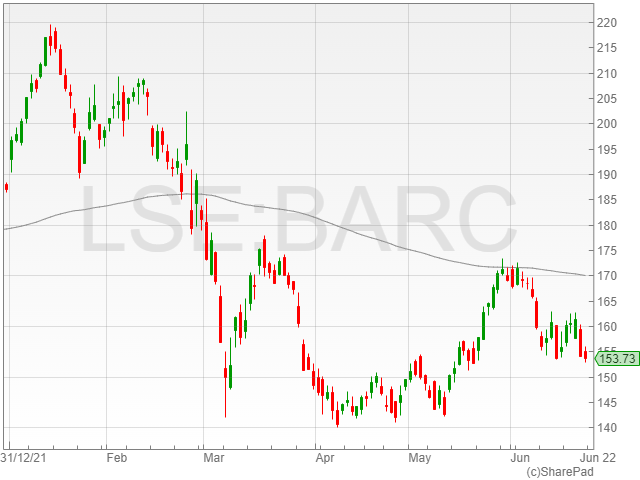

Barclays shares were down 0.1% to 153.8p in early morning trading on Friday after the group announced its intended acquisition of Kensington Mortgage Company (KMC) for approximately £2.3 billion.

The banking giant is set to purchase the firm from companies controlled by funds managed by Blackstone Tactical Opportunities Advisors L.L.C. and funds linked to Sixth Street Partners.

KMC is a UK specialist mortgage provider that uses proprietary technology to lend mortgages through brokers to borrowers with complicated incomes, including clients who are self-employed or with multiple or variable incomes.

The company is based in Maidenhead and employs 600 staff, who also execute mortgages for alternative parties.

Barclays confirmed the acquisition would enable it to broaden its product offering across the UK mortgage market, expand its customer numbers and grow mortgage originations to optimise its UK funding base.

The banking firm said KMC would retain the majority of mortgages it originates, although historically it did not hold mortgages on its balance sheet. The company originated £1.6 billion of mortgages in FY ended 31 March 2022.

Barclays mentioned it had also agreed to acquire a portfolio of UK mortgages consisting mostly of mortgages originated by KMC by October 2021 to completion of the KMC acquisition.

The portfolio reportedly amounted to £1.2 billion on 31 May 2022, comprised of approximately 70% owner-occupied and 30% buy-to-let residential mortgages, with a weighted average LTV of 77% at origination.

The acquisition is scheduled to complete in late Q4 2022 or early Q1 2023, and is set to be financed using Barclays’ existing resources. The agreement is estimated to reduce the banking company’s CET1 ratio by approximately 12 basis points, assuming the deal closes in late Q4 2022.

“The Transaction reinforces our commitment to the UK residential mortgage market and presents an exciting opportunity to broaden our product range and capabilities,” said Barclays Banks UK CEO Matt Hammerstein.

“KMC is a best-in-class specialist mortgage lender with an established track record in the UK market, strong broker and customer relationships and data analytics capabilities. KMC complements our existing UK mortgage business and broker relationships through the addition of a specialist prime mortgage originator and the utilisation of our strong UK funding base.”

“The Transaction should generate attractive returns for Barclays over the medium term as the KMC Mortgage Portfolio increases in size through the ongoing origination of new mortgages. We look forward to KMC management and employees becoming part of the Barclays group.”