It is estimated 40% of the entire undiscovered recoverable oil and gas of the United States lies in Northern Alaska with an estimated 30 billion barrels of oil resources waiting to be discovered.

Only this year Spanish group, Repsol, discovered 1.2 billion barrels of recoverable oil in the Horseshoe and Pikka fields in the Northern Alaskan slopes.

In addition to recent finds, there is currently a project underway in Alaska which has the possibility to become one of the most significant oil discoveries for a London listed stock in recent years.

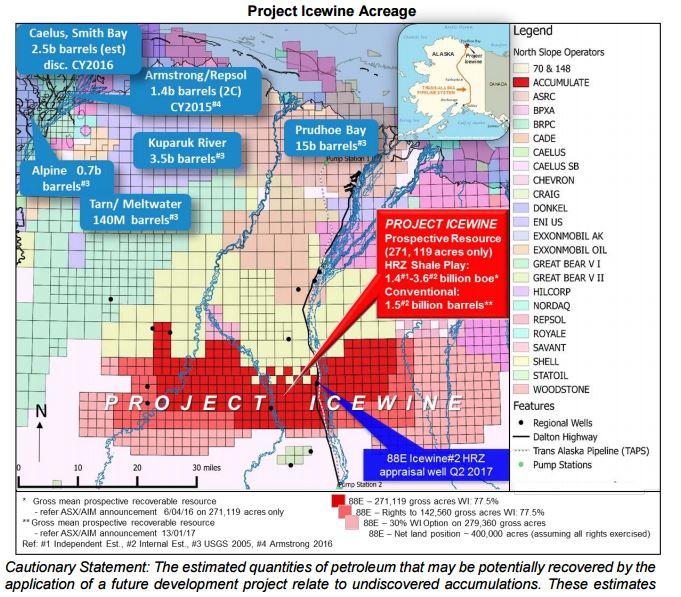

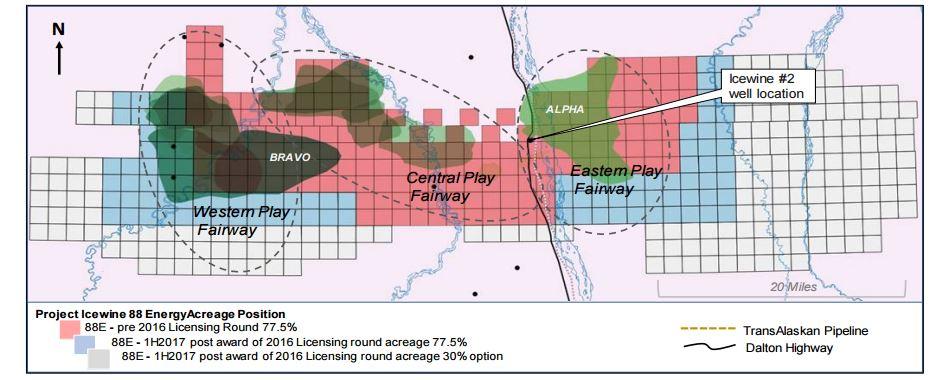

This project is being led by 88 Energy (LON:88E) who are pushing forward with the Icewine project covering some 690,000 gross acres and in the process, hoping to prove there is 3.6 billion recoverable barrels of oil. Achieving this would be monumental not only for the Alaskan oil industry but for the stakeholders of 88 Energy.

The Icewine project is targeting the HRZ shale play which has laid largely untouched since Alaska’s oil boom in the 1970’s and 88 Energy hope to reignite this boom by proving the viability of what would be the second largest field in the area with 3.6 billion boe.

Prudhoe Bay

To put 88 Energy’s project in context, it is some 35 miles south of the Prudhoe Bay Oil Field, the largest in North America currently operated by BP.

Prudhoe Bay current produces around 280,000 barrels of oil per day and account for half of the daily flow through the Trans Alaska Pipeline System (TAPS).

The geographical proximity to such a significant oil field has been a source of excitement since the start of the project – but recent developments have increase the anticipation.

