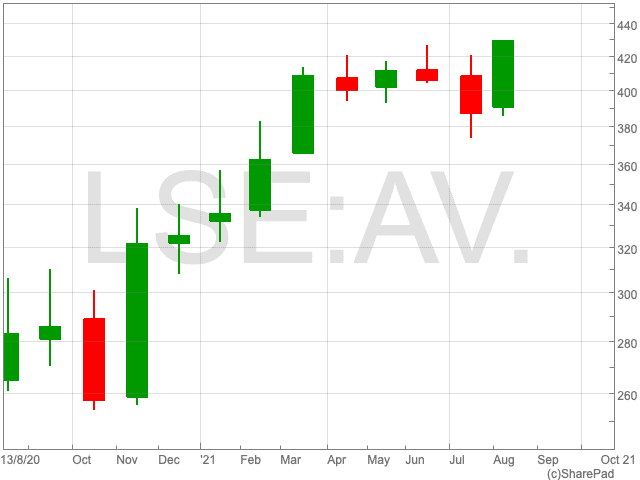

Aviva Share Price

The Aviva share price (LON:AV) is up by over 5% over the past two days as the company made some big announcements yesterday. Thursday’s results round off what has been a positive year so far for the FTSE 100 company, which now has an optimistic outlook, following strong measures taken by CEO Amanda Blanc. Year-to-date the Aviva share price is up by 31.15%, and is well above its pre-pandemic level, sitting at 428.70p at the time of writing. Praise has duly been arriving for Amanda Blanc, however, the boss is clear that these results are only the beginning.

Disposals

Blanc has impressed so far by very rapidly jettisoning Aviva’s non-core operations. Aviva has carried out a series of disposals over the past year, allowing the company to focus its efforts on the key UK, Ireland and Canada markets. The disposals, not all of which are yet complete, will bring in a total of £7.5bn. The money not returned to shareholders will be used to pay down debt.

“However, this was low hanging fruit and now this process is pretty much complete – and the cash returns to shareholders have been more or less confirmed – attention is likely to switch to the performance of the remaining core business,” says AJ Bell financial analyst Danni Hewson.

Cevian

Aviva’s operating profit rose by 17% to £725m over the first half of the year. However, it came in below the company-provided consensus of £781m. “The reason behind the weaker than forecast showing is weakness in the bulk annuity market – where pension schemes buy an insurance policy to cover future pensions and benefits due to be paid to its members,” said Hewson.

“It helps when this bitter pill on profit is sweetened by a very chunky return of capital, though still short of what activist investor Cevian had been pushing for since it joined the register of shareholders in June,” Hewson added.

Cevian being around means there is a lower chance of Blanc getting complacent and they are likely to keep her feet to the fire as they look for progress on driving down costs to support the Aviva share price.

“Looking ahead, Aviva needs to demonstrate it’s got a functioning plan for turning its huge cash inflows into ongoing returns for shareholders – as well as navigating changing risks as climate change sees protection claims rise – to continue the impressive share price growth seen in the past 12 months,” James Andrews, senior personal finance expert at money.co.uk, said.