The FTSE 250 was up 0.1% to 21,128.8 and the AIM was up 0.3% to 1,050.9 in afternoon trading on Thursday, despite another wave of anti-Russian sanctions and minutes from the latest Fed meeting revealing intent to significantly scale back asset purchases and raise rates.

“Both the cure, higher interest rates, and the disease, surging prices, are harmful to markets right now,” said AJ Bell investment director Russ Mould.

“The minutes from the Fed’s latest meeting showed it plans to drastically scale back asset purchases and that there is backing among its members for big rate hikes, all helping to pour cold water on investor sentiment.”

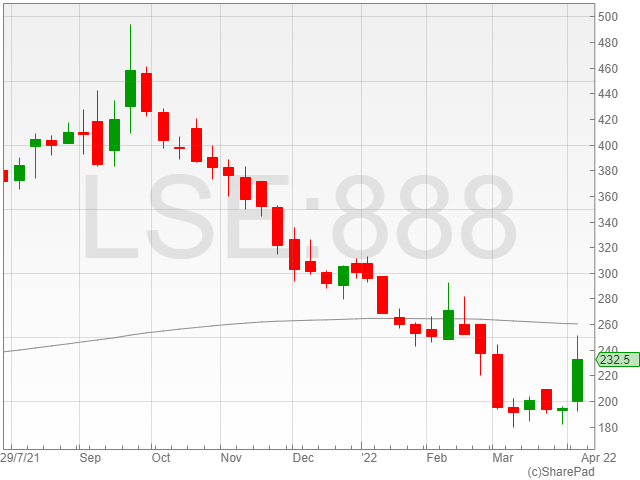

888 Holdings enjoyed a 21.5% increase to 233.4p following the announcement that the price of its William Hill non-US operations acquisition had fallen to £1.95 billion from £2.2 billion. The company currently intends to purchase the assets in June 2022 following its accelerated bookbuild to fund the project.

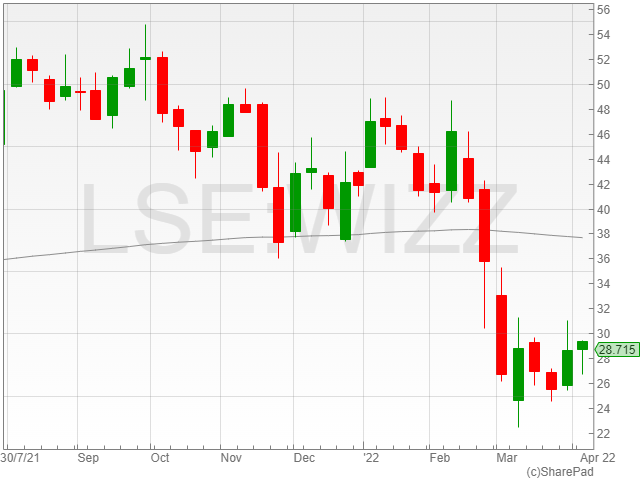

Wizz Air recovered ground with a 4.1% increase to 28,725p after the company was caught in the Covid-19 wave with staffing shortages alongside companies including EasyJet and IAG earlier in the week.

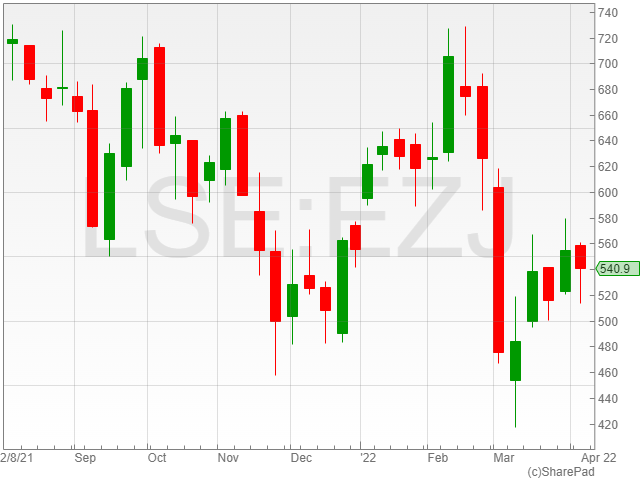

EasyJet saw a boost of 2.8% to 539.1p as shares rebounded after the company took a significant fall earlier in the week following its cancellation of over 200 flights.

