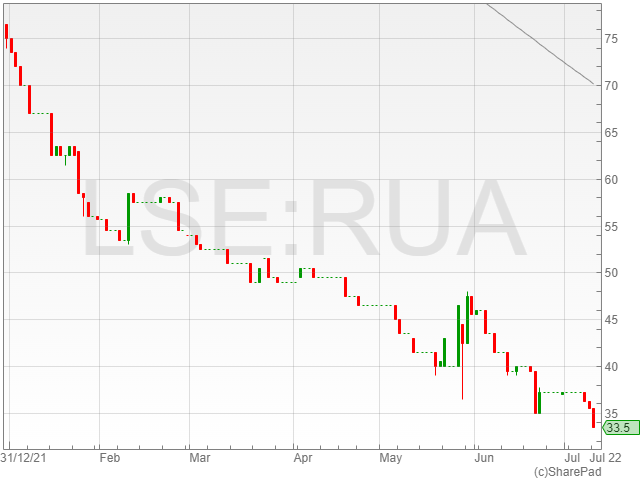

RUA Life Sciences shares were down 6.3% to 33.2p in late afternoon trading on Monday after the group announced a widened operating loss of £2,352,000 in FY 2022 against £1,551,000 in FY 2021.

RUA Life Sciences attributed its operating loss to higher costs for key research and development activities in its grafts and heart valves sectors, along with investment in growing its manufacturing infrastructure.

The company reported a revenue growth to £1,625,000 compared to £1,528,000 the last year, alongside a return to growth in contract manufacturing revenues of 11%.

RUA Life Sciences commented its delivery of polymer measured by volume to its licensees rose, however revenues in biomaterials fell slightly due to a one-off timing benefit in royalties the previous year.

It confirmed its gross margins remained strong in excess of 84%, apparently demonstrating the attraction of the polymer licencing model and the embedded value within medical device contract manufacture.

RUA Life Sciences mentioned a fall in year-end cash balances to £2,963,000 from £6,294,000.

However, the firm also highlighted several positives of the period, including the appointment of two new executive directors and the expansion of its biomaterials business volume year-on-year.

The company said its outlook was focused on FDA marketing approval for polymer-sealed grafts after failing to achieve 510,000 approval after its first attempt.

RUA Life Sciences added it was still in discussion with the FDA and anticipated final confirmation of the requirements in August 2022.

“A great deal of work has been undertaken within the business to continue the process of building RUA into a full-scale medical device manufacturer,” said RUA Life Sciences chairman Bill Brown.

“Key appointments have been made in the Regulatory, Finance, Quality and R&D Engineering teams with all departments making good headway. After the FDA indicated that they would like to see additional data and in particular a relatively small clinical study, constructive discussions continue on the precise requirements of the 510(k) process.”

“The Group is currently accelerating the changes required to fully transition to a medical device manufacturer and have a robust manufacturing process in place to meet anticipated demand for product.”