Auto Trader is the largest car listing website in the UK and is one of the most profitable businesses in the FTSE All-Share index. The company listed in March 2015 at 235p and has made solid financial progress since then.

A business earning a high return on capital employed (ROCE) will inevitably attract new competitors. The only way, therefore, that a company can sustain a high return on capital is if it possesses competitive “moats.”

Auto Trader generated a return on capital employed (ROCE) of 59% in the year to March 2017. This means that every pound invested in the group – debt and equity – earned 59p of profit before interest and tax.

Most companies can only dream of generating a ROCE at this level with 15% considered attractive. Auto Trader has sustained a high ROCE on the back of two competitive moats: networks effects and a strong brand.

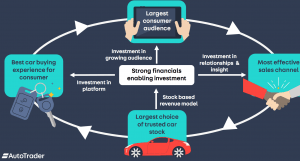

Auto Trader model & moats: network effects and a trusted brand

Source: Auto Trader investor presentation

Source: Auto Trader investor presentation

Listing platforms generate Network effects because additional listings attract more users and additional users attract more listings. People gravitate to the leading listing platform and have little incentive to switch to move elsewhere.

Gumtree Motors is the nearest competitor to Auto Trader and is owned by US group eBay. In January 2018, UK car buyers spent 678 million minutes on Auto Trader’s platform versus 138 million minutes on Gumtree Motors.

Auto Trader also benefits from having a trusted brand, which is particularly important in the used car sector. According to research, only 7% of car buyers trust car dealers and 23% find visiting a car dealership “daunting.”

There is a risk that Amazon or Facebook could use their brands to make an aggressive move into the UK car listing market. Network effects, though, suggest that it would be hard to usurp Auto Trader’s market leading position.

The end market for Auto Trader is, however, mature with UK used car sales expected to decline 1-3% in 2018 to 7.9 million vehicles. This compares to 7.5 million in 2007, before the financial crisis, and 6.9 million used vehicles in 2009.

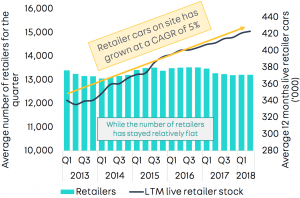

Retailers and last 12 months live cars on Auto Trader’s website

Physical stock on Auto Trader’s platform has grown 5% a year from 2013 with each car retailer listing more cars. In the six months to September 2017 there was a 3% year-on-year increase in vehicles on the platform to 451,000.

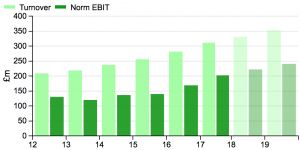

Auto Trader’s has seen solid top-line momentum recently with revenue up 8% in fiscal 2015, 10% in fiscal 2016 and by 9% in fiscal 2017. The operating profit margin has also improved from 57% in fiscal 2014 to 67% in fiscal 2017.

Turning to the balance sheet and the leverage ratio (net debt to EBITDA) declined to 1.55X at September 2017 versus 2.7X at September 2015. The company has been buying back shares since the IPO and looks set to continue doing so.

Auto Trader has delivered growth in a mature sector

When Auto Trader listed in March 2015 at 235p its forward P/E ratio stood at 18.3X. The forecast P/E ratio is currently 17.2X for the year to March 2019 and 15.5X for the year to March 2020 (using a share price of 340p).

Auto Trader is clearly a high quality business but the UK used car market is mature and cyclical. Revenue growth has been delivered on the back of increased listings per car retailer, new product offerings and price increases.

Disruption is a long-term risk with taxi apps like Uber, on-street car rental and autonomous vehicles reducing the need for car ownership. The independence that car ownership delivers, though, means that it is unlikely to disappear.

Disclosure: The writer does not currently hold shares in Auto Trader.