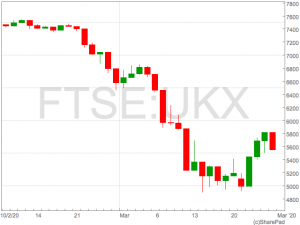

After the recent selloff in FTSE 100 shares there is an abundance of companies trading at their lowest levels for decades and could present excellent value for the long-term investor.

Indeed, many shares were offering very good value on an earnings basis before the coronavirus selloff, and it would appear that they only offer better value now.

However, the recent selloff is also a stark reminder that shares present risks to investors due to sudden changes in the macro environment that feed through to underlying company earnings. This is a risk that remains despite shares being at record lows and investors should think hard about what makes shares a good price to buy.

Taking the hypothetical example of company XYZ plc’s shares that were trading at £10 in January and are now trading at £3, it doesn’t necessarily mean they are now ‘good value’ or ‘cheap’.

When assessing the value of FTSE 100 companies, investors should reflect on companies’ earning potential in the future, typically over the next 12 months.

Earnings

The recent selloff in equities due to the spread of COVID-19 was driven in the most part by uncertainty on what earnings will look like over the next 12 months, and the assumption they will be severely reduced.

A reduction in earnings will be reported by a large proportion of the FTSE 100; airlines have completely shutdown, banks are being forced into repayment holidays and utility companies are going to see power usage and prices fall.

The key question for investors is now whether, over the next 6-12 months, the earnings outlook is going to change to the extent that the recent decline in equity prices makes current share prices good value compared to future earnings.

Whilst monetary and fiscal stimulus will prevent company earnings from completely collapsing, a broad rally in share prices will depend almost entirely on an economic recovery driven by businesses resuming operations and creating jobs, once the peak of coronavirus has passed.

In short, a sustained rally back to the FTSE 100 highs around 7,700 is only likely once the health crisis shows signs of ending.

However, as investors await a medical response to COVID-19 they will be presented with once in a generation opportunities for long term purchases, but must be prepared to accept short term volatility.

Bull Trap

Bull Trap

Indeed, measures implemented by central banks and government such as the Federal Reserve’s ‘unlimited’ asset purchase and the UK’s promise to pay workers 80% of their wages will provide short term relief rallies.

These should be treated with caution as they can represent ‘Bull Traps’ that suck investors into thinking stocks will continue back up to recent highs, before dumping again.

Technical analysts will always recommend waiting for markets to retest highs or lows before entering a position around market reversals. This means you avoid being sucked into traps and reaffirms the market will respect lows before they move higher.

In the case of the FTSE 100, the key levels to retest will be 5,000. This is both psychological and very close to the closing low of 4,993.