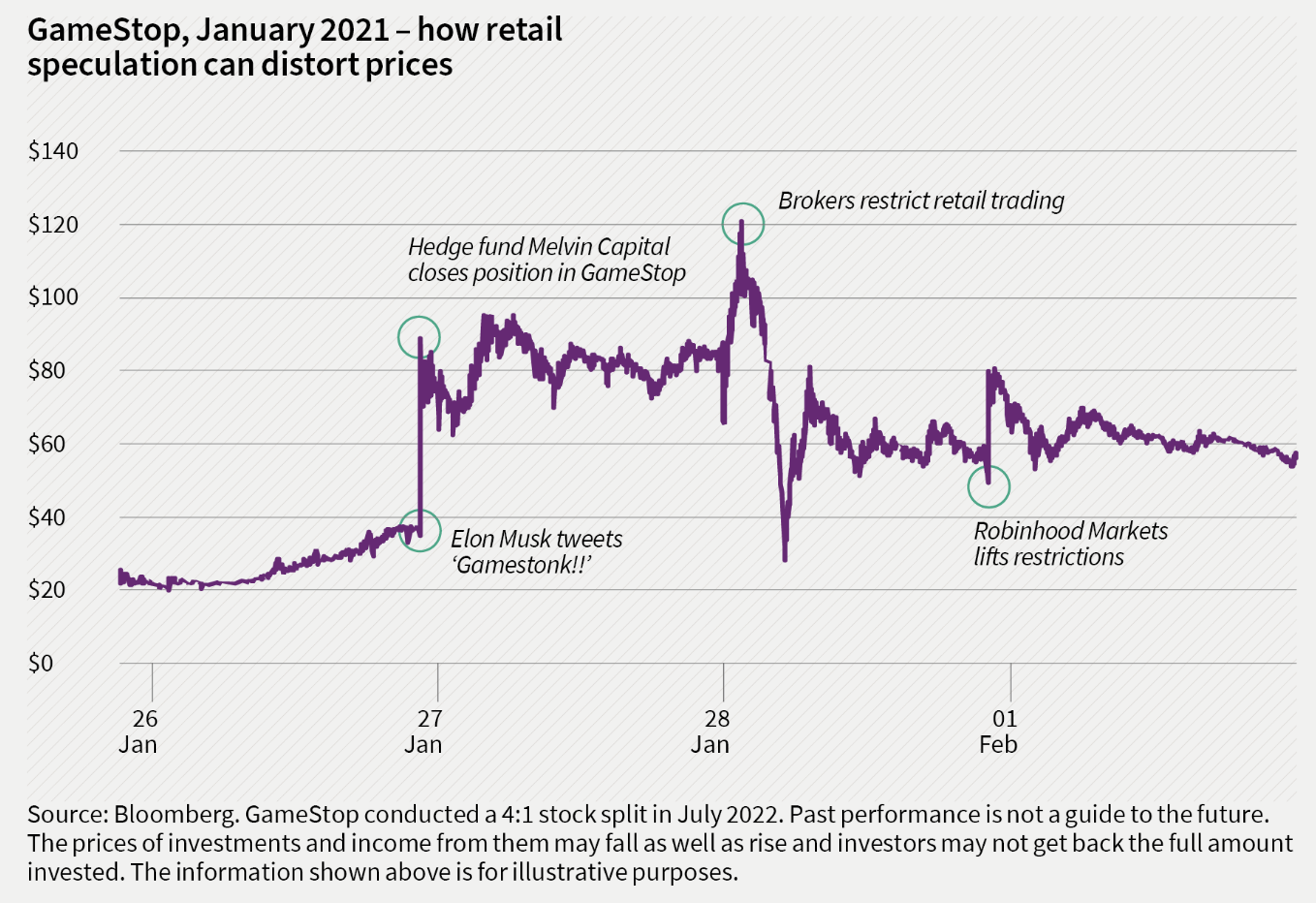

Meanwhile, the proliferation of retail day trading, fuelled by platforms like Robinhood and Reddit’s WallStreetBets community, has reshaped market behaviour in ways that extend far beyond previous cycles of rising individual investor participation.

