Over the past decade, India’s key growth narratives have centred around three pillars: 1) favourable demographics 2) structural reforms and 3) robust digital infrastructure development. One of the positive fallouts of this is the exponential surge in assets of India’s mutual fund sector.

Transformation of Indian Investment Culture

Historically, Indian families preferred investing in traditional assets like gold, real estate, or bank deposits, leaving equity markets predominantly to international investors. This landscape has fundamentally shifted as millions of households now embrace investing in equity, evolving from conservative savers into proactive wealth builders.

The domestic Mutual Fund industry has experienced significant expansion over last two decades, with Assets Under Management (AUM) multiplying approximately 44 times to reach US$773 billion by March 2025! In the last 5 years itself, it has grown more than 3 times. This tremendous growth stems from sustained capital inflows, currently averaging around $4 billion monthly, with gross inflows through Systematic Investment Plans (SIP) alone contributing over US$3 billion per month. SIPs represent an investment methodology by which a person can contribute fixed amounts to selected mutual fund schemes on monthly, quarterly, or annual basis, typically spanning six months to several years.

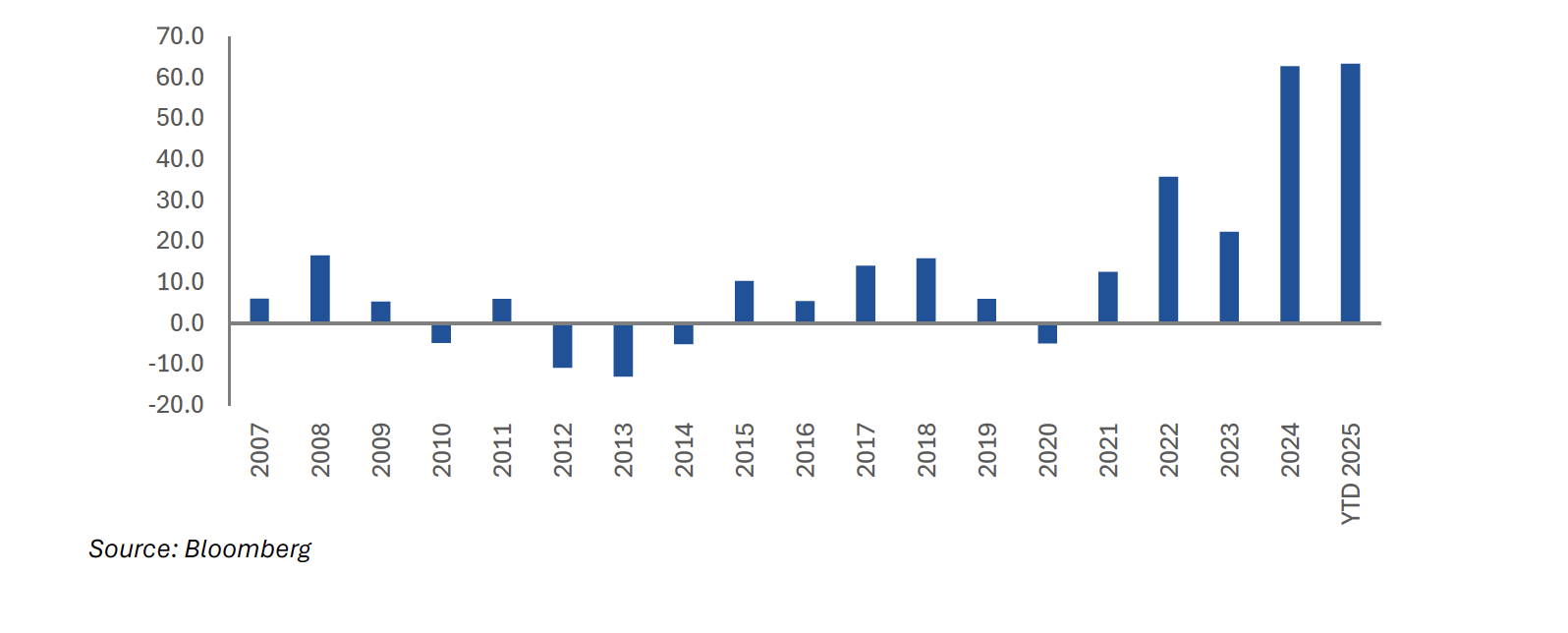

