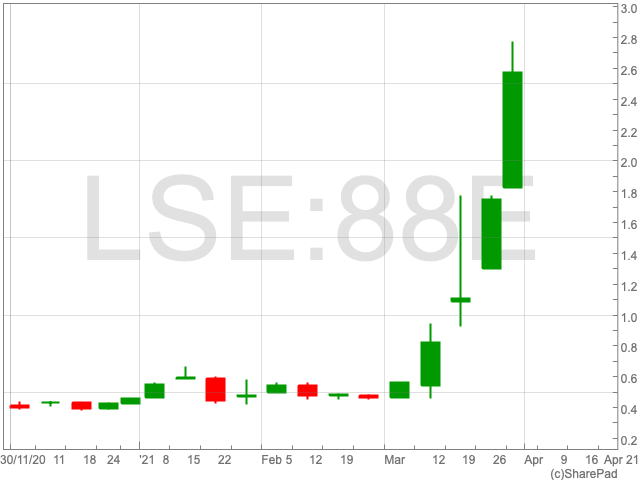

88 Energy Share Price

The 88 Energy share price (LON:88E) has accelerated throughout March, and is up a further 16% today to 2.61p per share. The surge over the past couple of days follows the company providing an operations update which this article will examine in further detail. Year-to-date the company’s share price is up by 542% and is catching the attention of UK Investors.

Operations

As mentioned, investors pushed the company’s value up recently after the company divulged news about its operations in Alaska.

Firstly, the AIM-listed company confirmed it had found potential hydrocarbon-bearing zones during a drilling program at the Merlin-1 well site, located at the company’s Project Peregrine in the northern area of the National Petroleum Reserve, Alaska (NPR-A). 88 Energy will now run a wireline programme to ascertain whether mobile hydrocarbons are present at the site.

Managing director Dave Wall managed expectations saying that “there is still work to do to confirm a discovery”. However, he did say that “the results to date are encouraging”. An additional update on the wireline programme is anticipated in the next seven to 10 days.

88 Energy also said that the Nanushuk Formation was found to be approximately 600ft low to prognosis. The Nanushuk formation is the main target for the company’s Merlin-1 well. The formation is also believed to be 500 metres thicker than the Analogue Wells formation to the north.

88 Energy said that “the gamma log indicates the presence of more sand packages than those in the Analogue Wells”.

These the highlights from an operational update which provides a broadly positive outlook for the oil and gas company. This has been reflected in the company’s share price in the last few days and since the turn of the year. Its ability to sustain an impressive performance could come down to further announcements about drillings, creating an element of uncertainty and risk for investors.