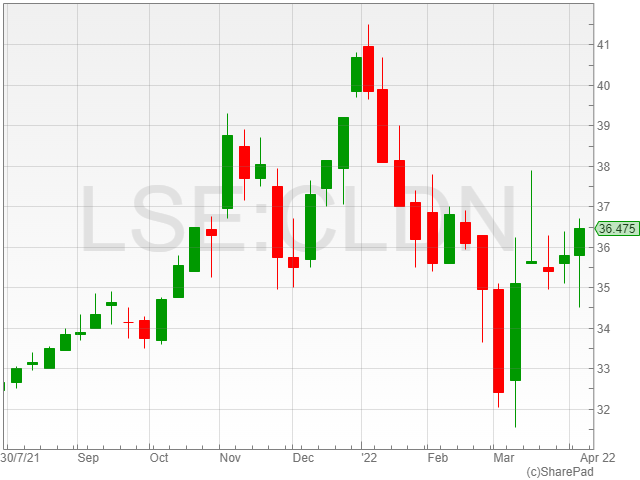

Caledonia Investment shares rose 3.4% to 36,375p after the firm announced its portfolio update, with a 28% total NAV return for Q1 2022.

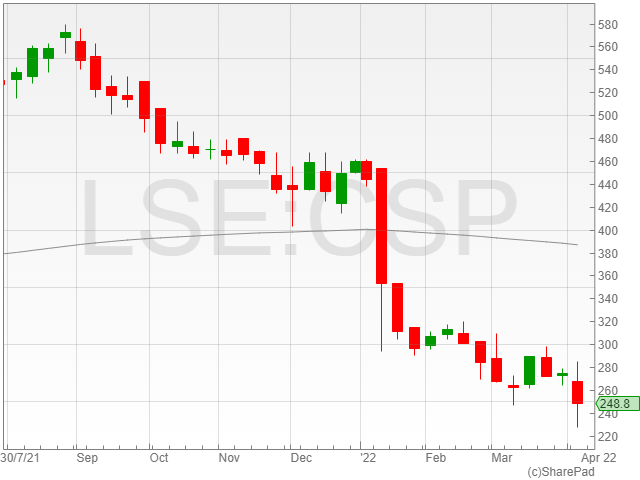

Countryside Properties took a blow of 9.4% to 251.9p after the company reported a 42% adjusted operating profit fall and a 13% drop in revenue for the last six months, alongside an operational overview that revealed “execution related” failures across its site operations.

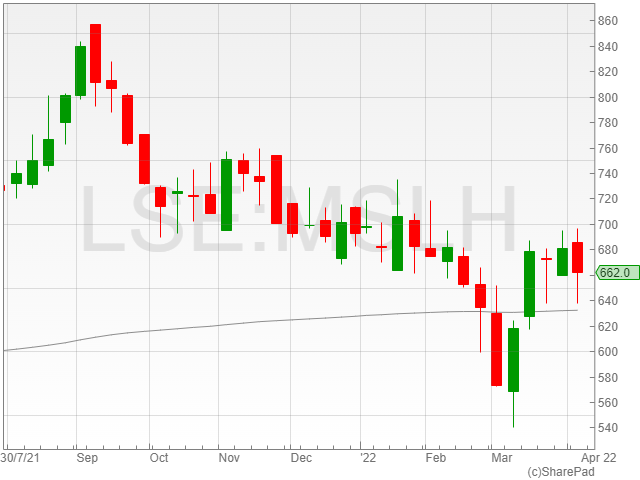

Marshalls’ shares fell 4% to 664.7p after the company announced the completion of the £187 million fundraise for part of the acquisition of pitched roof system manufacturer, Marley Group. The acquisition of Marley is going to cost Marshalls £535 million.

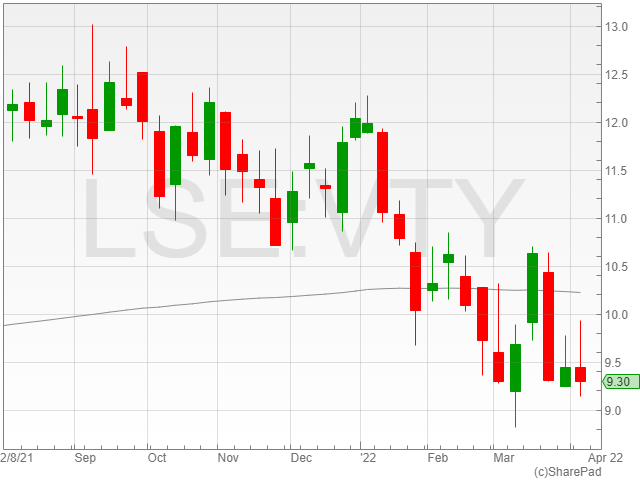

Vistry shares took a hit of 3.4% to 930p due to the company joining fellow housing companies Persimmon and Bellway in signing the UK Housing Pledge, which is set to see it shoulder the cost of altering fire hazards across its properties built in the past 30 years.