The corporate equity ownership structure reflects this dramatic transformation. Foreign Portfolio Investors (FPI)’s stake at 18.8% in NSE500 companies as of March 2025 is at a decade low, while domestic institutions have reached a record high of 19.2%. In fact, since 2021, domestic institutions have invested over US$192 billion compared to FPIs being net sellers of approximately US$8 billion, highlighting this remarkable reversal.

Figure 1: Domestic Institutional Equity Flows over the years (US$ bn)

Catalytic Events and Digital Revolution

Several pivotal events reshaped this landscape beginning with 2016’s demonetization, which triggered a reallocation of resources from physical to financial assets and led to change in mindset on hoarding cash. Simultaneously, fintech applications emerged during India’s mobile internet expansion, fostering increased digital transaction adoption and confidence. The 2021 COVID-19 lockdowns, combined with elevated savings rates, further accelerated investor migration toward equity markets and mutual funds.

But a lot of credit should go to active marketing by the industry. Since 2017, the Association of Mutual Funds in India (AMFI) has been carrying out an investor education campaign “Mutual Fund Sahi Hai” (Mutual Fund is the Right Choice). Visibility is high, as AMFI strategically positions its advertisements during the Indian Premier League (IPL). The 2025 edition of IPL had over 1 billion viewers across television and digital platforms.

