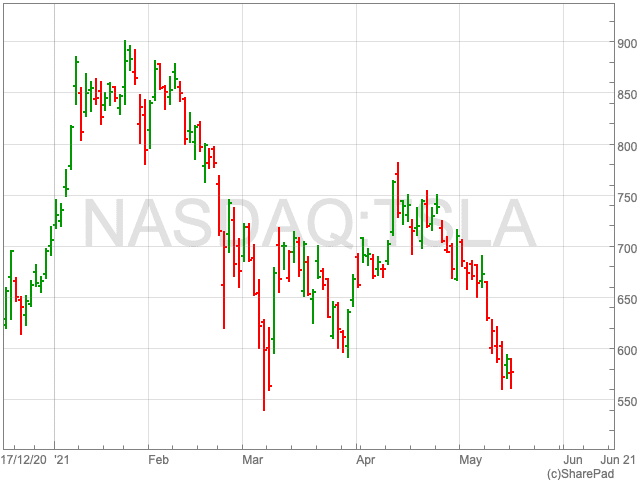

Tesla Share Price

After a positive start to 2021, the Tesla share price (NASDAQ:TSLA) has collapsed in recent months. Having closed yesterday at $576.83, down by 2.19%, it is around 35% down from its all-time-high in January. Having said that, the Tesla share price remains up by 548% since the middle of March 2020. Many investors have been monitoring the stock looking for an opportune moment to buy. However, they will be cautious about what the dip represents for the stock’s prospects. Also, whether or not it has further to fall. While Tesla’s Q1 results were encouraging, there are areas of concern for investors looking forward.

Competition

Competition is heating up in the electric vehicle market. Traditional car manufacturers are pushing forward plans to get their electric vehicles onto the road by 2030. The date the UK looks set to ban the sale of cars with internal combustion engines.

Volkswagen is one company that could threaten Tesla’s status. The German car maker set itself a target for 70% of the cars it sells in Europe to be fully electric by 2030. Over the past five years the company put aside $86bn of investment for developing electric vehicles.

The Volkswagen board also revealed the company will be opening six battery cell production plants across Europe by 2030. It said that it plans to transition to a new technology that would slash the cost of electric car batteries by up to 50% from as early as 2023.

Reducing the cost of batteries would drive down the cost of cars, and that would not be ideal for the Tesla share price. Susannah Streeter, a senior investment and markets analyst at Hargreaves Lansdown, told The Times that “Volkswagen is in pole position in the race to steal Tesla’s crown with a pledge to increase electric vehicle sales 27-fold by 2025.”

She added: “It is also researching solid-state batteries, which are considered less harmful to the environment, are easier to assemble and allow for faster charging compared with the lithium-ion batteries that Tesla relies on. These could help Volkswagen to gain the edge over Elon Musk’s empire.”

Meanwhile Daimler, owner of Mercedes-Benz, recently unveiled its ‘EQS’, while Ford and General Motors have stepped up their efforts in the EV market too. In short, remaining as the industry leader may be easier said than done for Tesla.

Michael Burry Bets Against Tesla Share Price

Another area of concern is the news that Big Short investor Michael Burry’s investment vehicle has disclosed a $534m bet against Tesla’s share price. It was revealed on Tuesday that Scion Asset Management, Mr Burry’s family office, revealed that it “put” options on 800,100 shares in the electric vehicle manufacturer,

This means that Burry’s company could be able to sell shares in Tesla at a specific price in the future. The options could also become more valuable as the Tesla share price decreases.

In February, Mr Burry tweeted about the latest Tesla share price surge: “Enjoy it while it lasts.”