Ever since Richard Nixon ended the Bretton Woods monetary system in August 1971, the US dollar has been on a downward spiral. Under the Bretton Woods system, gold was the basis for the US dollar and other currencies were pegged to its value. According to Russ Mould, AJ Bell investment director, “there are more than a few parallels between the economic backdrop then and now and these trends may have gold bugs thinking they could yet have cause to celebrate the fiftieth anniversary of Nixon’s monetary policy revolution”.

“In August 1971, President Nixon took the US dollar off the gold standard, ‘closing the window’ through which overseas governments could exchange paper greenbacks for the precious metal at a fixed rate of $35 an ounce,” Mould added.

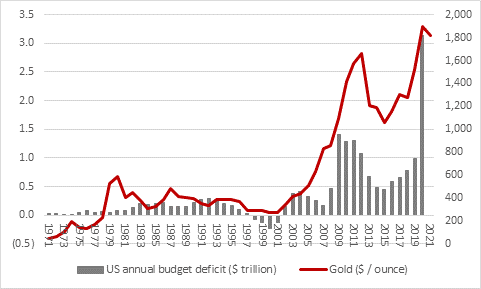

The move by Nixon allowed the US government to pay for welfare programmes and oversees wars. “Although economists and politicians hailed the policy as a liberation from a monetary straitjacket, investors may choose to draw their own conclusions as to what markets ultimately think of the launch of unfettered money creation.”

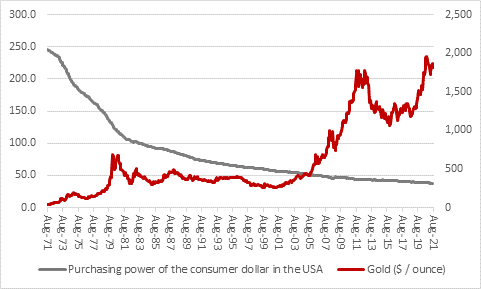

What has ensued ever since is clear as day. Over the past 50 years, gold has gained 4,160% against the greenback. “Put another way, the dollar has lost 98% of its value relative to the precious metal while 85% of its purchasing power has gone for good measure, thanks to an inexorable rise in the consumer price index (or inflation, in other words),” says Mould.

It could be argued by gold bugs that we are again seeing a replay of the events that caused Nixon to act. America is implementing unaffordable welfare programs, in addition to the Afghanistan war, as the price gold closely follows the current Federal ceiling.

However, even though most loyal of gold bugs would pause before celebrating too much. The precious metal has seen some substantial recent sell-offs for “reasons which have yet to become entirely clear”, according to Mould.

“Talk of a possible peak in the inflation rate in the USA could be one explanation. Others pointed to what they felt was a co-ordinated hit by hedge funds in the futures markets while a gathering consensus among economists that the US Federal Reserve may be about to start tapering its Quantitative Easing programme could have also had an influence.”

“Whatever the reason, though, the plunge did not last long, and gold has again held firm at around $1,800 an ounce.”