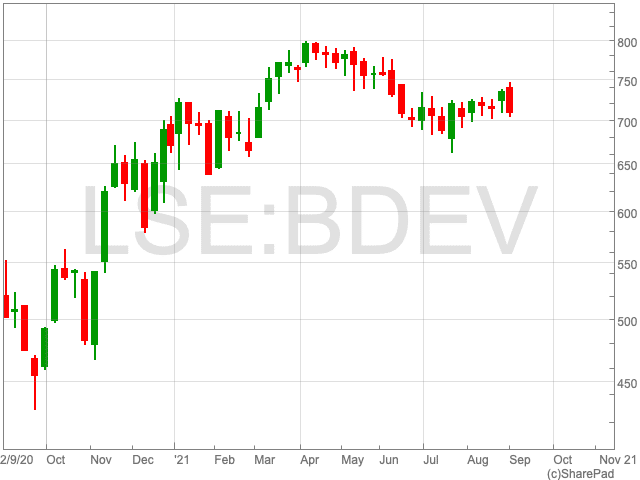

Barratt Share Price

The Barratt share price is down by 4.71% on Thursday despite strong demand for homes boosting annual profits by nearly two-thirds in its latest financial year.

“Perhaps it is down to concerns over the expiry of the stamp duty tax break in October, or worries over an increasing reliance on Help-to-Buy, or the potential impact of the proposed April 2022 launch of the Residential Property Developer Tax, but investors do not seem unduly moved by Barratt Developments’ strong full-year results,” says AJ Bell Investment Director Russ Mould.

Year-to-date the Barratt share price has added 8.89%. Although 2021 has seen healthy profits, a net cash balance sheet and a dividend that equates to a historic yield of 4%, the Barratt share price, at 707.60p, remains some way off its pre-pandemic level of 870.6p.

Outlook

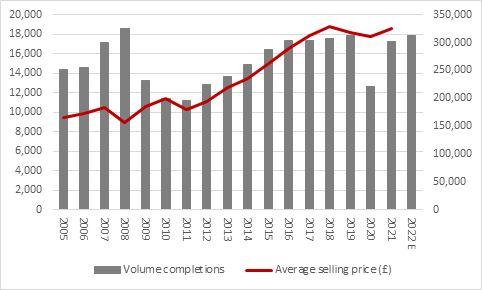

The FTSE 100 homebuilder expects to drive volume completions back to 2019’s pre-pandemic levels in the year to June 2022 and is set to benefit from further house price increases.

“That said, some investors may be fretting that the current surge in prices in unsustainable and the result of the stamp duty tax break, especially considering the fall in net private reservations through July and August, even if the UK housing market does still seem to be suffering from a shortage of supply,” says Mould.

Additionally, the pandemic could yet bolster the population’s desire for larger, suburban dwellings with gardens and underpin demand for some time to come.

Further price rises could allow the FTSE 100 firm to balance out an increase in ‘input’ costs which Barratt says are persistent. Barratt’s results presentation flags its expectation that input costs will rise by 4% to 5% in the year to June 2022. This raises the question of affordability, as people have, until now, been helped by the stamp duty holiday and the help-to-buy scheme.

“The percentage of buyers who used one version or another of the Help-to-Buy scheme reached 38% in the year just ended, up from 33% the year before, a record high since the introduction of the support programme by Chancellor George Osborne in April 2013,” says Mould.

“The latest version of Help-to-Buy, the equity loan scheme, runs until March 2023 and shareholders can be forgiven nervous for wondering what will happen after then if so, many people need this financial assistance to get on the housing ladder – even if the chances of yet another extension are probably quite high, given the political fall-out for any minister or Government which pulls the rug from under the housing market, accidentally or otherwise.”

Shareholders will also be paying attention to the costs associated with cladding remediation of previously-constructed sites, notably Citiscape in Croydon.

“The bill went up by a further £81.9 million in the year to June 2021, taking the total to £184 million since 2017, and management has flagged that the year to June 2022 could see further costs of £40 to £50 million, if its guidance for ‘adjusted items’ in the results presentation is any guide,” Mould said.

For all of these concerns, Barratt remains in a healthy position. It is serving an undersupplied market, is looking to drive completions toward its annual target of 20,000 and generates healthy profit margins.