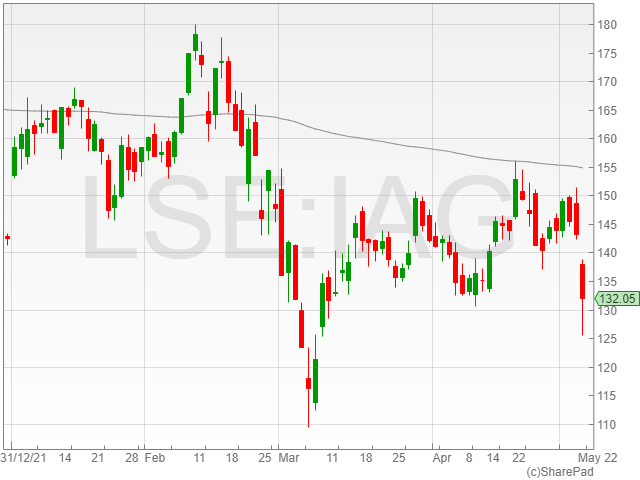

International Consolidated Airlines Group (IAG) shares were down 7.8% to 132p in early morning trading on Friday after the company reported an operating loss of €731 against a €1 billion loss year-on-year in its Q1 2022 trading update.

The airlines group highlighted a post-tax loss after exceptional items of €787 compared to €1 billion in Q1 2021, and a post-tax loss before exceptional items of €810 million against €1.1 billion the last year.

IAG highlighted that easing government restrictions boosted passenger capacity to 65% of 2019 bookings, representing an increase from 58% in Q4 2021 alongside strong demand for premium leisure bookings.

The group noted the short-term negative impact of Omicron over January and February on the operating result, passenger bookings and cancellations, however IAG reported no impact from the conflict in Ukraine on its business.

The travel company reported cash at €8.1 billion, increased from €241 million in Q1 2021, which the firm attributed to bookings for the rest of FY2022.

IAG noted that committed and undrawn general and aircraft financing facilities grew to €4.1 billion from €4 billion year-on-year, including an additional €200 million loan facility for Aer Lingus from the Ireland Strategic Investment Fund (ISIF), with an overall liquidity of €12.3 million compared to €11.9 billion in Q1 2021.

The group said it aimed to reach 80% of 2019 passenger capacity for Q2 2022, with 85% in Q3 and North Atlantic close to full capacity, and 90% in Q4, which would amount to a full-year capacity of 80% against 2019 levels.

“As a result of the increasing demand, forward bookings remain encouraging. We expect to achieve 80% of 2019 capacity in the second quarter and 85% in the third quarter. North Atlantic capacity will be close to fully restored in the third quarter,” said IAG CEO Luis Gallego.

“Globally the travel industry is facing challenges as a result of the biggest scaling up in operations in history and British Airways is no exception. The welcome removal of UK’s stringent travel restrictions, combined with strong pent-up demand, have contributed to a steep ramp up in capacity.”

“The airline’s focus at the moment is on improving operations and customer experience and enhancing operational resilience.”

IAG reported an expected operating profit from Q2, resulting in positive operating results and net cash flows for the remainder of 2022.

Analysts commented that though there was cause for optimism, the looming cost of living crisis threatened to eat into IAG’s recovering operating margins.

“IAG will take longer to recover than its short-haul focussed friends, but that doesn’t mean it should be discounted,” said Hargreaves Lansdown lead equity analyst Sophie Lund-Yates.

“There’s an argument to say that now the world is largely re-opening, customers could be inclined to splurge on a long-haul trip having been stuck at home for years.”

“The other side of that story though is of course the cost-of-living crisis. Those that often travel first class are likely not going to see much of a change in spending habits, but the situation may well act as a drag on BA’s shorter duration routes.”