Ted Baker’s board released a press statement confirming the group received two unsolicited non-binding cash offers from Sycamore Partners Management for the complete acquisition of the apparel company.

The proposals received by Sycamore Partners were regarding cash offers for the ‘entire issued and to be issued ordinary share capital’ of Ted Baker.

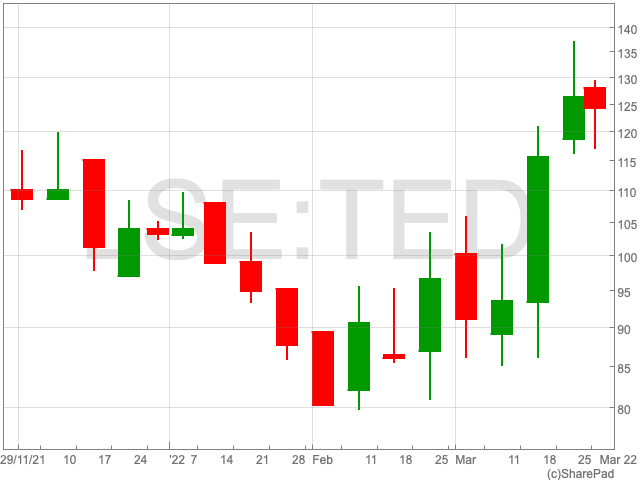

The first proposal was received on the 18th March 2022 from Sycamore which offered 130p per share for each Ted Baker share and was rejected.

On 22nd March, Sycamore increased their bid by 5.8% to 137.5p in their second proposal. However, the second bid was also rejected.

Ted Baker’s board of directors and its advisers thoroughly examined the offers that Sycamore made and concluded that the private equity firm has significantly undervalued Ted Baker and also inadequately compensates shareholders from the significant upside they would gain if Ted Baker remains listed.

Laura Hoy, Equity Analyst, Hargreaves Lansdown commented, “Ted Baker rebuffed advances from Private Equity firm Sycamore, saying the takeover offers didn’t accurately reflect the group’s potential.”

“It’s unsurprising that management’s not keen to give up the reins after a few difficult years. We’re finally starting to see some greens shoots from the group’s turnaround efforts now that formal occasions are back on the social calendar.”

Ted Baker has undergone a change in management over the last 2 years which has led to the company’s solid footing for a strong future for the brand.

Currently, Ted Baker is dedicated to providing value to its shareholders exceeding Sycamore’s bids.

The company urges its shareholders to not take any haste decisions as they say there is no certainty on any firm offers coming in or terms for existing offers changing.

Hoy also said, “However there’s still a bumpy road ahead with inflation weighing on customers’ willingness to shell out for a new outfit. Ted’s prices are on the higher end of the spectrum, but not quite reaching into luxury, meaning its customers won’t be immune to the cost of living squeeze and could start to slide down the value chain.”

“The best of Sycamore’s offers reflected a 9% premium on Ted’s Friday closing price, so it’s a nod of confidence from management that they think they can deliver something better.”

“On Sycamore’s side, the deal makes sense given the group’s stable of investments include a variety of American fashion brands similar to Ted.”

“But as there’s still a lot of work to be done and as Ted turned its nose up at a relatively steep premium, it’s unclear if another offer could be coming.”

Ted Baker’s shares fell 1.6% to 124p following the rejected proposals and increasing inflation rates impacting consumer spending.