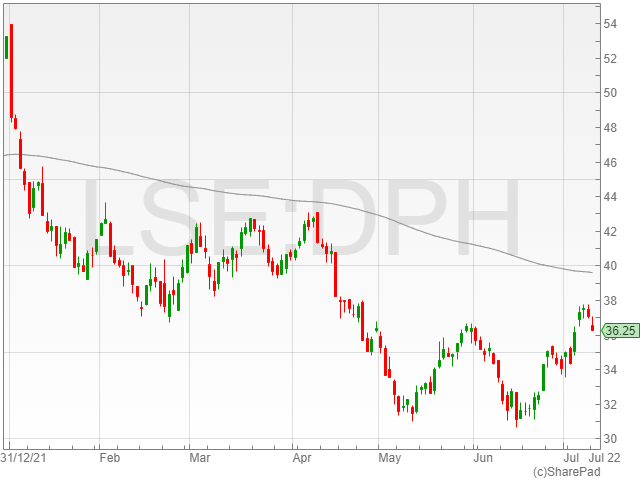

Dechra Pharmaceuticals shares fell 2.9% to 3,640p in early morning trading on Monday after the group reported a slower revenue growth in HY2 2022 in its trading update, in line with management expectations as the impact of the Covid-19 pandemic on the pharmaceuticals market started to unwind.

Dechra Pharmaceuticals mentioned a 14% rise in company revenue at constant exchange rate (CER) and a 12% increase at actual exchange rate (AER).

The veterinary medicine firm announced a European pharmaceuticals revenue climb of 8% at CER and a 5% uptick at AER, including the contributions from its Tri-Solfen acquisition on 5 February 2021 and Osurnia on 27 July 2020.

Dechra Pharmaceuticals also noted a North American pharmaceuticals growth of 24% at CER and 25% at AER despite a rise in generic competition, with revenue also contributed from its series of product acquisitions over the timeframe.

The group commented its supply chain remained robust, despite the ongoing geopolitical volatility, and its cost base increased as a result of global inflation. However, the company said it was well-placed to proactively manage the rise in expenses.

Dechra Pharmaceuticals further highlighted its six minor product acquisitions for the North American market, alongside the global rights to novel canine lymphoma treatment verdinexor (branded as Laverdia), giving it access to a new niche therapy on the market.

The company also drew attention to its launch of novel therapeutic dog sedative Zenalpha.

“We are delighted that the financial year just ended was another record year for Dechra and in line with expectations, with Group revenue growth slowing to more normal levels as expected in H2 as the impact of the pandemic on our markets unwinds,” said Dechra Pharmaceuticals CEO Ian Page.

“Whilst we expect current macroeconomic uncertainties to continue, the veterinary pharmaceutical market remains resilient and in growth. Our global trading continues to be strong and we continue to outperform the market, particularly in North America.”

“The complementary product acquisitions we made during the period strengthen our existing portfolio and are performing in line with initial expectations; there are a number of acquisition opportunities that we are assessing. We continue to believe in the ability of our people to execute our strategy and remain confident in our future prospects.”