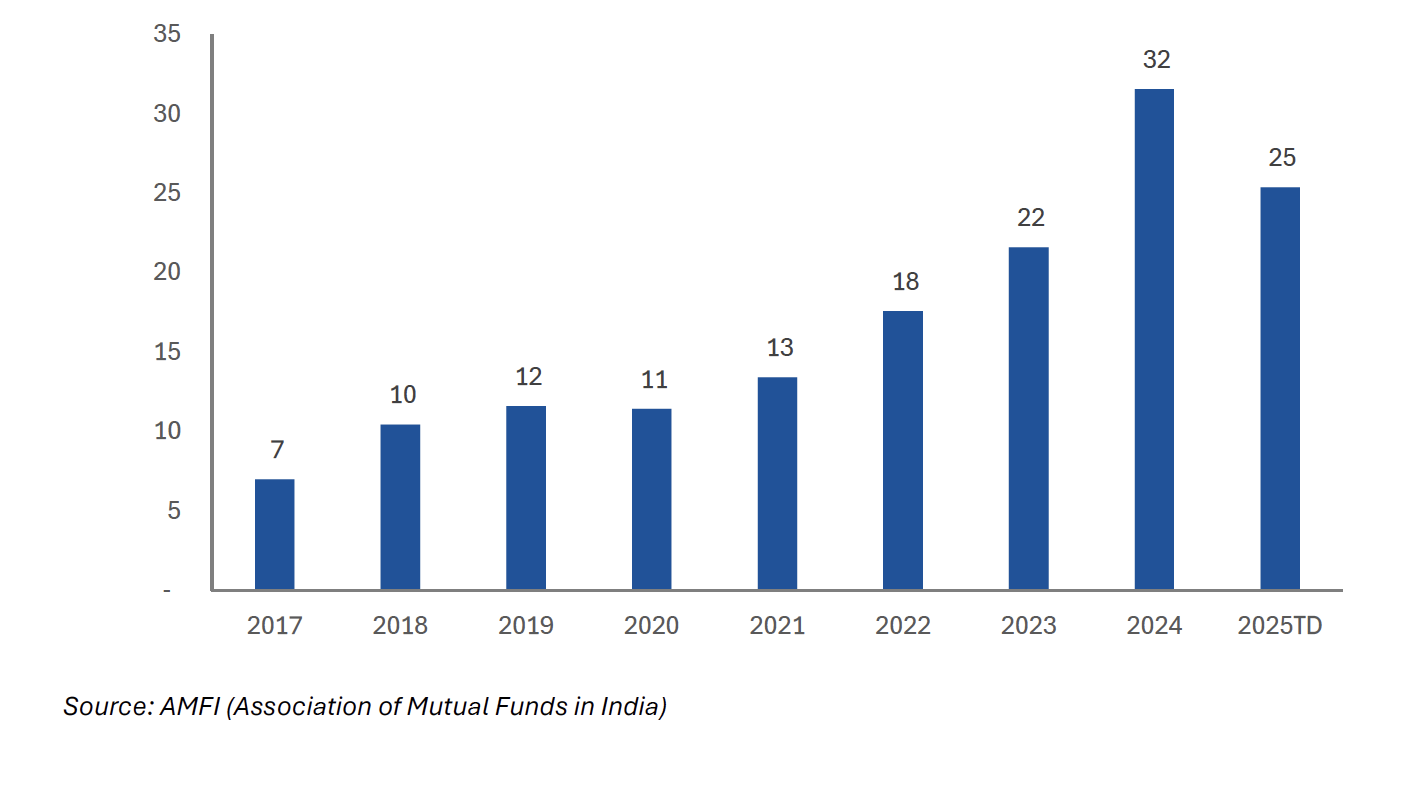

AMFI’s comprehensive marketing initiatives encouraged serious SIP consideration among investors. Mutual funds emphasized affordability with entry points as low as Rs500 (£5), enhancing accessibility and adoption. Consequently, SIP contributions have emerged as the primary driver of sustained inflows, growing from approximately US$350 million a month a decade ago to over US$3 billion a month currently. Active SIP accounts have exceeded 95 million, representing 20% of the industry’s total AUM.

Leading distributors identify liquidity and small ticket sizes as crucial criteria favouring mutual funds over alternative investment options. Retail investors are now looking at investing over a 5–10-year investment horizons, and these are now being looked at akin to an EMI, but for wealth creation. These concepts have resonated with retail investors, resulting in higher mutual fund inflows even during high volatility periods.

Figure 2: Inflows through Systematic Investment Plans (US$ bn)

Digital Infrastructure and Democratisation

The above would not have been possible without the digital revolution which has fundamentally transformed investor behaviour patterns. Tech-savvy younger generations increasingly utilize online platforms and mobile applications for mutual fund investments. User-friendly interfaces have democratized investing, making it accessible to broader population segments, while mutual funds now provide convenient platforms for seamless investment tracking and redemption.

Reflecting the capital markets’ digital transformation, India’s top three brokers are all online/digital platforms: Groww, Zerodha and Angel One. As digital transactions accelerated, mutual funds expanded distribution networks nationwide, increasing participation from smaller towns and semi-urban areas.

