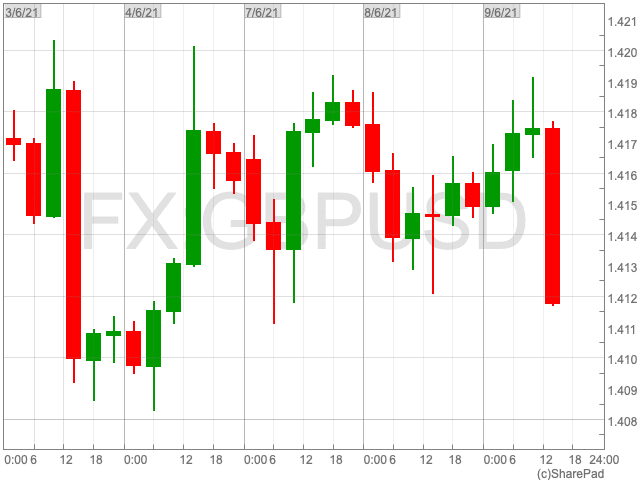

The topic of Brexit made a sudden return on Wednesday in what proved to bad news for the pound.

The UK and EU failed to reach a breakthrough over Northern Ireland Brexit checks, however David Frost, chief negotiator of Task Force Europe, pointed out that talks had not broken down.

“This a new situation, that requires new thinking and new solutions,” said Aodhán Connolly, director of the Northern Ireland Retail Consortium.

“Nevertheless, the lack of progress, and fears over what it would mean if an understanding isn’t reached soon, took a chunk out of sterling as the day progressed,” said Connor Campbell, financial analyst at Spreadex. Against the dollar the pound dipped 0.2%, while against the euro it was down 0.4%, hitting a near-2-week low of €1.1583.

“The pound’s nostalgic decline helped the FTSE 100 cut its own losses from 0.5% to 0.2%, though that wasn’t enough to push it back above 7,100,” Campbell added.

The gains made by the euro, meanwhile, appeared to hurt the DAX, which shed 0.7%, or 115 points, on Wednesday afternoon.

In the States there wasn’t much to report. The Dow Jones was flat at 34,600, likely hesitant to stray from that level until it gets a look at tomorrow’s inflation readings.

“Forecasts would suggest it’ll be good news for the index; the standard CPI figure is set to fall from 0.8% to 0.4%, while the core number is expected to drop from 0.9% to 0.5%. However, similar retreats were expected for April’s readings, and they instead surged to recent highs,” said Campbell.

London’s mid-cap stock index, the FTSE 250, reached an all-time high this month speeding past its previous high of 22,000 in April.