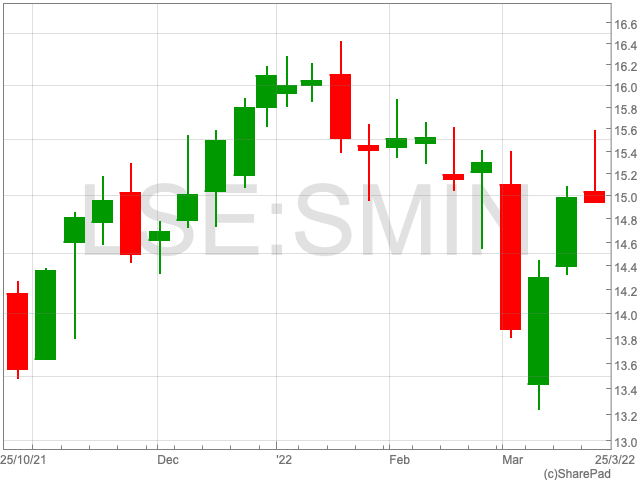

The tech engineering firm, Smith Group saw shares fall 1% to 1,501p on early morning trade on Friday despite the company’s reported underlying operating profits increase of 11.1% to £189m, with higher orders in H1 2022.

Smith Group saw a 3.4% increase to £1.19bn in underlying revenue compared to the first half of 2021, with revenues of £1.15bn.

General industrial contributed 40% to the revenues with safety and security contributing 32% followed by energy and aerospace adding 21% and 7% respectively.

Aerospace saw the largest growth in revenues with an increase of 16.7% as demand for Flex-Tek and Smith Interconnect aerospace solutions remained strong.

The 5.7% growth in revenues of general industrial came from ‘original equipment and aftermarket growth’ in chemical processing, pulp & paper, and mining segments for John Crane.

Safety and security lost 3.5% in revenues between H1 of ’21 and ’22 due to the performance of Smiths Detection and Smiths Interconnect’s defence related products.

To add to their growth, Smith focused on product development and launched 9 ‘high-impact’ new products, such as space qualified connectors and a new seal for pipelines during H1 2022.

Smith Group gained £1bn through the disposal of Smith Medical to ICU Medical in January 2022, sooner than expected.

With a strong balance sheet, the group managed to pay repay $400m bonds and capital returns and complete over 25% of the £742m share buyback.

The group reported basic EPS of 30.6p compared to 26p in H1 2021. Smith saw ROCE increase from 10.3% to 14%.

Dividend for Smith Group has increased from 11.7p to 12.3p between H1 of 2021 and 2022.

Paul Keel, Group Chief Executive Officer, Smith Group said, “Our performance in the first half demonstrates the meaningful progress we are making against our strategy. We accelerated Smiths’ organic revenue growth to +3.4% and converted that into even stronger profit and earnings growth, despite supply chain challenges and cost inflation.”

“Improvement in the first half centred on the levers we are pulling to accelerate our growth and consistently deliver results, underpinned by our focus on continuous operational excellence and investment in our people and culture.”

“An important milestone for us was completing the sale of Smiths Medical, ahead of schedule. This has enabled us to simplify our business, focus on our higher-performing, more strategically-aligned industrial technology core, whilst investing for growth, deleveraging and returning surplus capital to our shareholders. ”