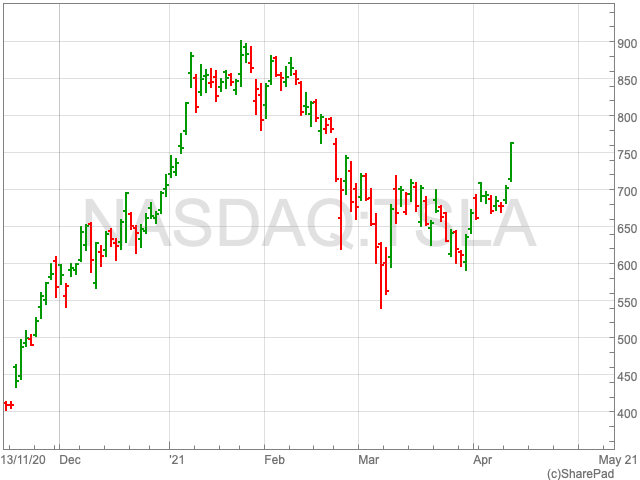

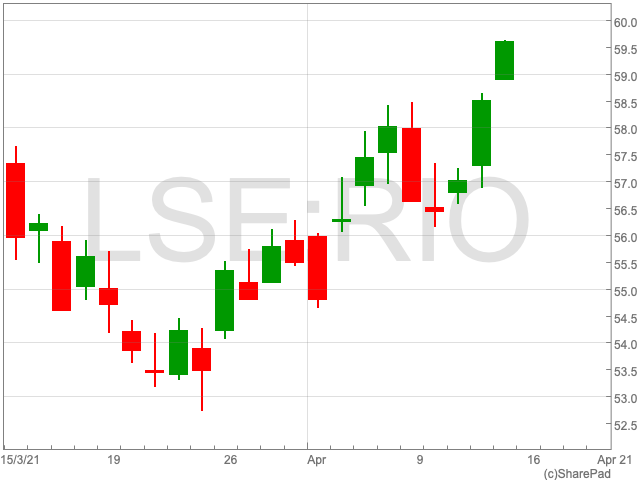

Rio Tinto Share Price

Rio Tinto’s share price (LON:RIO) is up by 2.96% on Thursday to 5,959p. It is a continuation of a recent trend for the mining company which has grown by 6% over the past month, although Rio remains down from its all-time high of 6191.7p in February 2021. After shareholders in the mining company received their $5.17 per share dividend today, they will be wondering whether the company, founded in Andalusia, Spain in 1873, remains a viable investment option.

Iron Ore

A month ago UK Investor Magazine reported that the Rio Tinto share price could be vulnerable to its overweight iron ore exposure. However, in recent days and over the past month the FTSE 100 company has continued to benefit from its reliance on the commodity.

Iron ore prices have been picking up again on tight near-term supply, helping to drive up Rio Tinto. Benchmark iron ore futures in China extended gains for the third session in a row, closing at the highest price in over a month. Deliveries from Australia and Brazil – two of China’s largest suppliers – dropped by 4m tonnes to 24m tonnes as of April 9 from the week before, according to data from Mysteel consultancy.

“Domestic demand and consumption driven by overseas economic recovery also helped sustain iron ore prices,” analysts with Huatai Futures wrote in a note.

However, while iron ore was the best performing commodity during 2020, these supply and demand factors may not last, which could cause the Rio Tinto price to come back down. While iron ore prices are way way above the levels seen a year ago, they have eased since hitting levels last seen in 2011 in early March.

Furthermore, Australia’s office of the chief economist says there are a number of factors causing downward pressure on prices over the coming months. Firstly, Brazilian output is expected to recover towards the end of 2021. While the Chinese government could be phasing out some of its stimulus measures, thereby reducing demand-side pressure on the price of iron ore.

Prices are expected to halve by the end of next year and then gradually decline to reach $72 a tonne in real terms by the end of 2026. In that case Rio’s upwards movements over the past month, and its massive growth since the beginning of the pandemic, could come into question.