England ended a 55-year wait to play in a major tournament final on Wednesday night, beating Denmark in extra-time at Wembley courtesy of a Harry Kane goal. The Three Lions will now face an Italy side that has also impressed throughout, getting past a resilient Spain team in its previous game en route to the final.

For both countries the coronavirus pandemic has been a trying time, causing the loss of life and economic despair. As both now appear to be on their respective roads to a recovery, this article will examine the performance of the stock markets and wider economic outlooks of the on-field rivals.

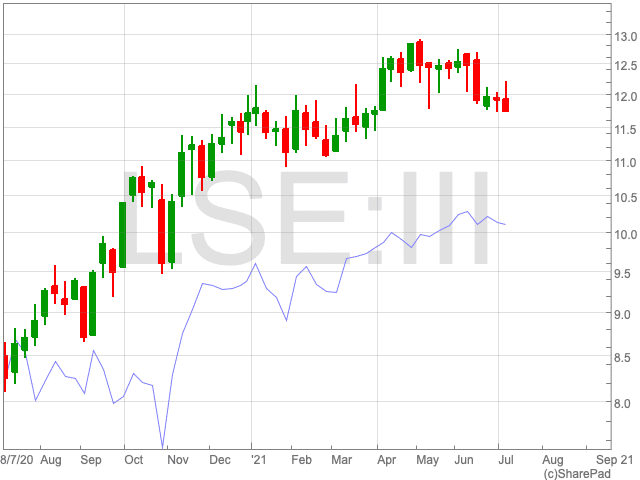

FTSE 100 vs FTSE MIB

Despite the jubilant scenes in HA9 and across the country, the mood was not reflected by the FTSE 100 on Thursday. At the time of writing, the UK index is down by 2%. Similarly, in Italy, the euphoria has not rubbed off on its major index, the FTSE MIB, which is down by 3.02% over the past five days.

The FTSE MIB, tracked above by the blue line, is the benchmark stock index for the Borsa Italiana, the Italian national stock exchange. Following a dramatic crash, as with many indices across the world in February 2020, the FTSE MIB recovered to surpass pre-pandemic levels. However, following a recent retreat, it is sitting at 24,609 points, slightly below the level before the coronavirus took a grip of the world economy.

The FTSE 100, on the other hand, remains some way off its pre-pandemic high of over 7,400 points. This is despite a strong recovery which has seen the UK index trade above the 7,000 mark for over a month now.

UK

While the performance of the players has undoubtedly raised the mood of the country, can this translate into economic performance? Chancellor Rishi Sunak suggested that there could be an increase in consumer confidence on the back of the Euros, while business owners continue to draw attention to the constraining measures of the continued restrictions.

Simon French, chief economist at brokers Panmure Gordon, told the BBC that on-pitch success could translate to increased growth. However, it is dependent on other factors, he added.

“If a victory on one day coalesces with a broader feelgood factor, like we saw during during Euro 96 or the 2012 Olympics, it could boost consumer sentiment,” French told the BBC.

“The difference this time is that UK households have a lot of pent-up savings due to the pandemic – we estimate about £20bn – and the speed with which they are spent is closely linked to consumer sentiment. Winning the final, along with lots of other things, like reopening, the easing of restrictions, could help unlock many billions of pounds worth of additional spending. But it would only be a contributing factor.”

While the UK economy’s recovery, specifically the rapid vaccine roll-out, has been reported to be going well, there are some complications.

A recent rise of Covid-19 infections in the UK has caused a fall in the number of people visiting bars and restaurants in June. The prime minister confirmed his intention to go ahead with the removal of ongoing restriction on July 19. While it could merely represent a slight bump in the road, other complications remain, such as inflation and labour shortages.

Italy

The Bank of Italy believes the Italian economy will grow by 5% in 2021. It put its raised forecast down to circumstances around Covid-19 improving, and an increased revision in Q1 GDP data. The central bank also said growth in 2022 would come down to 4.5%.

These figures will come about as investments will rise significantly on greater certainty over the future, in addition to low interest rates and funding from the EU’s ‘Recovery Fund’. In 2020, the Italian economy contracted by 8.9%, its most damaging fall in output since the second world war.

However, Italy has exported many more goods since the pandemic as its businesses have adapted to digital technology. By April, the Financial Times reported that goods exports had increased by 6% compared to January 2020 levels. In addition, online retail sales increased by more than 50% in January 2020, far exceeding the 42% average in the eurozone.

Digitalisation and innovation are fundamental to Italy’s plans following the pandemic, in a country which has been previously held back by crippling bureaucracy.

On the economic front, there is much to be cheerful about for the UK and Italy. Yet, as for their respective football teams heading to Wembley on 11 July, there is still work to be done.