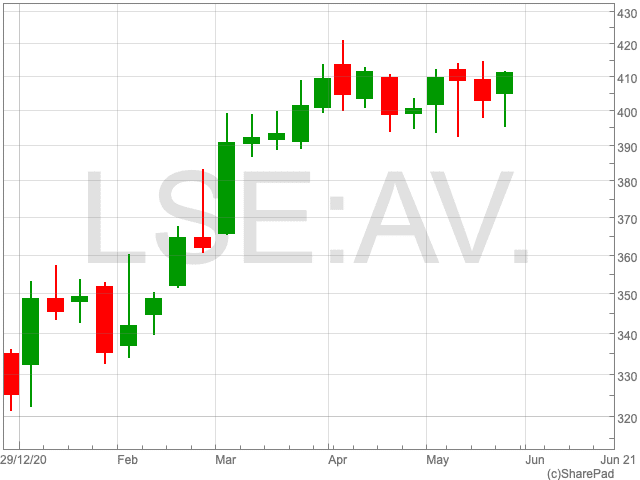

Aviva Share Price

The Aviva share price (LON:AV), at 410.90p per share, has now reached its pre-pandemic level. This is despite moving sideways for the last two months. Since the beginning of the year, the Aviva share price is up by 26.4%. As the FTSE 100 insurance company released its Q1 results today, this article will analyse Aviva’s ability to maintain its bullish run moving forward.

Results

Aviva announced solid sales figures from its life insurance business, at £8.3bn, as well as a 4% increase in general insurance on Thursday.

Aviva also sold eight businesses, amounting to £7.5bn over the past year, in order to focus on its priority markets, the UK, Ireland and Canada. The British insurance company reaffirmed its pledge to give cash to shareholders. However, this could happen as late as 2022, according to chief financial officer Jason Windsor.

“Combined operating ratios in the General Insurance business, which illustrates the proportion of premiums that are paid out either as claims or in operating costs, improved dramatically – falling 28.1 percentage points to 90.6%,” said Nicholas Hyett, equity analyst at Hargreaves and Lansdown.

“The group expects conditions to get tougher as the year goes on, especially as motor claims increase when lockdown ends, but expects the combined operating ratio to remain below 95% this year,” Hyett added.

Analysts at JP Morgan described the Q1 update as “strong”, and restated an “overweight” rating for the company.

“Aviva put on a good show following its strong Q1 results that contained plenty of meaty headlines for investors to absorb,” Chris Beauchamp, chief market analyst at IG.

Focus on Sustainability

Aviva has also refocused towards strategies around sustainability. This was one of the reasons for their decision to sell some of their assets across the world.

Amanda Blanc, chief executive of Aviva, recently outlined the group’s efforts to clean up their investments, saying Aviva will only invest “where [they] are sure it delivers sufficient returns’ for stakeholders. Blanc added that ‘where [they] see a valuable opportunity to invest in growth, [they] will take it”.

This follows Aviva’s commitment to becoming the first major insurance company in the world to slash its emissions to net-zero by 2040.

With strong results and a clear strategy on environmental issues, the Aviva share price looks like a solid proposition for investors.