Since 2020, retail trading volumes have grown dramatically. In 2021, retail investors accounted for 25% of total US equity trading volume, nearly double the share reported a decade prior10.

Several factors have contributed to this shift: easier access via commission-free apps, heightened market volatility during the pandemic, the influence of social media and government stimulus cheques that gave many individuals the means – and the motivation – to speculate.

The impact has, at times, been extraordinary, as best illustrated by the trading in GameStop in January 2021, which saw the stock swing wildly within hours – rising 82%, falling 77%, then jumping 150% – as coordinated retail buying overwhelmed institutional players.

How this creates opportunity

We believe the growth of passive investment strategies has driven the valuations of the largest stocks in the most popular markets – those receiving a disproportionate share of passive flows – significantly above their intrinsic value. Conversely, they are driving the valuations of many other stocks being sold down by active managers significantly below their intrinsic value.

The momentum-driven, valuation-agnostic approach of pod shops only reinforces this, as does the activity of retail day traders. The focus of all three groups is often on the same narrow set of stocks.

For disciplined, long-term investors, this can be frustrating – but it is also the source of opportunity. When share prices are driven further below the underlying value of the business, the potential for future returns increases.

What this means for Temple Bar

Whilst it is possible to view passive flows as an unstoppable steamroller, flattening anything that tries to get in its way, we believe this is a finite process. At some level of undervaluation, entire companies are bid for by competitors or private equity firms. Others use their low valuation to create enormous value by buying back their own shares. And eventually, the upper hand returns to the surviving stock pickers, and money flows out of passive and back to active.

Perhaps that point has already been reached. The recent increase in takeovers and share buybacks suggests that, in the UK at least, we may have reached the lower limit on valuations – and others appear to be stepping in to take advantage of the value on offer.

As far as Temple Bar is concerned, our approach is rooted in long-term fundamentals and a disciplined focus on valuation. Market dislocations of any sort can help widen the opportunity set for investors like us. If we are now entering a period where valuation starts to matter more, that should prove a favourable environment for our strategy.

Conclusion: why value still matters

The growing influence of valuation-agnostic investors presents both challenges and opportunities for fundamentally driven investors. A key challenge is that, for periods of time, valuation may be ignored. Share prices can move significantly on short-term momentum or flows, while robust undervalued businesses are overlooked. This can be frustrating for disciplined, long-term investors. But it also creates opportunity. If fundamentals are being sidelined, the number and scale of pricing anomalies should increase, offering more chances to buy good businesses well below their intrinsic worth.

