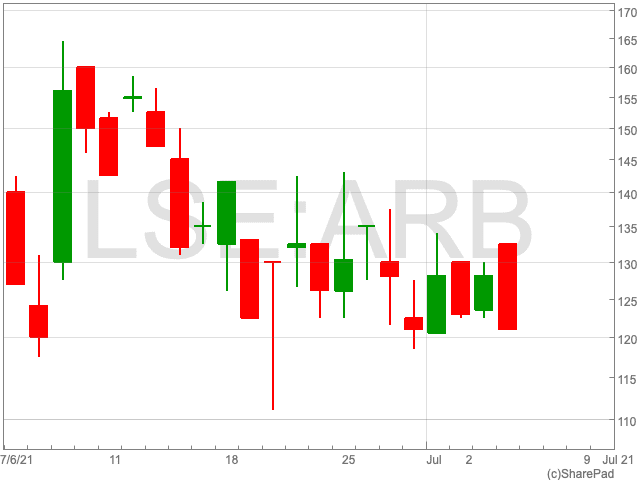

Argo Blockchain Share Price

The Argo Blockchain share price (LON:ARB) continued its steady decline throughout June, falling by 3.15% over the past month. From its high-point of 284p in the middle of February, the Argo Blockchain share price is down by well over 50%, sitting at 121.55p at the time of writing.

While Bitcoin keeps threatening to go up or down, the mining company made an announcement today, which could impact the outlook of the Argo Blockchain share price.

Argo Blockchain Considers Secondary Listing

Argo Blockchain confirmed on Tuesday that it is considering a secondary listing in America on the Nasdaq, although it hasn’t yet decided when.

The Bitcoin miner said its proposed listing depends on market and other conditions, and cannot guarantee that the proposed listing will be completed.

Operational Update

In June, Argo Blockchain mined 167 Bitcoin, up by one compared to May, bringing the total number of Bitcoin mined in 2021 to 883.

Based on daily foreign exchange rates and cryptocurrency prices in June, mining revenue for the month came to £4.36m, down from £5.51m in May.

Argo Blockchain now owns 1268 Bitcoin.

Bitcoin

Bitcoin traded below $30,000 in June, the first time since January as China strengthened its regulations giving rise to fears of a crackdown across the world as well as a reluctance of institutions to invest.

Peter Wall, Chief Executive of Argo said: “June has seen big changes in the cryptocurrency sector, with the reduction in total global hash rate and mining difficulty as mining machines have come offline in China. We’ve seen the global hash rate drop from over 150m TH/s to just 90m TH/s in the space of a month and mining difficulty adjusted to reflect this reduction.”