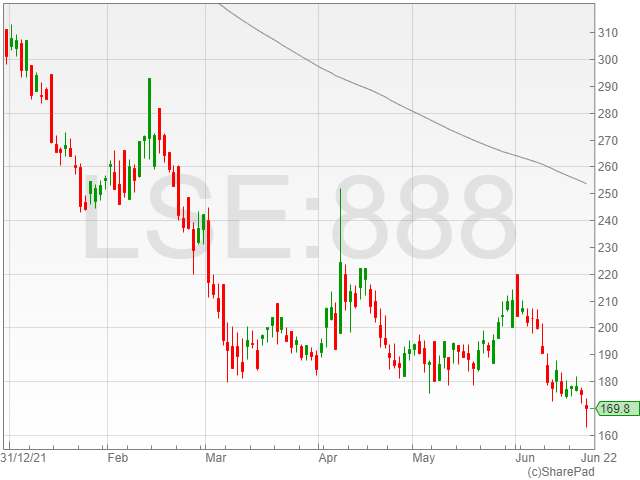

888 Holdings shares were down 2.7% to 170.4p in early morning trading on Thursday, following a reported £690 million in revenue and £109 million EBITDA generated by the company for the twelve months ending 28 February 2022.

The group confirmed William Hill brought in £1.3 billion in revenue and £238 million in adjusted EBITDA for the financial period.

888 Holdings commented that the performance of both businesses largely reflected a constitution of trends outlined in its 29 April 2022 prospectus, with the impact of retail reopening and positive performances across a slate of regulated countries offset by closure in the Netherlands and the effect of additional safer gambling measures in the UK Online sectors of its business.

888 Holdings highlighted an expected revenue between £330 million to £335 million for the six months ended 30 June 2022, broadly meeting board expectations.

The firm noted again that the growth in certain European markets had been offset by the impact of safer gambling measures and its temporary exit from the Netherlands.

William Hill revenue for the 26 weeks ended 28 June 2022 is anticipated between £620 million and £630 million, with capex for 2022 expected to be slightly higher for 888 Holdings and William Hill year-on-year.

The 888 Holdings board has reportedly set a goal of hitting a pro forma net leverage ratio at of below 3.0x in the medium term.

In a separate announcement, 888 Holdings confirmed it expected to market £1 billion aggregate principal amount of senior secured indebtedness, comprising a US dollar-denominated term loan B facility which is scheduled to mature in 2028 and euro-denominated senior secured fixed rate notes due on 2027, alongside euro-denominated senior secured floating rate notes due 2028.