Heathrow is pressing for UK travellers to go to America without restrictions

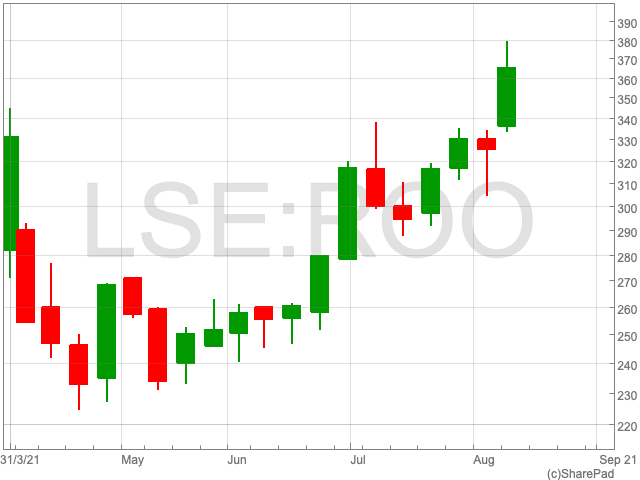

Heathrow airport reported an increase in passenger numbers in July, while urging America to ease its restrictions on passengers travelling from the UK.

During July, Heathrow dealt with 1.5m travellers, a 74% increase on the same month a year before, although the number is still down by 80% from levels seen before the pandemic.

It said the improved numbers were down to the government’s easing of restrictions, although it added that Heathrow is yet to see the impact of the decision to allow vaccinated people from the USA and the EU to come into the UK without having to quarantine.

However, travellers heading to America have not yet been allowed to make the journey without restrictions.

Having reaped the benefits from North American travellers coming into the country, Heathrow is now pressing for the UK travellers to be able to do the same going the other way.

“With fully vaccinated US visitors now able to travel to the UK without the need to quarantine, the joint UK/US travel taskforce must capitalise on the UK’s world-leading vaccine rollout and reach a reciprocal agreement for fully vaccinated UK travellers,” the airport said.

Heathrow’s chief operating officer, Emma Gilthorpe, was optimistic over the outlook for the travel industry in a statement, but reaffirmed the need for the government to act.

“The job though is far from complete. Government must now capitalise on the vaccine dividend and seize the opportunity to replace expensive PCR tests with more affordable lateral flow tests.”

“This will ensure travel remains attainable for hardworking Brits, desperate for well-earned getaways and keen to reunite with loved ones before the summer travel window closes.”