FinTech is a sector that has grown up within the EU – in fact, it has never functioned without it. Within the climate of openness and cross-border investment cultivated by the European Union, London’s has become the EU’s undisputed Fintech capital. But after Brexit, is London likely to keep the top spot?

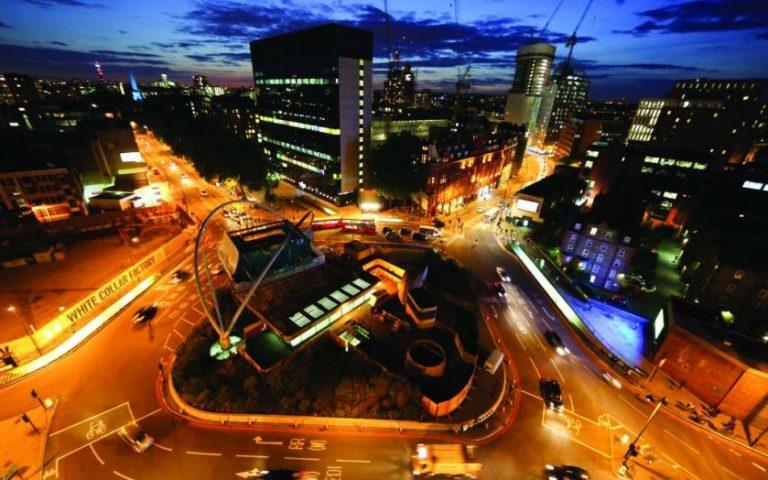

Rightly, many are worried about the effect Brexit will have on the city’s booming industry. London’s Fintech companies were strong remainers; a survey by Tech London Advocates, a body that represents about 2,700 of the British capital’s tech sector, found 87 percent of its members polled wanted to remain in the EU. London has been the most friendly climate towards start-ups, and fintech firms in particular; ex-mayor Boris Johnson, along with George Osborne, championed the development of the Silicon Roundabout area. But now all this is at risk – and many new firms are considering whether it would be better to move abroad.

Market access

One of the obvious benefits that the European Union brings the Silicon Roundabout is access to markets throughout Europe. For Fintech start-ups, this is key – EU rules mean that the UK has “passporting” priviledges, allowing a bank to operate in all European countries so long as it has a licence from an EU member state. Having the opportunity to operate in 28 countries is clearly invaluable to a start-up business.

Similarly, freedom of movement widens the pool of talent and allows fintech firms to hire the brightest developers from all over Europe. According to Innovate Finance, 30 percent of people employed in Fintech in the UK are from overseas; if the UK is facing a skills gap in areas that start-ups need, Europe is the best solution to the problem.

EU Investment

The European Investment Fund (EIF) is a huge source of investment for British businesses – last year, the UK benefited from £559 million from the fund. Once Britain formally leaves the EU, it seems unlikely that it will still be allowed to benefit.

In 2015, the British Fintech sector generated £6.6 billion in revenues and attracted £524 million in investment. According to a report from Accenture, in 2013 the UK and Ireland represented 53 percent of Europe’s rounds and two-thirds of the total raised by Fintech startups – investment that came from investors all over Europe, wanting to put their money into a leading Fintech firm. For them, London is the best bet – after Britain leaves the EU and loses the benefits of the single market, this may no longer be the case. Fintech firms in other European capitals are rapidly catching up with London – including Berlin, Dublin and Stockholm, who have all seen a growth in their Fintech sector over the last year – why would investors put money in British firms when other countries have the benefit of Europe on their side?

Until Article 50 is invoked and Britain agrees its terms for leaving the EU, investment is likely to be impacted by uncertainty.

So – a possible move to Europe?

Given the possible repercussions of Brexit on Fintech firms, many are considering moving their headquarters to Europe in order to maintain access to EU benefits. Just last month, a German sponsored truck rode the streets of London with a colourful placard reading “Dear startups, keep calm and move to Berlin”.

Whilst this may sound like a laugh, moving business to Berlin is not. According to German senator Cornelia Yzer, more than 100 startup companies in London are looking into relocating to Germany’s capital. In fact, every time she speaks in the UK a number of start-up companies approach her with questions about the feasibility of relocating.

During a presentation at the financial technology industry’s conference London Fintech Week 2016, Senator Cornelia Yzer said every time she speaks publicly about Berlin post-Brexit, a number of startup companies approach her office about moving to Berlin.

“Not 10 or 20 or 30, more, over 100,” she said, according to International Business Times.

Just a week after the referendum the co-founder of TransferWise, Taavet Hinrikus, tweeted about the possibility of moving abroad:

Ireland, Switzerland, others reaching out and tempting @TransferWise to start/move operations there – competition between states is good 🙂

— taavet hinrikus (@taavet) 3 July 2016

However, not all Fintech firms are worried. James Johnson, Group CEO of Nicoll Curtin, a global FinTech and Change recruitment agency, believes London’s sector will be largely unaffected: “Brexit will just accelerate the focus on technological solutions to problems. Technology crosses borders easier than people! This will increase tech hiring.”

He added, “Brexit could even accelerate the focus on and progress of London’s fintech sector because the solutions they’re creating could address some of the challenges of Brexit.”

Alex Crocombe, CFO or start-up Goji, has a similarly positive outlook despite experiencing some post-Brexit wobbles when looking for investment. He said, “initially, we thought it would be fatal to our business and the many other startups looking for funding, as investors evaluated the damage to their current Fintech investments and paused on marking new investments. Although there is still real uncertainty as to the medium to longer term effects Brexit will have on the UK and Global economy and our sector, we have actively seen investors return to the market and commit funds.”

Like so much of the UK post-Brexit, the outcome for London’s Fintech sector remains to be seen – with any luck, Silicon Roundabout’s success will continue to grow as Britain becomes an independent country.

09/08/2016