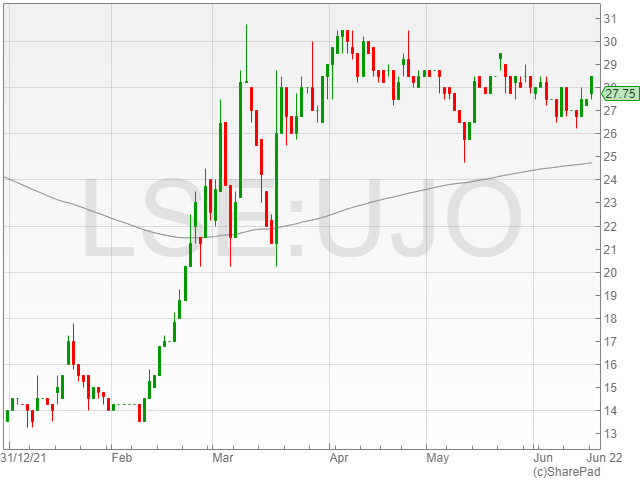

Union Jack Oil shares were up 1% to 27.8p in late afternoon trading on Monday following a reported $7 million in net revenues achieved from the Wressle hydrocarbon development located within licenses PEDL180 and PEDL182 in North Lincolnshire.

Union Jack Oil holds a 40% economic interest in the development, which has a current constrained flow-rate of 750 barrels of oil per day (bopd) with the well in-excess of the prognosed 500 bopd from the Ashover Grit reservoir.

The company reported that the well continued to produce under natural flow with zero water cut, with Union Jack Oil remaining cash flow positive covering all G&A, OPEX and contracted or scheduled CAPEX expenses, including any budgeted drill activities for at least the next year.

The oil and gas firm has cash balances and short term receivables over £8.4 million on 20 June 2022 and confirmed it was also debt free.

Union Jack Oil mentioned an expected maiden profit in the coming unaudited HY results ending 30 June 2022.

“The ongoing excellent operational and financial performance at Wressle continues to bolster the Company’s cash position, balance sheet and income statement,” said Union Jack Oil executive chairman David Bramhill.

“Net revenues from Wressle have now exceeded US$7,000,000 and, as a result of this exceptional performance, plus revenue contributions from the Keddington oilfield, the Fiskerton Airfield oilfield and North Sea Royalties.”

“The Board now expects to report a maiden profit in the forthcoming unaudited half year results ending 30 June 2022”.