The FTSE 100, which features companies that benefit from a weaker pound, is up by 0.47%

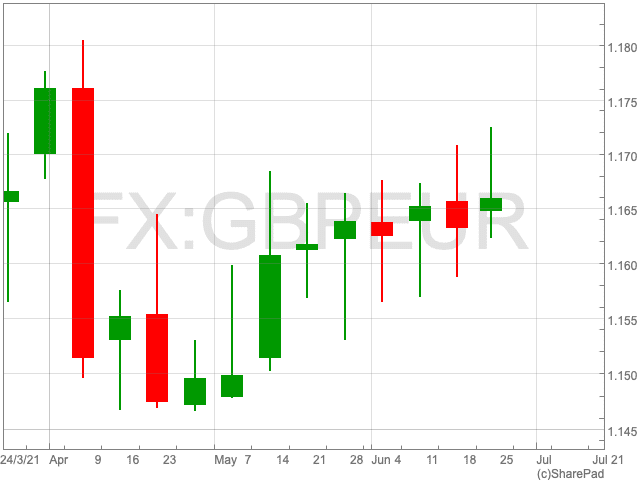

Sterling fell on Thursday, down from its strongest position against the euro in over two months, as the Bank of England predicted inflation would exceed 3%.

The central bank’s forecast of inflation is above its target for a “temporary period”.

GBP, having traded at €1.17 prior to the Bank of England meeting on Thursday, fell by 0.5% against the euro to €1.165. Cable fell by the same amount to $1.3894.

The news has not motivated the BoE to urgently act by tightening its policy.

“The economy will experience a temporary period of strong GDP growth and above-target CPI inflation, after which growth and inflation will fall back,” the monetary policy committee said.

The FTSE 100, which features a number of companies that export goods and services that could benefit from a weaker pound, is up by 0.47%.

Commenting on sterling falling as the Bank of England expects inflation in excess of 3%, Olivier Konzeoue, FX Sales Trader at Saxo Markets, said: “The BoE chose to maintain accommodative measures in place, keeping the Benchmark Interest Rate at 0.1% and holding government asset purchases at GBP 875Bln, whilst outgoing chief economist Haldane was the only dissenter voting against keeping the bond-buying program unchanged (8-1 split on the topic).”

“The MPC used similar rhetoric to that used by the US Fed of late, describing an expected peak in inflation in excess of 3% (versus 2.47% previously) as likely temporary in nature and flagged the uncertainty around the labor market outlook with close to 1.5 Million people still receiving wages through the furlough scheme. This justifies pushing back a potential 15Bps rate hike to August 2022, instead of June 2022, in order to avoid undermining recovery by a “premature tightening in monetary conditions.”

“GBP fell to session lows around 1.3906 after the announcement and hovers around the 1.3920 mark, whilst UK 10-year yields dropped 3Bps to 0.75% from 0.78%.”