Victorian Plumbing has become one of the largest retailers of bathroom products in the UK. Online retailers are picking up a greater share of the market and this is being led by Victorian Plumbing, which is growing much faster than the market as a whole.

Existing shareholders sold just over one-third of the shares in issue and raised £285.9m in the flotation.

The money raised by the company mainly went on paying the expenses of the flotation. There is plenty of cash in the bank and the business is cash generative. The dividend policy is to pay shareholders up to one-fifth of earn...

UK property transactions cool down in May as stamp duty holiday comes to an end

There were 114,940 residential property transactions in total in May

UK property transactions are down in May, as the end of the stamp duty holiday appears likely to bring about a cooling of the housing market.

Last month there were 114,940 residential property transactions in total, as confirmed by the Office for National Statistics (ONS), 3.9% down compared to April 2021, a month before.

House prices have soared over the past 12 months as the stamp duty holiday was introduced by Rishi Sunak.

However, as the end of the policy draws near, the evidence is suggesting that sales are beginning to slow down.

Sam Mitchell, CEO of online estate agent Strike commented: “Despite property transactions easing in May for the second month in a row, numbers remain well above pre-pandemic levels with buyers and sellers scrambling to complete before the stamp duty holiday deadline at the end of this month,” said Mitchell.

“Now with only days left until the stamp duty holiday deadline, we expect property transactions to skyrocket, similar to the frenzy we witnessed in March before the original deadline. Some may be expecting a drop after the stamp duty holiday has come to an end, but with the tapering off period until October and the Government’s lending scheme combined with low interest rates, there are still plenty of factors to keep the market bubbling into the Autumn.”

“Plus, with the extension of lockdown restrictions announced last week, buyers will no doubt still be considering a home that matches their new lifestyle, whether that’s somewhere with more green space or perhaps closer to family.”

John Eastgate, managing director of Property Finance at Shawbrook Bank, added that “re-mortgaging levels are therefore also likely to receive a boost as homeowners and investors choose to fix and secure another few years of low rates.”

Brent crude oil price goes past $74 as US/Iran talks stall

Ebrahim Raisi elected as leader of Iran

The price of Brent crude oil is creeping higher again on Tuesday, as demand keeps picking up, while talks between the US and Iran over the lifting of sanctions appear to be stalling.

Early this morning Brent crude oil went past the $74 mark, before retreating somewhat heading into the afternoon in the UK.

Further to the US talks, Ebrahim Raisi has been elected as leader of Iran, which could add further complications, thereby delaying a final outcome.

“We support the negotiations that guarantee our national interests. … America should immediately return to the deal and fulfill its obligations under the deal,” Raisi said according to a Reuters translation.

As the US and Europe continue their recoveries from the pandemic, energy demand appears to making a strong recovery.

“Oil prices are on the march once more on supply concerns, helping to lift index heavyweights BP and Royal Dutch Shell and fuelling the FTSE 100’s rise,” said Russ Mould, investment director at AJ Bell.

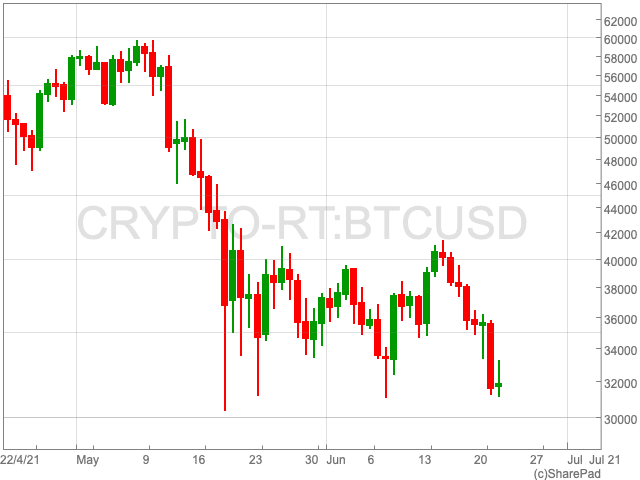

Bitcoin falls as Chinese government ramps up crackdown

China accounted for 65% of worldwide bitcoin production last year

After staging a mini-recovery at the beginning of June, bitcoin has crashed again, as the Chinese Communist Party ramps up its crackdown on mining and trading.

Bitcoin is down to $31,522 at the time of writing, from just under $41,000 two weeks ago, as Beijing called on major banks to reinforce the ban.

In May China’s cabinet, the State Council, pledged to come down on mining and trading in an effort to mitigate financial risks.

“People still react strongly to actions from China that create uncertainty so this is likely to reflect negatively on the bitcoin price,” said Ruud Feltkamp, chief executive officer at at crypto trading bot Cryptohopper.

“China is rolling its own cryptocurrency and has every incentive to have as little competition as possible … I think we will see miners leaving China and relocate where there is spare or cheap energy.”

According to data from the University of Cambridge, bitcoin mining in China makes up around 65% of worldwide production last year.

Since China makes such a high proportion of the world’s bitcoin, a change in regulations is capable of creating a massive swing in the price of the cryptocurrency.

