2015 saw the increased use of crowdfunding and private investment in Fintech firms – but also a decrease of IPOs and trades on the stock market. So what does the future hold for the stock market? In the modern world, has the traditional ambition to graduate to public company become irrelevant?

Increase in private funding

Fintech, one of the largest growth sectors, remains for the most part privately funded. Far fewer tech companies than expected floated on the stock market in 2015, instead choosing to stick with the copious private investment being offered and keep their finances away from prying eyes. Private funding rounds totalled $51 billion, according to CB Insights – more than six times the $8.26 billion raised in US tech and Internet public offerings this year.

The number of companies in the industry did go public, 48, was one of the lowest ever according to data compiled by Bloomberg and many such as Etsy have share prices hovering at below IPO levels; market volatility has, understandably, led to many companies delaying their IPOs.

Increase in crowdfunding

The growth of crowdfunding has meant that finding hedge funds or very wealthy angels to invest is not the only way to achieve private funding – funding from the public is also now a viable option and has grown exponentially over the past couple of years.

Crowdfunding five years ago was a relatively small industry, accounting for $880 million in 2010. However, the crowdfunding industry grew to over $16 billion in 2014 and is on track to account for more funding than venture capital. The World Bank estimates that crowdfunding will reach $90 billion by 2020, but if the current rate of growth continues, that figure will be hit by 2017.

Crowdfunding has revolutionised the world of business finance and has been transformed into a viable form of investment, encouraging many companies that perhaps would have looked at going public to stay in the private sphere a little longer.

Decrease in the market’s popularity

2015 was a rocky year for the stock market, hit by crises in both Greece and China over the summer, and so far 2016 hasn’t been much better. It seems that companies are picking up on the risks associated with the market and, whilst there is ready private funding available, staying out of the public sphere.

Data going back 25 years shows that new IPOs are steadily decreasing, and 2015 was another bad year. The annual rate of companies joining global stock markets halved in the decade after 2000 compared with the decade before, according to the Organisation for Economic Cooperation and Development.

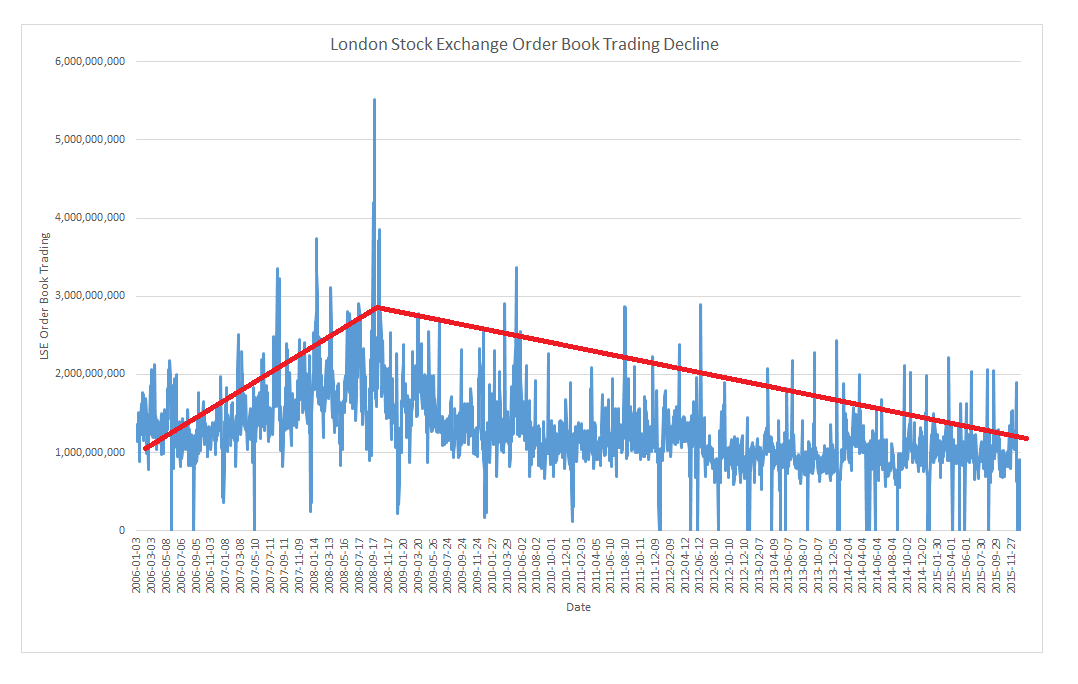

Furthermore, the volume of trades on the London Stock Exchange has steadily declined since 2008, with overall activity in the stock market decreasing over the past eight years. This inactivity, combined with the uncertainty and volatility of the stock market, could well be a reason why private companies considering floating are staying away.

So is this the end of the stock market as we know it?

Whilst unicorn companies are riding a wave of private investment at the moment, in the long term this may not continue. Talk is already rife on the subject of whether companies such as Dropbox, which is currently valued at $10 billion, are worth their lofty valuations when their technology is such a fast-moving industry and staying ahead of the crowd is so difficult. Crowdfunding is an excellent option for raising short rounds of cash for short term expansions, but is not really a match for the amount of capital offered by floating on the stock exchange.

However, over the past decade, there have certainly been changes to the way companies aim to expand and finance their business – with the general trend leaning towards keeping companies privately-owned for as long as possible. And with fewer regulations to comply with and a lesser need for transparency, its easy to see why.

Miranda Wadham on 06/01/2016