Zephyr Energy was one of the best performing UK stocks throughout the first half of the year

Zephyr Energy (LON:ZPHR), the oil and gas company, confirmed on Monday that it will be able to commence drilling in line with its forecasted timetable as the company gave an update on the Paradox Basin, Utah.

Zephyr announced that Cyclone plans to commence mobilisation of Rig #34 to the State 16-2LN-CC well site on Monday.

“Once on site in the coming days, the equipment will be rigged up over a period of a week in preparation for drilling, and Zephyr remains on track to spud the well before the end of July. Drilling is expected to take approximately 20 days following spud. Further updates will be provided in due course,” Zephyr said in an update released on Monday.

At the back-end of June, Zephyr announced the signing of a drilling contract with Cyclone in an effort to secure Cyclone Rig #34 for the purpose of drilling the State 16-2LN-CC appraisal well.

Last winter, the same rig successfully and safely drilled Zephyr’s State 16-2 vertical well to a total depth of 9,745 feet in less than 19 days, a record performance versus historical drilling in the northern part of the Paradox Basin.

Rig #34 is fully capable of drilling to the planned depths and pressures that are expected at the State 16-2LN-CC well.

Colin Harrington, Zephyr’s chief executive, commented: “I am delighted that the pieces are coming together for our forthcoming drilling programme, enabling us to commence drilling in line with our forecast timetable. With permitting and site preparation completed and rig mobilisation now commencing, we are in full countdown mode ahead of this highly anticipated drilling effort.”

“Our key objectives are to drill a safe, responsible and successful well, and I’d like to thank our technical team and contractors for their meticulous preparation in helping us deliver on these objectives.”

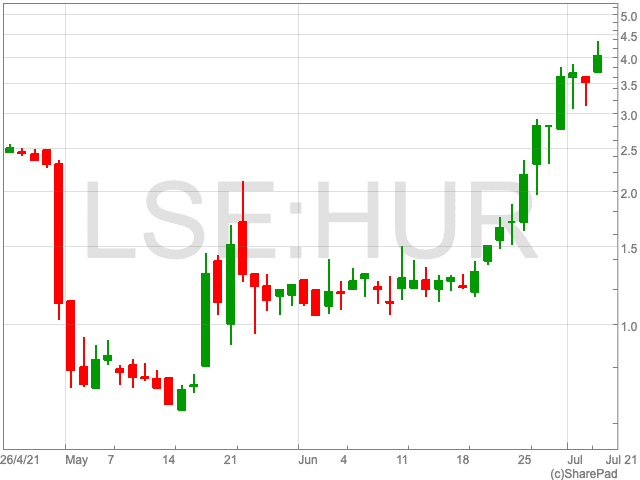

The Zephyr Energy share price is up by 61.1% over the past month.

The oil and gas company, with projects in Utah, North Dakota and Colorado, has seen its share value rise on account of its low debt, minimal fixed costs and active deal pipeline.

With a 552% increase over the past six months, Zephyr Energy was one of the best performing UK stocks throughout the first half of the year.