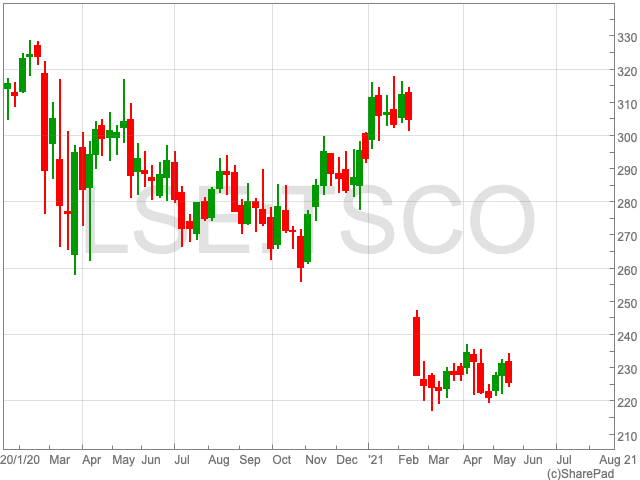

Tesco Share Price

The Tesco share price (LON:TSCO) held steady during the pandemic, as supermarkets benefitted from more people staying at home. Over the Christmas period, and into the new year, it surged above 300p per share before a sharp dive below 230p share, where it remains now. Investors are curious about the cause of the dip and if it represents a buying opportunity.

Special Dividend

The current Tesco share price is concerning for investors. However, it does not neccessarily reflect the outlook of the FTSE 100 supermarket chain. Following the $10.6bn sale of its businesses in Thailand and Malaysia to Dhanin Chearavanont’s CP Group, Tesco made a £5bn special dividend payment.

The payment amounted to 50.93p per share, or just over 21% of Tesco’s market cap. The sale reduced the supermarket’s total market capitalisation by around 20%. As a result, the company carried out a share consolidation, as it would have dropped by the amount of the dividend when it was paid out anyway. The share consolidation was 15 new shares for every 19 previously held. Therefore, the recent share dip in the Tesco share price should not scare off potential investors.

Tesco Health Food Pledge

Earlier this month Tesco shareholders managed to pressure the supermarket to commit to promoting healthy food. As a result, Tesco has expanded its “major new programme of reformulation” across its European businesses. A group of seven investors, holding £140bn in assets, and headed up by campaign group ShareAction, put forward the first nutrition-based shareholder resolution at a FTSE 100 company.

Louisa Hodge, a representative from ShareAction said: “By filing a shareholder resolution, our investor coalition sent a strong message to Tesco and to other supermarkets that shifting sales toward healthier options is important.”

Unhealthy food is not typically considered among other issues when it comes to ethical investing, however, the supermarket industry could be set to change. “Most asset managers now have a wide range of strategies and funds claiming to address climate change, but health gets little more than a nod in their annual investment reports,” argued Kieron Boyle, chief executive of Guy’s & St Thomas’ Foundation, in the Financial Times.

The issue the power of collective shareholder action, along with changing trends in the food industry. The future prospects of the Tesco share price may depend on its ability to provide healthier options for its customers.