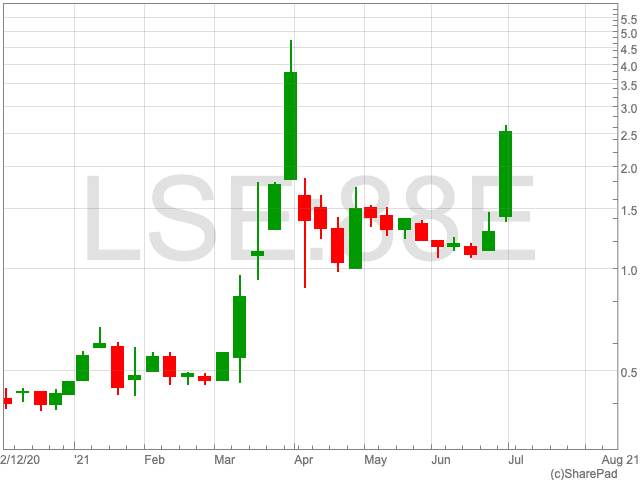

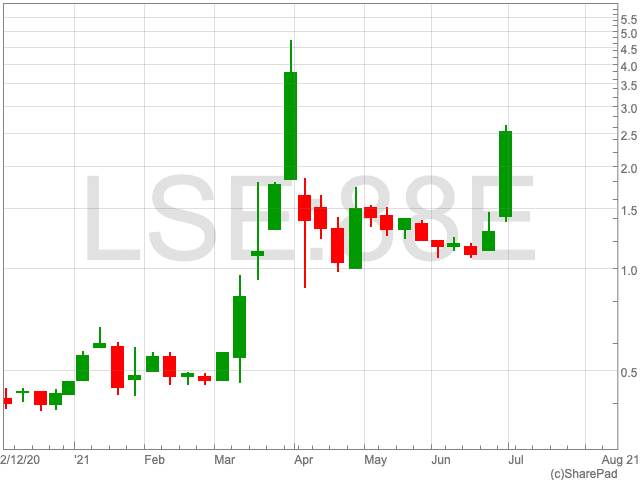

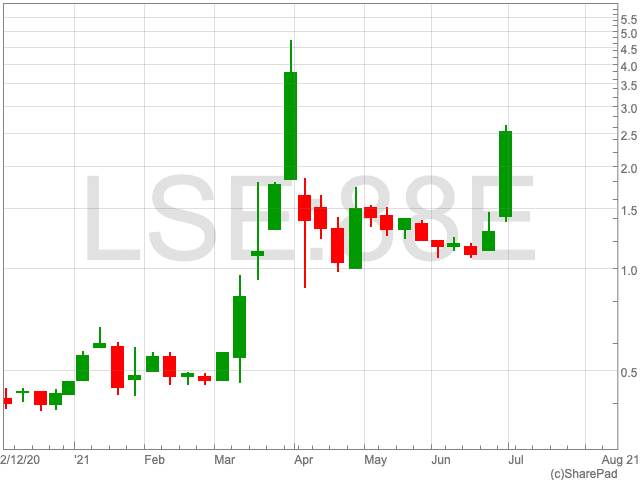

88 Energy Share Price

The 88 Energy share price (LON:88E) is up by 22.29% on Friday after the company revealed it has completed the sale of the Alaskan Oil and Gas Tax Credits. It means that the company has now paid of all of its existing debt. The Australia-based energy firm has now added 119.22% to its share price over the past month and 404.2% since the beginning of the year.

Today’s rise caps off a strong week for 88 Energy as the FTSE 250 company made announcements which bode well for its future.

88 Energy Repays Existing Debt

At the beginning of June, 88 Energy confirmed it had agreed the sale of Alaskan Oil and Gas Tax Credits which by a subsidiary owned by the company.

The news followed on from a previous announcement made by the compass on 21 June. 88 Energy then stated that the sale price of the Tax Credits was $18.7m.

The FTSE 250 firm said most of the money generated from the sale would be allocated to paying of 88 Energy’s outstanding debt of $16.1m. The debt was set to mature at the end of 2022.

The debtor waived early repayment penalties as 88 Energy confirmed on Thursday that the debt repayment was finalised.

88 Energy Adopts Global Standard for ESG Reporting

On 30 June 88 Energy confirmed it adopted the Environmental, Social and Governance (ESG) framework designed by the World Economic Forum (WEF).

Impact monitoring technology company, Socialsuite, a leading provider of Impact Management Systems, will measure 88 Energy’s performance across 21 core ESG metrics and disclosures.

The company will then report its ESG progress across each sustainability area.

The company has paid off outstanding debts, as well as well as committing to transparency over its sustainability measures, which has been reflected in the 88 Energy share price.