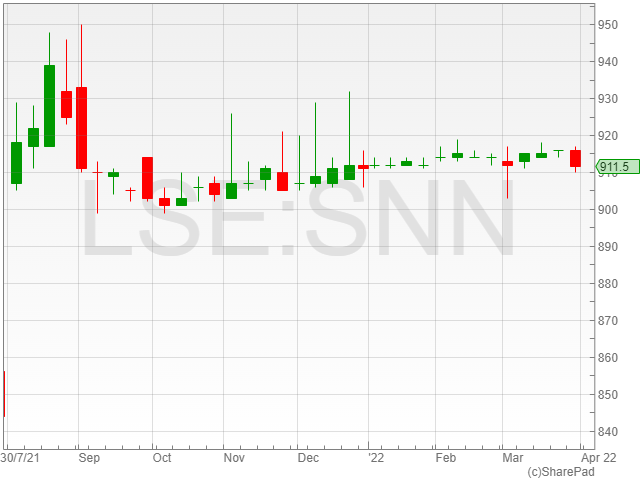

Shares in the Sanne Group fell 0.2% to 912p in early morning trading on Friday after the firm released an 85.5% decrease in statutory operating profits following a series of acquisitions over 2021.

The corporate services firm reported a 14.4% increase in net revenue to £194.2 million against £169.7 million in 2020.

Sanne noted its 48.4% increase in new business over 2021, representing a £33.4 million boost in revenue.

The company highlighted its 12.9% rise in underlying operating profit to £54.2 million compared to £48 million in 2020, however the firm noted a statutory operating profit loss of 85.5% to £3.5 million against £23.9 million in 2020.

The group attributed the lowered statutory operating profit to a series of new acquisitions which joined the company at a lower profit margin, and a surge in new business requiring short-term scaling-up of client service teams ahead of full revenue recognition.

The firm acquired PEA and Strait in a bid to expand its presence in Scandinavia, alongside its reported acquisition of the PraxisIFM Group fund administration business, which contributed to the group’s presence in Guernsey, UK, Malta, Jersey and Luxembourg.

Sanne further noted the impact of rising costs due to high staff turnover during a period of takeover rumours across the company.

However, Sanne also noted its sale of the firm’s investment in Colmore AG for net proceeds of £18.1 million at a value more than twice its original investment, with the company set to remain involved in the project under its new leadership.

The company added that its new business is set to push it towards a strong performance in 2022, with the combination of the firm’s newest acquisitions positioning the firm as one of the largest platforms in the sector.

The firm announced no final dividend for 2021 after its 14.7p per share dividend the previous year.

“Despite the material distractions arising from well-publicised offers for the Company during the year, 2021 has seen a strong financial performance from the Group, with impressive double-digit growth and maintenance of healthy profit margins and cash conversion,” said Sanne CEO Martin Schnaier.

“We have begun to see good returns from our investment over the last three years in our business development and product specialist teams, as well as benefitting from the continued market recovery in the alternative assets space.”

“As a result, we have successfully delivered net revenue growth of 19.0% and underlying operating profit growth of 21.0%, both at constant currency.”

“It is particularly pleasing to see this result given that the Group was the subject of takeover speculation and a formal offer period for the majority of the year.”