Berkeley is now expecting forward sales of properties to reach £1.7bn by 31 October

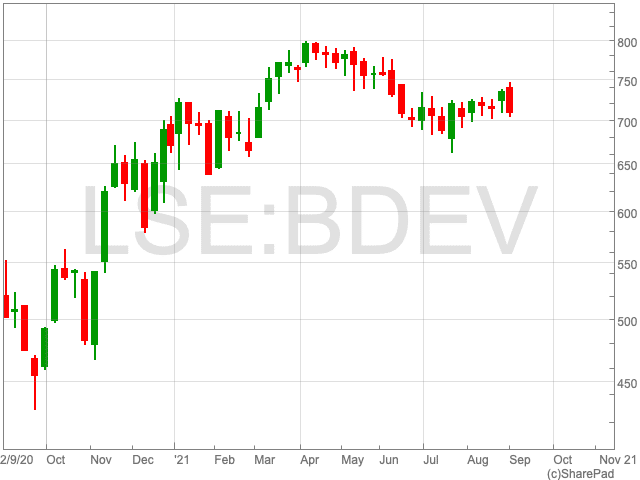

Berkeley (LON:BKG), the London-listed homebuilder, released a trading statement on Friday morning ahead of its anticipated AGM.

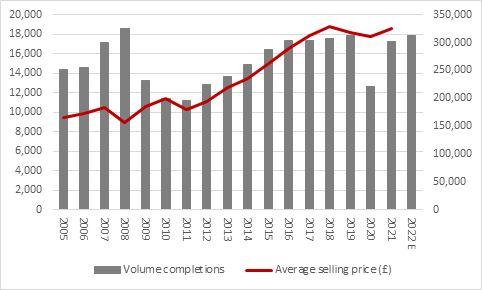

The FTSE 100 firm reported that reservations have recovered to levels from before the pandemic, while the group feels confident about its ability to earn profits of at least £518m for the year ending in April 2022.

Berkeley is now expecting forward sales of properties to reach £1.7bn by 31 October, when the group reaches its half-year end.

The homebuilder will pay £451m to shareholders from a pending return of capital and it intends to allocate a further £228m of surplus capital to increasing its land buying, allowing it to capitalise on favourable market conditions.

The Berkeley Group share price is up by 0.44% to 4,788p early on Friday morning.

Commenting on the results, Steve Clayton, HL Select fund manager said: “We hold Berkeley in our HL Select UK Growth Shares fund because of its strong cash generation. Berkeley takes on the big, complex projects that rivals find daunting. That means it can buy land cheaply, because it can be the only one that turns up to the auction. Their development expertise allows them to turn cheap, brownfield sites into premium developments, making fat margins in the process. Right now, conditions are good.”

“Yes, there are cost pressures out there, especially for building materials. But selling prices are rising, leaving profitability strong. Reservations are back to pre-pandemic levels, suggesting an increase of around 25% over 2020 levels as the London market comes roaring back to life. The group’s confidence is shown in their comment that the next shareholder return of £141m could be made via share buy-backs.”