Boohoo shares (LON:BOO) are stirring interest among investors again as the fast fashion brand emerges from the pandemic in tact. However, the next few weeks could be telling for investors interested in the online retail giant as the company faces up to the prospect of a tax hike from the UK government and an outright ban from the US authorities.

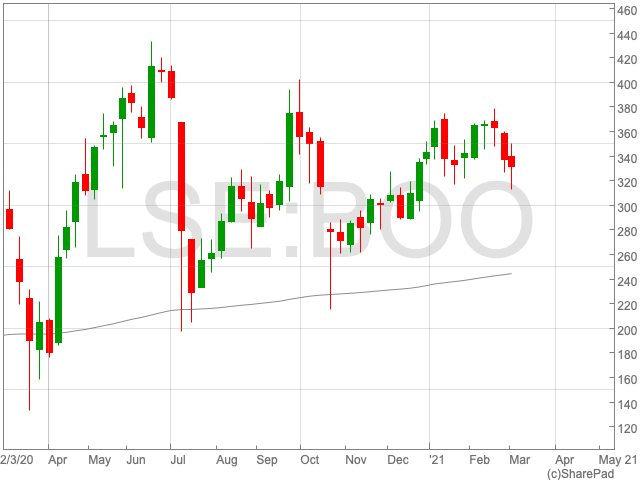

Boohoo share price

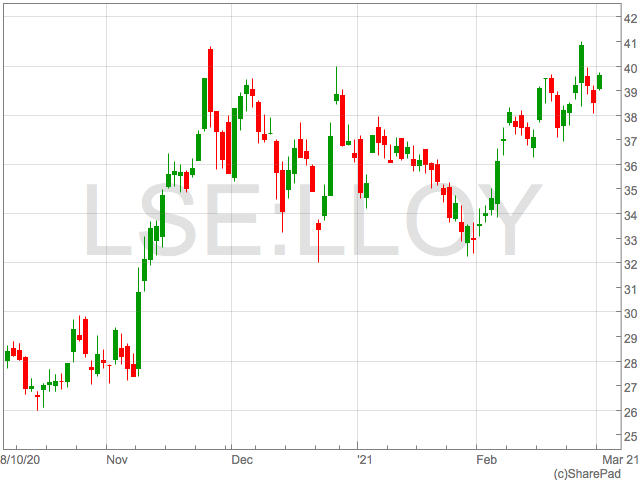

Boohoo’s share price tumbled in July by over 20% to 210p per share as news emerged of poor factory conditions and low pay at some of the company’s suppliers. However, the fast fashion brand showed resilience and recovered well in the following weeks by convincing investors that they planned to turn the situation around. At the end of January, when Boohoo announced its acquisition of Debenhams, the company’s shares jumped up but have since retreated.

Over the past 12 months, taking into account the pandemic and the factory scandal, Boohoo’s share price has risen by over 10% to 333.42p per share. Asos, one of the online retailer’s main competitors, saw a dramatic rise in its share price during 2020, from 2,945p per share to 5,646, an increase of over 90%. However, over a period of five years, Boohoo’s share price, up 669%, has far outperformed Asos, which is up 84%.

Boohoo’s outlook

Boohoo’s revenue growth over the past year has been strong across all regions. In January the retailer released a trading update. Four the final four months of 2020, Boohoo saw its revenue grow by 40%, up to £660.8m. More specifically, in the UK, the US, the rest of Europe and the rest of the world, revenues were up by 40%, 51%, 32% and 34% respectively. The fashion brand anticipates revenue growth between 36% and 38% for the financial year to 28 February 2021. Boohoo also expects to deliver an adjusted EBITDA margin for 2021 at around 2021.

Risks

Boohoo’s price-to-earnings (PE) ratio is at 58.4. This is a high PE ratio, which appears expensive, however it could also reflect the company’s potential for high earnings growth.

While Boohoo recovered well from the factory controversy in 2020, the issue may not have been put to rest. The company could be facing a ban on importing into the US as an investigation has been launched into the its handling of claims of “modern-day slavery”.

Online retailers, including Boohoo, could also face the prospect of a tax policy aimed at the companies that have profited from the unique nature of lockdowns.