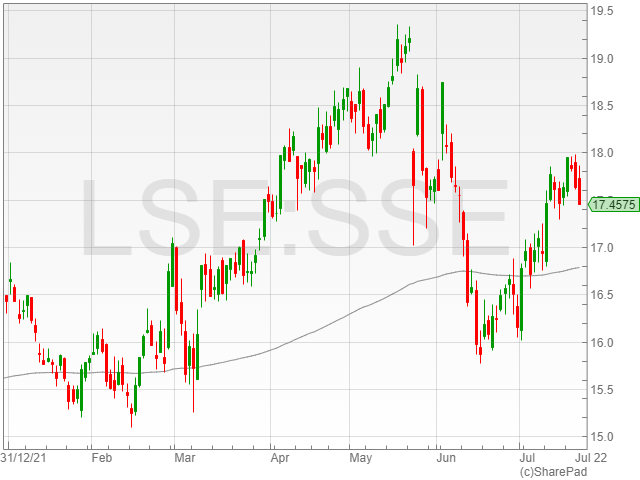

SSE shares were down 0.8% to 1,748p in early morning trading on Thursday after the company announced a performance that “slightly exceeded” expectations in its Q1 2023 trading update.

The energy group reiterated its guidance of an EPS of at least 120p per share for FY 2023, along with a projected adjusted capital expenditure and investment in excess of £2.5 billion.

SSE commented it expected first power from its Seagreen offshore wind farm by the end of July, with construction on Viking onshore wind farm and Dogger Bank A, B and C offshore wind farms reporting good progress.

The company also said progress was ongoing for its disposal of a 25% minority stake in SSEN Transmission, with the formal process underway and a targeted agreed sale by the end of 2023 after regulatory approvals.

“The strength of SSE’s integrated and balanced business model, combined with our commitment to positive engagement with key stakeholders, is serving us well through a period of market, political and regulatory complexity,” said SSE finance director Gregor Alexander.

“Meanwhile, CfD success at Viking, progress on our Southern European pipeline acquisition, the positive outlook for Transmission from the recent Holistic Network Design and new hydrogen options at Saltend all position us well for the long term.”

“We remain confident in our financial outlook for strong earnings growth this year and look forward to updating the market on performance in our interim results statement on 16 November 2022.”