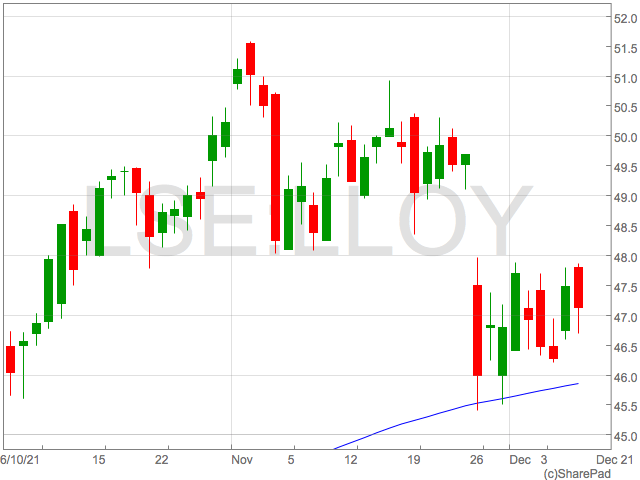

The Lloyds share price has was subject to heighten volatility as the Autumn started but has since become stuck in a very tight trading range.

While this may not be an immediate cause for concern for some, it does raise the question why Lloyds shares haven’t joined in the rally to the extent other companies have since the announcement of the new COVID variant.

Omicron was announced 26th November and caused the most severe selling of equities in 2021.

All industry groups were hit in a broad sell off as the market panic sold into low volumes due to the Thanks Giving Holiday.

The Lloyds share price was particularly heavily hit that day giving up more than 7% of it’s value. However, unlike many shares in the FTSE 100, Lloyds is yet to recover the losses recorded since.

Indeed, Lloyds shares are down 4.88% from the close 25th November 2021 at the time of writing. This ranks Lloyds 89th out the 100 shares in the FTSE 100 since in terms of performance since the close 25th November. Darktrace is the worst performer, down 13%, whilst BHP is the top performer, gaining 7.9%.

Lloyds shares in 2022

The underperformance in Lloyds share can be attributed to a range of factors but the stand out driver will be the uncertainty cast over whether the Bank of England will now hold off from hiking rates in 2021.

Lloyds shares had previously surged following strong UK economic news that significantly increased the chances of a rate hike in the bank’s December meeting.

#Markets appear to be deciding that the #Omicron variant is not going to have too much impact on the recovery. The US Fed and Bank of England meet next week. Will they have a similar view? It's time to normalise #interestrates and "retire" transitional.

— Jamie Constable (@jamie_constabl) December 7, 2021

With possible economic disruption caused by the new Omicron variant, Lloyds may miss out on the opportunity to achieve increased Net Interest Margins with higher rates, if the Bank of England keeps rates on hold.

This will not only be a concern for investors around the December BoE meeting, but will persist into 2022 as uncertainty reigns.

With the UK government outlining new restrictions, the UK could well see a economic downturn in Q1 which would not only push back expectations of a rate hike, but even impact the quality of Lloyds’ assets such as mortgages and loans.

The UK government has now ended furlough and may be hesitant to reintroduce fresh measures alongside COVID restrictions. This would have a detrimental impact on the UK economy and UK-focused shares such as Lloyds.

If this scenario plays out, investor should expect the Lloyds share price to underperform the wider market in a similar way to the last two weeks.