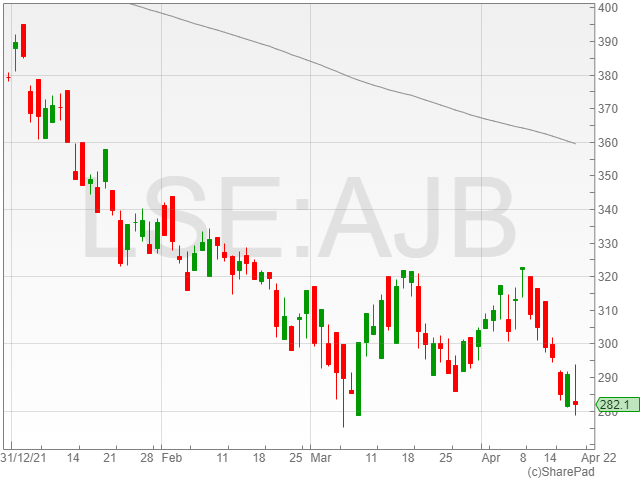

AJ Bell shares were down 3.5% to 280.7p in early morning trading on Thursday after the company reported slowing rates of investor activity in Q1 as markets dipped and the impact of the pandemic began to fade.

The investing group said that the Q2 term in 2021 was comparatively stronger as a result of consumers investing excess savings built up over the Covid-19 lockdown period.

However, the upheaval caused by surging inflation and increased market uncertainty left the firm with a weaker Q2 in 2022 as investors became less risk-happy in light of Russia’s war in Ukraine and the skyrocketing cost of living.

AJ Bell still reported decent numbers, with a total customer increase of 21% to 418,309 over the past year and a 5% uptick in Q2, bringing in total net inflows of £1.5 billion over the period.

The company reported total assets under administration at close of £74.1 billion, a 14% increase across the last year, but a 2% dip over the quarter due to an adverse market and additional movements of 4%.

The group pointed out that the FTSE All-Share index fell by 0.5% and the MSCI World Index fell by 5.5% during the poorly-performing term.

The investment platform noted additional highlights, with over 75% of new accounts listed as tax-advantaged pensions or ISAs, and a customer retention rate at 95%.

AJ Bell reported a slight fall in gross inflows to £2.7 billion compared to £2.8 billion in Q2 2021, and a net inflows drop to £1.6 billion against £1.8 billion.

The group confirmed a et inflows decline to £223 million over Q2 2022 compared to £311 million in Q2 2021.

“Although our D2C customers invested slightly less via our platform than in the comparative period as they assess the impact of the rising cost of living, net inflows to our advised platform remained on par with last year, which was a strong comparative. Net platform inflows of £1.6 billion is an encouraging result given the uncertain market backdrop,” said AJ Bell CEO Andy Bell.

“Our first five multi-asset funds recently passed their fifth anniversary, an important performance milestone particularly for advisers. Performance of all five funds was in the top 30% when compared against their peer groups, with four being in the top quintile.”

“Since launching these funds in 2017 we have shared the benefits of our increasing scale with customers, reducing the Ongoing Charges Figure from 50bps to 31bps during that time.”

The company also announced the launch of its new Dodl by AJ Bell investing app, which is set to expand the platform’s offerings to DIY investors with all the central tax wrappers and a streamlined investment range to help consumers pick funds and shares for their portfolios.

“This week we launched a new investing app called Dodl by AJ Bell which expands our offering to DIY investors. With an annual charge of just 0.15% and no commission for buying or selling investments, Dodl is a low-cost proposition perfectly suited to individuals who want an easy way to invest for their future,” said Bell.

“We believe it will be particularly attractive to the 8.6m adults in the UK who hold more than £10,000 of investible assets in cash, especially in the current climate of rising inflation where cash savings are being eroded in real terms due to the low interest rates available.”