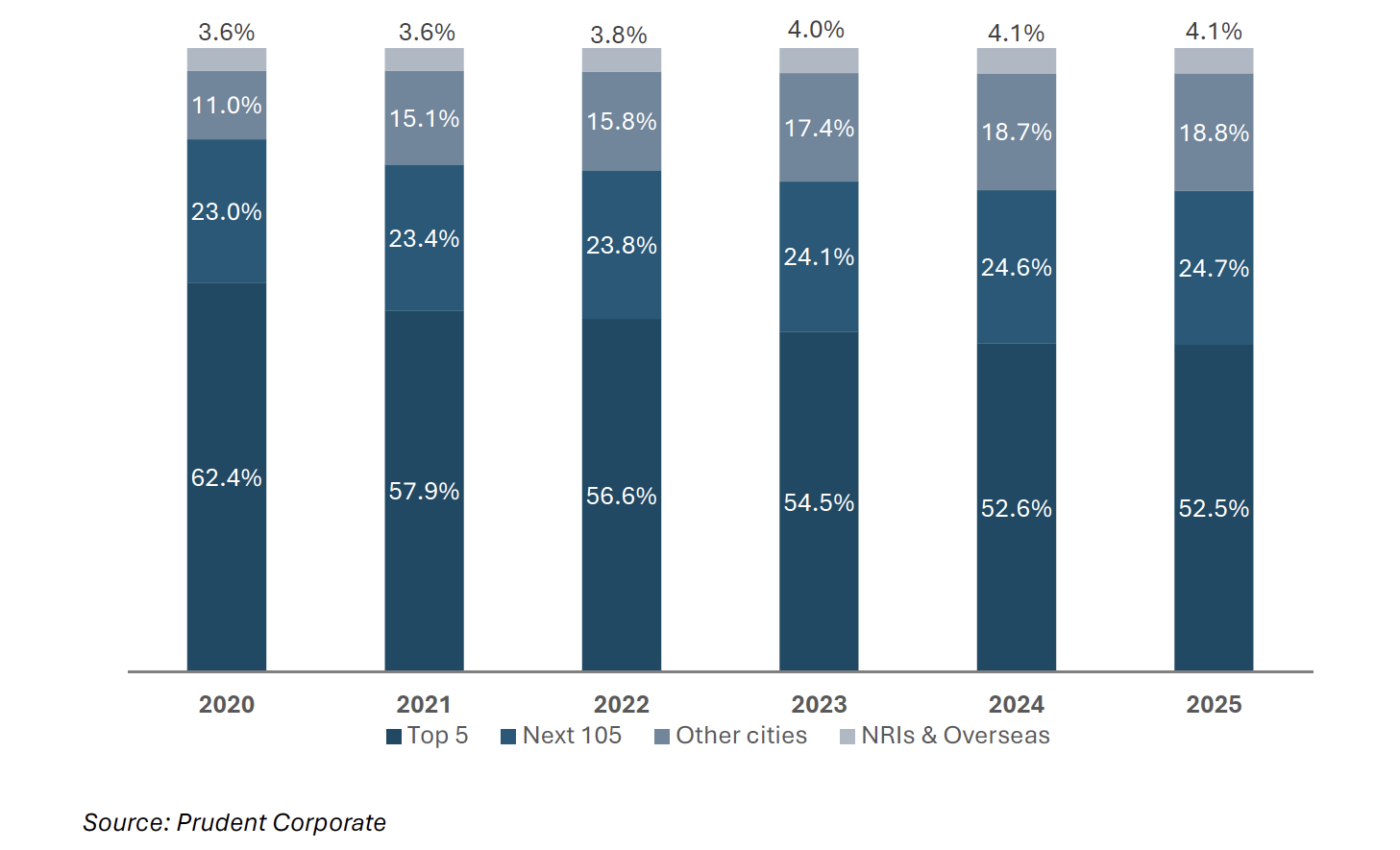

According to AMFI data, the top 5 cities’ share declined from 62% in 2020 to 52% in 2025, while contribution from towns beyond the top 110 cities increased from 11% to approximately 19% during the same period. This trend demonstrates investment diversification beyond major metropolitan centres, indicating enhanced financial inclusion and investment activity in smaller cities.

Figure 3: Rising penetration in urban & semi-urban cities

Is it sustainable?

The question we often ask ourselves is whether these domestic flows are sustainable? Even after the strong inflows, mutual fund industry’s current AUM-to-GDP ratio stands at just approximately 20% compared to the US at 100%+, indicating ample room for growth. Mutual funds represent only about 12% of Indian household financial assets (March 2025) versus 20%+ in the USA. Going by macroeconomic factors like young demographics, digitally native population, and higher economic growth, these flows look sustainable.

Notably, mutual fund inflows have demonstrated resilience over the past year despite negative equity returns (-5% for BSE Sensex as of September 30, 2025) and increased volatility from geopolitical disruptions. However, prolonged market consolidation and subdued returns could potentially moderate future flows.