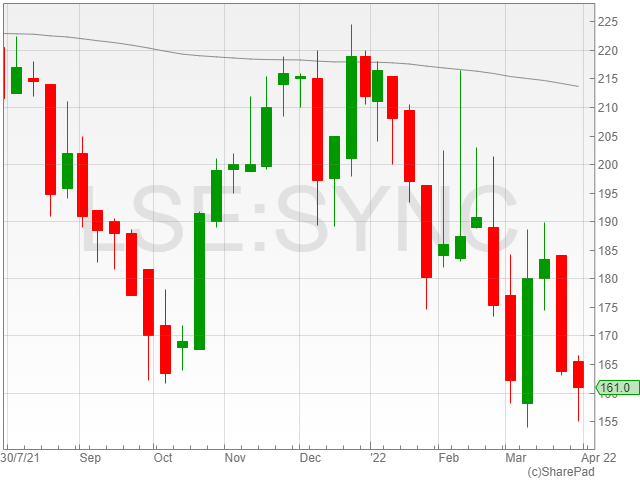

Syncona shares rose 1% to 161.1p in early morning trading on Friday following a reported drop in cash reserves from the company’s Freeline Therapeutics subsidiary.

Freeline Therapeutics reported cash and cash equivalents of $117.6 in 2021 against $229.9 million in 2020.

However, the group added that it currently expects its available cash to fund its operating expenses heading into the second half of 2023.

The company mentioned that it successfully closed a $26.1 million registered direct offering with select long-term shareholders, which is set to support the advancement of the company’s clinical-stage platforms and scientific capabilities to fight an expanded selection of diseases.

Freeline Therapeutics highlighted that its Phase 1/2 programs were currently on track in Haemophilia B and Gaucher disease, alongside accelerated progress in Fabry disease.

“2022 is shaping up to be a watershed year for Freeline, building on the strong foundation we put in place in the second half of last year,” said Michael Parini, Chief Executive Officer of Freeline.

“Under new leadership, our streamlined organization has executed with urgency and increased financial discipline on a refocused set of clinical programs and corporate priorities.”

“We also have recently strengthened our balance sheet to enable us to deliver meaningful clinical data readouts through 2022 and beyond to demonstrate the value of our promising gene therapy candidates as we advance on the path towards pivotal Phase 3 studies.”

“Additionally, we are working on a new R&D strategy to explore the application of our science and platform technologies to new disease areas, including extending these strengths to efforts beyond rare monogenic disorders.”