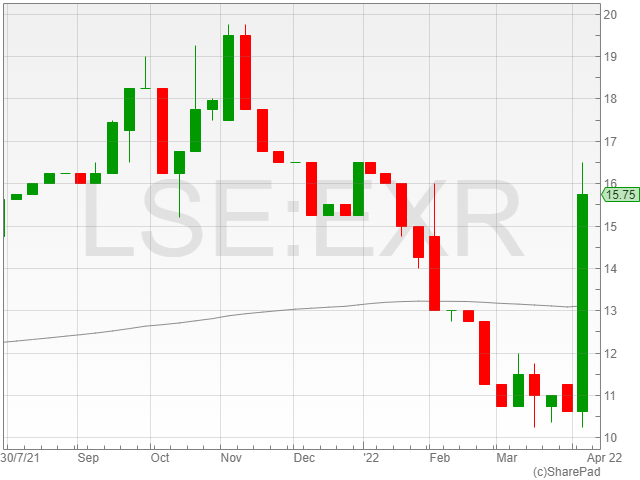

Meanwhile, on the AIM, Engage XR Holdings shares soared following its partnership with Victory XR announcing the rollout of 10 Metaversities funded by Meta.

The project reportedly features Virtual Reality university campuses for students to attend as an augmented type of remote learning.

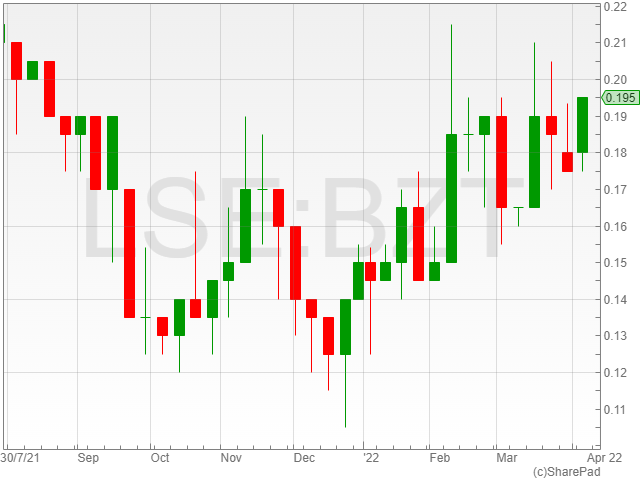

Bezant Resources shares were up 11.1% after it reported maiden results in its joint-venture copper-gold mine with Caerus Mineral Resources.

Bezant Resources and Caerus Mineral Resources noted a selected cut-off grade of 0.5% copper, along with a hard rock resource estimate of approximately 2.7 million tonnes at a copper equivalent grade of 0.74%, copper equivalent 0.51% copper and 0.26 grams per tonne of gold.

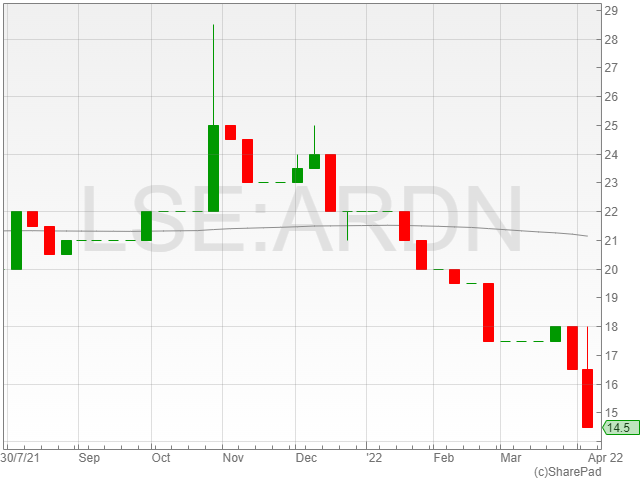

Arden Partners shares fell 19.4% to 14.5p following the company’s update on its Nomad condition, which revealed that the London Stock Exchange had denied Nomad status to Arden Partners’ takeover by Ince Group, putting the takeover status in question.

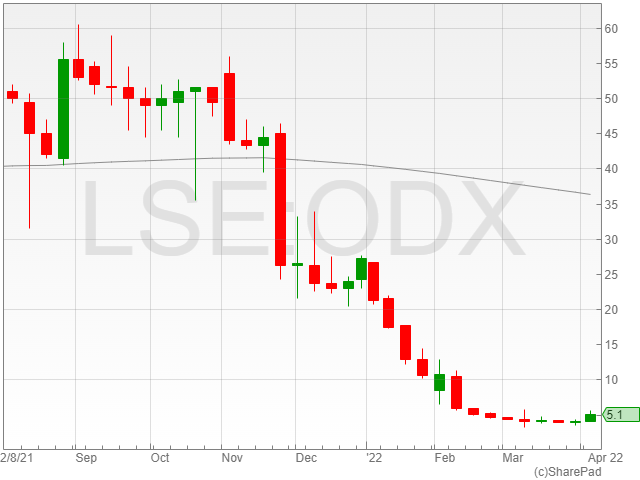

Omega Diagnostics dropped 8.9% to 5.1p on the back of its ongoing dispute with the Department of Health and Social Care (DHSC).

The group reported an estimated 41% increase in revenue to £12.3 million despite a drop in Covid-19 related revenues, which are set to account for approximately £2.6 million.