The question of whether Germany’s growing property prices constitute a new housing bubble has been debated for over half a year now, and was recently reignited by data showing that Germany’s building permits on flats were at a ten year high in January this year. Commerzbank has now published a report detailing their assessment of the danger lying in the German property market. The results constitute a mixed view.

Worries about the German housing market persisted since late 2015

Worries about the growing volume of demand and rising property prices in Germany already came up late last year when economists warned that the ECB’s monetary expansion program could cause bubbles in the housing market of the UK, Germany and Norway.

Germany has historically been a country less prone to volatile cyclical developments in the housing market due to having a more prevalent renting culture than other European countries. According to Eurostat only 52.5% of German households owned their own home in 2014, compared to 64.8% in the UK and 70.1% in the European Union collectively.

However, in the last three months of 2015, construction expanded to become one of the country’s biggest contributor to growth fuelled by higher demand for individual home ownership. New mortgages jumped 22% over the course of 2015 after years of 3% growth or below.

Data on 2016 developments in the housing demand and property prices reinforced concerns

Fears persisted after Destatit published data which showed that in January this year building permits for flats rose by 34.5% compared to the same month the previous year. Numbers of new building permits therefore reached record highs last seen a decade ago.

Economists also observed that house prices have risen by over 5% year on year in the first half of 2016, levels similar to the housing boom the country experienced in the late 1980s and early 1990s corresponding with the fall of the Berlin Wall and subsequent unification of West and East Germany. Bloomberg in May published figures suggesting that housing prices in major cities such as Berlin, Hamburg and Munich grew as much as 30% over a 5-year period.

New Commerzbank report discusses the extend of the issue

Commerzbank now published its own assessment of the likelihood that growing property prices in Germany will turn the property market into a volatile time bomb and its views are mixed.

Commerzbank first warned of worrying developments in the country’s housing market at the beginning of the year when its Real Estate Monitor started to indicate imbalances in the German housing market. The research department of the bank has now stated that such indicators have since worsened further.

The report argues:

“The housing boom in Germany is looking increasingly like a bubble as house prices steadily decouple from the fundamental factors. – Since 2010, prices have risen faster than rents, consumer prices and private household income.”

The imbalance between the rise in property prices to rents, inflation and income may be the first sign that Germany’s housing market is well on its way to balloon.

ECB expansionary monetary policy is to blame

Driving the growing housing demand in Germany is the ECB’s expansionary monetary policy that Mario Draghi committed himself to in order to recover the Euro Zone economy from the Euro Crisis.

Quantitative easing and low interest rates have encouraged lower mortgage rates and enabled German households to afford their own homes. But, as it could be observed in the US in the years before the US housing crisis, the probability that rates can drop much further is now extremely low, which could start to grind demand to a halt when rising housing prices are no longer rebalanced by lower interest rates. In the US this development ultimately led to a sharp correction in demand and pricing, followed by growing default rates on mortgages which ignited the start of one of the worst financial crisis to shake the global economy.

In Germany, growing house prices were outweighed by lower interest rates and rising income, making the financing of housing easier, until the beginning of 2015. However, since then rises in house prices have started to exceed both growth in income and decreases in the interest rate and housing is becoming less affordable.

Commerzbank said:

“According to our own index – which is not comparable 1:1 with the US index – the costs of financing an average house relative to average private household incomes are still much lower than [in the US] in 2009. However, as a further sharp fall in interest rates is now unlikely, the unfavourable trend in housing affordability should continue if the recent trend in prices continues as it has done recently.”

“The tensions on the housing market are generally rising, albeit from quite a low level.”

German ten-year yields and construction boom now eyed as future indicators

One important indicator to keep an eye on now is the German ten-year bond yield. If they should rise – and mortgage rates follow – the tensions in the housing market are likely to increase.

The risk could also increase if we were to observe a further construction boom in Germany which would resolve current housing shortages in some regions, reducing upwards pressure on property prices. However, so far there is little evidence of such developments as Commerzbank reports. Although building investment has outpaced GDP in growth since 2010, its’ share in GDP only rose to 6%, well below the benchmark of 7.5% which was reached during the 1990s housing boom.

While construction orders have increased realty in volume, production has largely failed to respond to the increase in demand. This is attributed to a lack in capacity to deliver on a higher volume overturn. Therefore, the deciding factor will be whether companies increase their capacity to cater to the higher demand on new constructions.

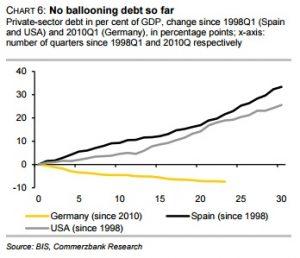

Low private debt ratio eases concerns

On a positive note, Commerzbank and other analysts acknowledged that there is so far no sign of ballooning private debt, such as was observed in the US and Spain before the latest crisis. The private debt ratio has in fact decreased in the first seven months of 2015. This suggests that the German private debtors are in a considerably better position than mortgage holders were in the US and Spain around a decade ago.

Therefore, although it is worth keeping an eye on the developments in the German housing market, as well as debt levels, it is unlikely that the current rise in demand for private property in Germany will develop into housing boom and consequential bust as in the USA and Spain.

Katharina Fleiner 09/08/2016