The FTSE 100 was down 0.4% to 7,582.9 on Tuesday on investor concerns over inflation and rising bond yields.

Defensive stocks such as utilities and insurers suffered the heaviest falls, with companies across the board in the red as the market trudged into a dismal day of trading.

Risk-off sentiment flared up across Europe, with Deutsche Bank decreasing 10% and Commerzbank spiralling almost 9% after reports that a major investor had sold a substantial chunk of their shares in both firms.

“Another day, another decline for key equity indices. European stocks were in the doldrums as investors fretted about inflation, politics, consumer spending and more,” said AJ Bell financial analyst Danni Hewson.

“Corporate news flow is picking up which is giving investors a reason to want to trade the markets, but mixed messages from these businesses is making it hard to call which way equities will move next.”

Commodities prices increased and sent mining stocks on the rise, including a 1.3% increase to 16,860 in Antofagasta, a 1.3% uptick to 527.2p for Glencore shares and a 1% rise for Rio Tinto to 61,400p and Endeavour Mining to 20,050p.

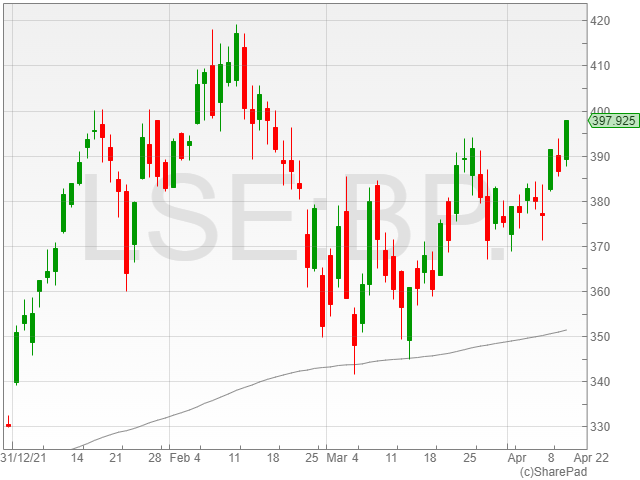

BP soared to the top of the FTSE 100 with a 2.7% rise to 397.5p after the price of Brent Crude increased 3.5% to $102 per barrel.

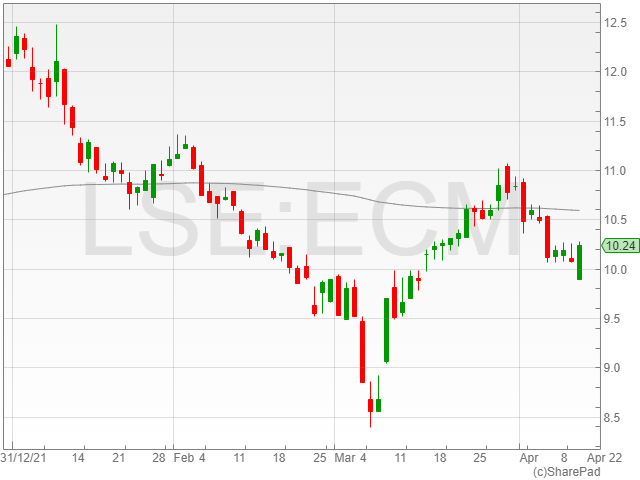

Electrocomponents enjoyed a 1.4% rise to 10,225p on the back of shining projections of a 26% like-for-like revenue growth for 2021, alongside an adjusted operating profit margin at the high end of its management consensus range.

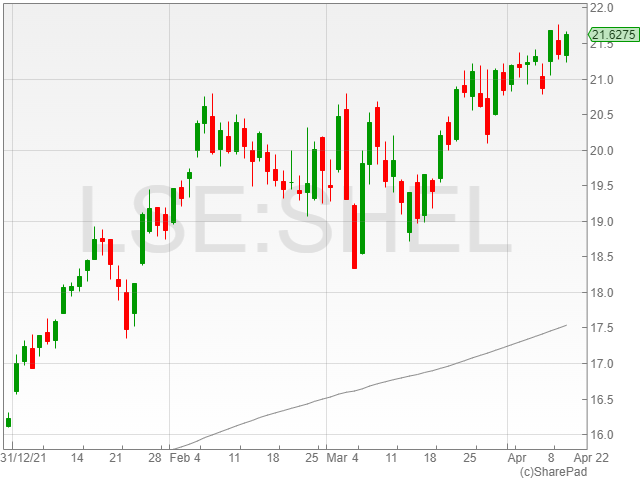

Shell shares rose 1.1% to 21,602p as it also rode the oil price uptick higher.

The Rolls Royce Group fell 5% to 90.2p after negative broker comments from JP Morgan toppled investor confidence in the company.

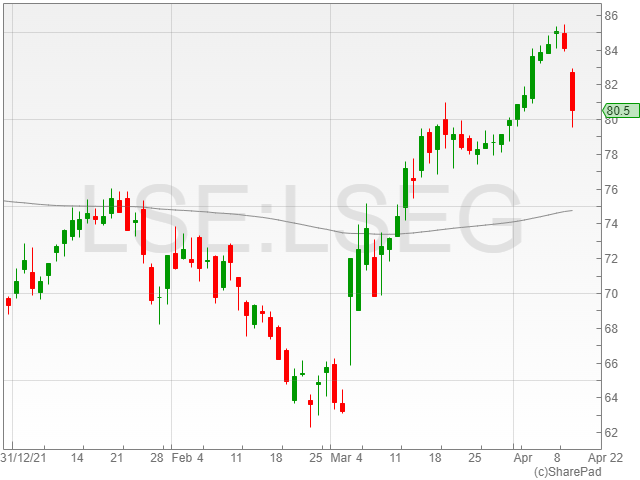

The London Stock Exchange hit the list of fallers as it suffered a 4.1% decrease to 80,590p in light of additional poor recommendations from brokers.

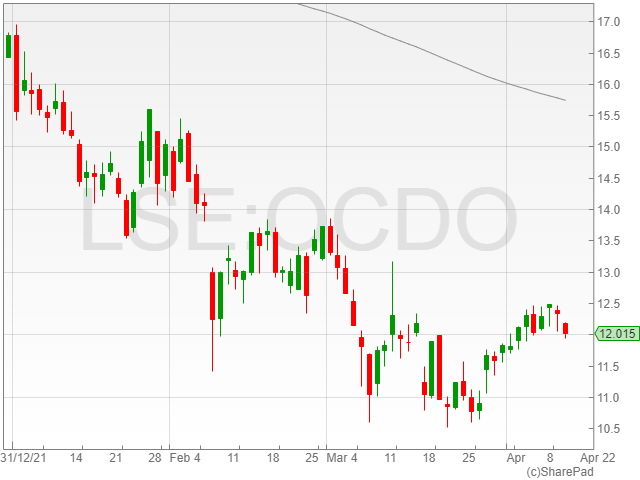

The Ocado Group dropped 2.9% to 12,017p as the struggling online retailer saw its star continue to fall in the new era of post-Covid retail, with the company struggling to adapt to survive its rapidly approaching obsolescence.