Icewine

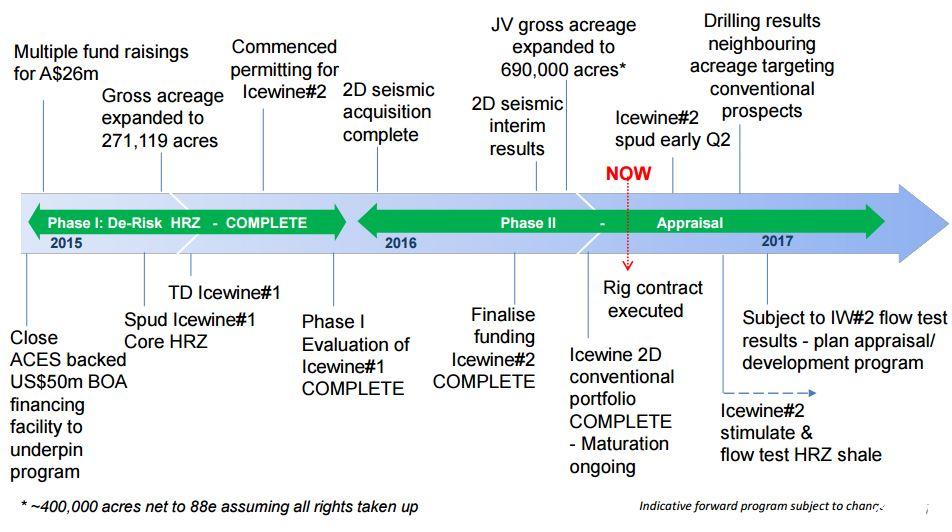

The Icewine project commenced in October 2015 with the spud of the Icewine #1 exploration well. The initial results were positive and shares rallied over 500% on indications of ‘permeability super highways’. These highways where confirmed by further analysis revealing permeability numbers 20 times better than pre-drill estimates.

Shale formations are loosely packed formations of sedimentary rocks or mudstone that can hold oil and gas. The permeability of these formations dictate how well oil and gas can flow to wells in shale formations and ultimately the rate at which it can extracted.

The fact Icewine permeability was increased by such a large degree means the potential for a lucrative flow rate rose dramatically.

Results from Icewine #1 also revealed high Total Organic Carbon ‘TOC’ content of 3.55%. These results were very positive when compared to other US shale formations and were a step towards proving the viability of the project.

Thermal Maturity Sweetspot

Further tests were revealed in the Icewine #1 Core Evaluation Update. Many of the 272,000 acres mapped in the evaluation were found to be in Thermal Maturity Sweetspot.

The Thermal Maturity Sweetspot refers to areas in shale formations where wet gases meet with oil, enhancing the ability for higher flow rate, key for economic oil production.

This was astoundingly good news for the project, adding to positivity created by the analysis of the TOC and permeability.

Independent Resource Estimate

A review of all the findings culminated in the Independent Resource Estimate for the HRZ formation jumping to 1.4 billion barrels of oil equivalent and the Internal Resource Estimate for HRZ to rising 3.6 billion boe.

If this estimate is confirmed, or even increased, it would be the second largest find in North Alaska after Prudhoe Bay’s 15 billion barrels in place.

There must be consideration paid to the comparison of the Prudhoe Bay field and Icewine however, as Prudhoe Bay is a conventional oil play and Icewine is almost exclusively unconventional shale formations.

Icewine #2

The Icewine #2 drill is now underway and production testing is set for the end of June / early July.

At the time of writing, 88 energy had just attempted to cement a 4.5” hole through the Pebble Shale unit sitting beneath the HRZ production interval.

The testing and analysis of the Icewine #2 drill could be the catalyst for the next leg higher in shares if the results are as positive as those from Icewine #1.

Alaskan Exploration Attractiveness

Operated by BP, the Prudhoe Bay field went online in the 1970s and drove the Alaskan oil boom, peaking in the late 1980s at circa 1.5 million barrels of oil per day production.

That figure has reduced to around 550,000 barrels per day and with the reduction in oil production, comes a reduction in the Alaskan oil royalty fund revenue.

To help maintain royalty payments for years to come, the State of Alaska offers attractive subsidies to firms exploring for oil and gas in the region in return for production royalties.

Companies can currently claim 35% of exploration operating costs – making 88 Energy’s project cheaper than other exploration activities in different regions.

Financial Position

Despite government subsidies, drilling campaigns can be expensive and 88 Energy are in a good financial position to complete the current program.

As of 31st December 2016, 88 Energy had $27,303,178 in cash and net assets of $48,010,413.

The cash on hand can facilitate Icewine#2 drilling with some to spare. If, however, the firm should need further cash it has a $50m facility with Bank of America it can call on for certain projects at the discretion of Bank of America.

Partnerships

88 Energy are operating the exploration in partnership with Burgundy Xploration. 88 Energy agreed a 87.5% working interest, falling to 77.5% on spud of the first well on the project.

If 88 energy are to de-risk further reserves there is the possibility of a farmout to fund further development of the field without having to issue equity and dilute existing shareholders.