Payment platform Alipay, owned by fintech company Ant Group, confirmed that its intention to implement a system to monitor major websites to track illegal crypto transactions.

Some analysts are saying that recent price movements mean the cryptocurrency may have officially seen the end of its bull market.

Bitcoin’s 50-day moving average recently crossed its 200-day moving average, a phenomenon known as the “death cross”, which has been known to precede heavy crashes.

Having said that, when it comes to bitcoin, a death cross can signal the the worst is over, as seen in 2017 and 2019.

Sotheby’s recently confirmed it will accept cryptocurrency as payment for a rare diamond which is expected to fetch more than £10m.

Government borrowing eases in May but scars remain

Government debt is now at £2.2trn

Government borrowing dropped in May compared to 12 months ago, as lockdowns are easing and the UK continues its recovery.

Borrowing stood at £24.3bn, £19.4bn lower than May last year, as government spending continued to surpass tax income.

With measures such as the furlough scheme, borrowing has been reaching record levels.

Government debt is now at £2.2trn with all the borrowing that has occurred over the past year. This amounts to a rate of 99.2% of GDP, a rate last seen in the 60s.

The Office for National Statistics (ONS) reckons that the government borrowed £299.2bn during the financial year ending in March.

Danni Hewson, AJ Bell financial analyst, comments on today’s government borrowing figures:

“How you look at today’s public sector finances depends if you are a glass half-full or empty person. On the one hand borrowing in May was down by more than £19 billion compared to the previous year, on the other it was the second highest figure for May since records began and almost £19 billion more than May 2019,” said Hewson.

“Income was up by £7.5 billion compared to the same time last year, helped along by a 133% increase in fuel duty and an almost 90% leap in stamp duty income but there’s still a huge gap between what’s coming in and what’s going out and interest payments on all that debt has risen substantially, up 26% year on year, though much of that rise is down to changes in RPI.”

“But the gap is narrowing as the economy heals. Furlough costs were down a whopping 75% as the country went back to work and, though it doesn’t help with tax receipts, the fact that income from alcohol duty was down 20% reflects changing fortunes as people are able to reengage with friends and family.”

“The pandemic has left big scars on the nation’s finances and reopening is a salve but one that needs careful application. Too much, too soon and those inflation worries that have caused so much concern will come to bear. Not enough, too slow, or if variants demand another reverse then there will be difficult conversations about spend vs taxation. But today feel like a glass half full day, more income, less spend and a gentle foot on the accelerator.”

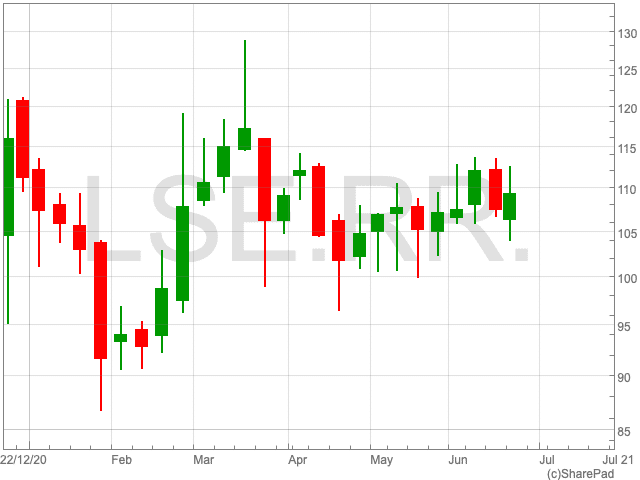

Markets shake off Fed fears as FTSE 100 consolidates above 7,000

The FTSE 100 consolidated its position above 7,000 once again on Tuesday, up by 0.31% during the morning session, or 21.67 points. US stocks rallied hard on Monday, while Japan’s Nikkei 225 produced a notable comeback on Tuesday.

“Well that didn’t last too long. After getting into a lather about the accelerated timetable for potential interest rate hikes announced by the US Federal Reserve last week, markets seem to have regained their poise,” says AJ Bell investment director Russ Mould.

“The catalyst seemed to be messaging from Fed officials which softened the hawkish tone of last Wednesday’s meeting, plus also a realisation that any rate increases are still two years away.”

“Meanwhile the dollar fell overnight and yields on long-term bonds were rising once again, leaving the past few days’ volatility looking like a brief hiccup rather than a major speed bump for markets. Oil prices are on the march once more on supply concerns, helping to lift index heavyweights BP and Royal Dutch Shell and fuelling the FTSE 100’s rise.”

Commercial property landlords British Land and Land Securities were also up strongly on recovery hopes as the former confirmed plans to commence construction on a new tower block in east London.

FTSE 100 Top Movers

Heading up the FTSE 100 during the Tuesday morning session is Land Securities (4.44%), British Land (4.28%) and Royal Dutch Shell (2.68%).

At the other end of the index is Just Eat (-2.24%), DS Smith (-2.27%) and Hargreaves and Lansdown (-2.07%).