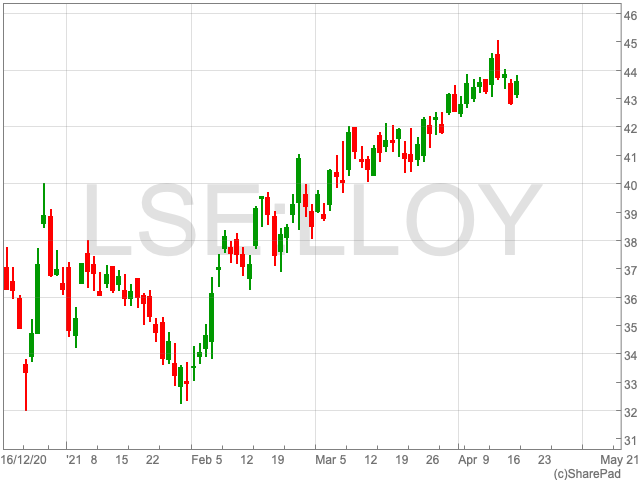

Lloyds Share Price

The Lloyds share price (LON:LLOY) has risen sharply since the turn of the year as pent-up demand and the vaccine roll-out is creating a positive mood around the UK economy. Having begun 2021 at under 35p, Lloyds shares are now valued at 43.56p per share, an increase of nearly 20%.

With the outlook for the UK economy improving as the so far successful vaccine roll-out has led the governor of the Bank of England to hint at stronger than anticipated growth in the coming months, the FTSE 100 bank looks set to capitalise.

Price Target

The UK bank has been given some positive targets by analysts that will be welcomed by investors. Barclays’ investment banking arm recently upgraded its “overweight” share price target for Lloyds to 47p from 46p. Barclays based its estimate on favourable outlook for the UK banking sector. “There are also nascent signs of stabilisation in unsecured personal lending (albeit at subdued levels) while asset pricing remains stable, with March mortgage pricing down marginally following softening in February,” the bank said.

While Deutsche Bank analysts also upgraded the stock from “hold” status to a “buy”. Despite the upgrade, the bank maintains its 50p target price, which is more than 6p above the current Lloyds share price.

Savings

Brits are set to have saved an additional £180bn in their bank accounts, or around 10% of UK GDP. While this figure might seem favourable to a bank such as Lloyds, this may not be the case as Banks will struggle to find a way to lend this money profitably as UK consumers are cutting their borrowing at a record pace. Consumer borrowing dropped 9.9% year-on-year compared with February last year – just before the pandemic struck the West – the biggest fall since the series began in 1998, the BoE said.

However, business loans could continue to rise in 2021, creating an avenue for Lloyds to return to profit. “Banks lent firms a total of £35.5bn in net terms last year – £34.7bn of which was lent since the start of the pandemic in March – with a further £26bn forecast by the end of 2021, and many firms unlikely to start repayments until 2024,” a report by financial services company EY stated.