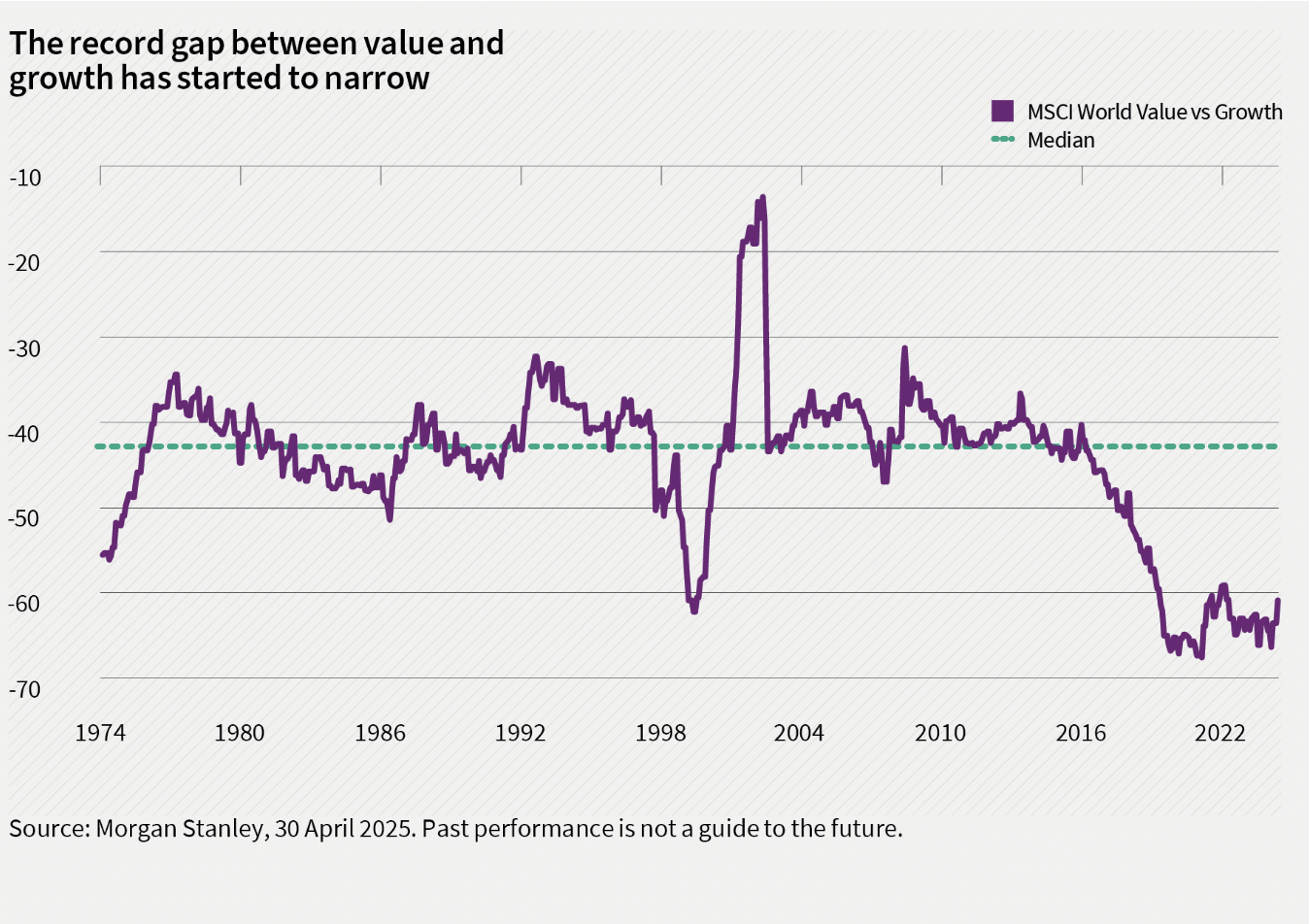

Although fund flows still appear to favour passive strategies, there is strong evidence that fundamentals are reasserting themselves in markets. The valuation gap between value and growth stocks, which had reached historic extremes, has started to narrow. Outside the US, value has been outperforming growth consistently. Even in the US, there have been periods this year when value has shown clear relative strength. As far as the UK stock market is concerned, the recent uptick in takeovers and share buybacks also suggests that others are beginning to take advantage of the abundant value on offer.

For Temple Bar, this environment is encouraging. We continue to focus on fundamentals and valuation – and we believe that, as the market continues to rediscover the importance of value, our approach is well placed to benefit.

1 Source: Portfolio Institutional, February 2025

2 Source: Morningstar, March 2025

3 Source: Company websites, Redwheel, April 2025

4 Source: Yes, I give a fig, September 2024

6 Source: Company websites, April 2025

7 Source: Goldman Sachs, April 2024

8 Source: Rupak’s Substack, March 2025

9 Source: NSP Group, March 2024

10 Source: The Retail Investor Report, August 2023

Past performance is not a guide to the future. The price of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This article is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

The statements and opinions expressed in this article are those of the author as of the date of publication.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.