Sponsored by OenoFuture

Despite being the home of Sassicaia, Tignanello and a host of sensational Barolo producers, Italy has long been in France’s shadow when it comes to fine wine investment.

Yet as the traditional collector’s favourite Bordeaux continues to lose market share, Italy has been a key beneficiary.

The latest figures from Liv-Ex show Bordeaux’s share of the fine wine market hitting an all-time low of 49.5% in October 2019, while in the same month Italian fine wines claimed a 11.4% market share by value. Taking a longer term view, the figures are even more compelling; according to Liv-Ex since 2015 Italian fine wines on the secondary market have risen in value from £2 million to £5m with volumes rising by 1500% over the past decade.

“No one has a crystal ball”, comments Daniele Napoletano, Head of Italian Investment at the London-based fine wine investment company OenoFuture. “We live in times when a single tweet by Donald Trump can wipe billions off the markets and we’re currently in the longest stock market rally since the Great Depression. The beauty of the wine market is that the price movements are much more straightforward. Fine wine is produced in tiny quantities yet demand is growing across the world, especially from emerging economies.

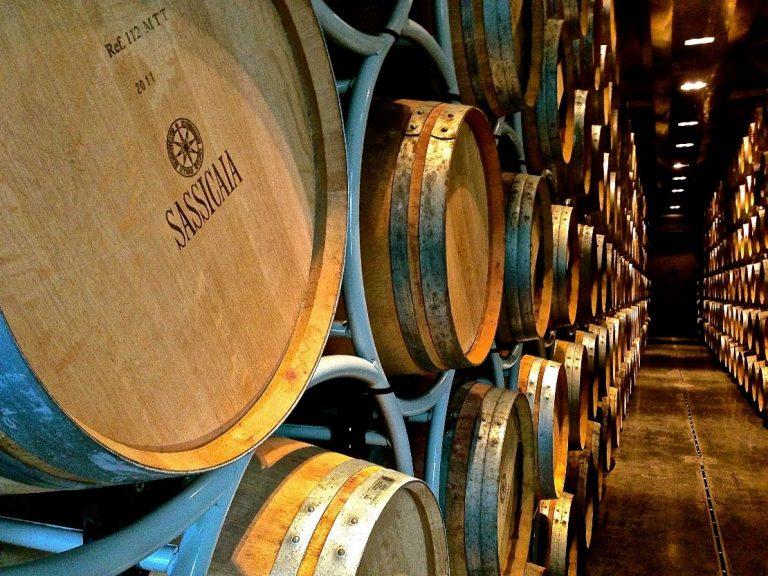

foto matteo baldini/guido mannucci

I always recommend that my clients also diversify their wine investment portfolio by looking beyond Bordeaux and the traditional investment regions. The remarkable growth shown by Italy over the past couple of years proves that these wines have a very exciting future ahead of them.

At OenoFuture we are privileged to have an incredibly knowledgeable team including Italian wine expert Daniel Carnio and Master of Wine Justin Knock. They have exhaustively tasted the world’s great wines and are equipped find upcoming superstars like Bibi Graetz in Tuscany before they reach blue chip prices. This kind of insider knowledge allows us to achieve exceptional results for our investment clients.”

As well as these high potential emerging producers, investors should take inspiration from the remarkable track record of wines like Sassicaia.

First released in 1968, this stunning Super Tuscan has gone from strength to strength in recent years, with the 2016 vintage awarded 100 points by Monica Larner from Robert Parker’s Wine Advocate. From a release price of £1,270 per case of 12 this magnificent wine is now trading at around £2,200.

With results like these, it’s easy to see why Italy is fast-becoming the darling of the fine wine market in the face of Bordeaux’s continued decline.

For the moment, the market is largely dominated by Super Tuscans from producers which are able to generate volumes comparable to Bordeaux’s top estates. Piedmont, on the other hand, is more comparable to Burgundy with a plethora of smaller producers, making it more the preserve of connoisseurs and those with access to fine wine investment advisors.

For Daniel Carnio, co-founder of OenoFuture, Barolo is particularly exciting for those looking to take a longer term view; “the development of the Barolo cru system with 181 ‘crus’ or growths has been a real game-changer.

Moving forward I expect to see increasing interest in Barolo across the world, and especially in markets like China where Italian wine is almost not present. Typically for emerging markets French fine wines are the first to enter, followed by Spanish, Italian, and wines from the rest of the world. For the savvy investor wanting to be ahead of the game, now is the moment to invest in Italian fine wine.”