AstraZeneca shares

AstraZeneca shares have been in an uptrend since March 2021, with the pharmaceutical company constantly performing and innovating to meet market needs with Covid vaccines along with an array of medicinal treatments for rare diseases, cancer and respiratory problems.

The question is, after such a strong rise in the AstraZeneca share price, is it possible for Astra shares to break to all-time highs once more?

AstraZeneca and its Results

In February 2022, AstraZeneca reported its Q4 and full-year results for 2021 where the company addressed the hike in sales as a result of the covid vaccine dole out, which was met with a positive market reaction.

AstraZeneca’s revenue climbed 41% to $37.4bn from $26.6bn in 2020 as the 41% increase in product sales to $36.5bn aided revenue growth.

The company swung to a pretax loss of $265m from a profit of $3.92bn year-on-year in 2021 as R&D costs jumped 63% to $9.74bn and SG&A expenses rose 35% to $15.2bn.

AstraZeneca said selling its vaccine at cost during the pandemic was not helping its profits.

The company’s earnings per share fell 97% to $0.08. However, core EPS climbed to $5.29, up 32% at reported rates and 37% at constant currencies. According to AstraZeneca, the discrepancy is related to the acquisition of Alexion Pharmaceuticals, as well as impairments and restructuring charges.

In July, the company purchased Alexion, a biotech company based in Boston, Massachusetts, for USD13.3 billion in cash and 236.3 million new AstraZeneca shares. Alexion is included in Astra’s results from July 21 of last year onward.

“Growth was well balanced across our strategic areas of focus, and we saw double-digit growth in all major regions, including Emerging Markets despite some headwinds in China,” said Chief Executive Pascal Soriot.

AstraZeneca and its Outlook

At constant currencies, core EPS is predicted to expand by a mid-to-high twenties percentage in 2022, while sales are expected to grow by a high teens percentage.

The revenue from Covid-19 medicines is likely to drop by a low-to-mid 20%, with a drop in vaccine Vaxzevria sales being somewhat offset by rising Evusheld sales, a Covid antibody treatment.

AstraZeneca wants to boost the annualised dividend by $0.10 to $2.90, showing its confidence. It will pay a total dividend of $2.87 for the year after granting a second interim dividend of $1.97 for 2021.

“The positive news from our pipeline, including approvals for Evusheld and Tezspire, supports the outlook for 2022. This, along with the transformative acquisition of Alexion, means that we are confident in our long term growth and profitability. After a landmark year in 2021, we are increasing the dividend for our shareholders,” Added CEO Soriot.

AstraZeneca in Latest News

Due to China’s current economic situation, AstraZeneca predicts a decline in sales.

The group has been considered a significant growth market in China, making it more vulnerable to a revenue slowdown than other ‘big pharma’ companies.

As a result of the outbreak, AstraZeneca’s growth will be hampered, especially as it begins to affect economies in other parts of the world, such as Europe and the United States, where it generates a significant portion of its total revenue.

In the face of this potential setback, AstraZeneca has pledged to donate 9m face masks to countries grappling with the illness, as well as expand diagnostic testing efforts.

Some analysts have suggested AstraZeneca may be able to offset this income loss by developing a successful pharmacological agent against Covid-19, such as their cancer medication Calquence (acalabrutinib).

A clinical trial of the medicine in Covid-19 patients is being developed quickly by the business. AstraZeneca has also teamed up with Sanofi in the hopes of producing a vaccine, which would help the company recoup lost revenue.

Earlier in April, the group’s lung cancer antibody-drug conjugate Enhertu also received a priority review from the FDA.

AstraZeneca also announced that its candidate for unresectable liver cancer Tremelimumab has been accepted under priority review by the US FDA in late April.

Apart from the positive news for Enhertu and liver cancer candidate, AstraZeneca’s Ultomiris and its investigational antisense oligonucleotide, AZD8233, presented optimistic results.

AstraZeneca Pipeline

Currently, AstraZeneca has 2 vaccines in Phase III trial under the “Other” category which are aimed to battle Covid-19.

Vaxzevria is to be used as a Covid-19 vaccine whereas, Evusheld is used for the prevention and treatment of Covid-19, both of which are in Phase III trials.

As of last quarter, AZD2816 which is used to prevent Covid-19 has been discontinued from AstraZeneca’s pursuit of fighting Covid-19.

AstraZeneca’s vaccine was the main jab used by the UK government to combat the pandemic once the vaccine was readily available.

Apart from Covid treatments under respitaroy studies, AstraZeneca has many drugs underway for oncology, cardivasular, renal & metabolism, and rare diseases. As mentioned above, the company has been enroute to approvals and optimistic results with various drugs, meaning a positive outlook for AstraZeneca in 2022.

Astra share price

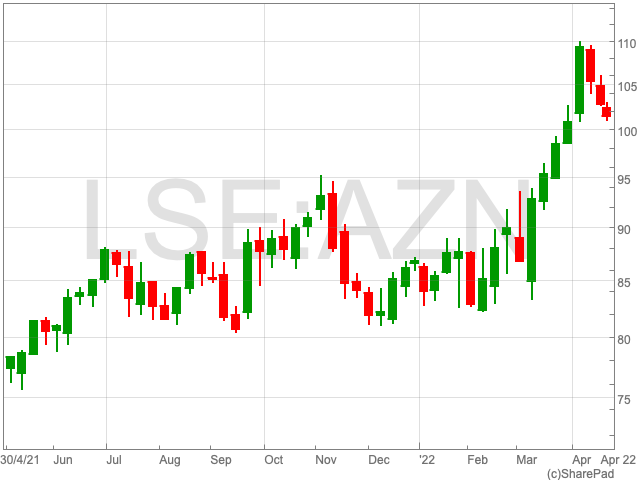

The pandemic began in March 2020 and AstraZeneca shares took a sharp slump in line with a broad market sell off.

However, the group’s shares have since rallied from lows of 6,100p to trade above 10,000p at the time of writing.

Along with a general melt up in markets, Astra received investor interest after Astra joined the fight against COVID with their vaccine.

Since January 2022, AstraZeneca’s shares rose 19.8% and is one of the best performers year-to-date.

AstraZeneca Share Valuation

AstraZeneca has a current P/E of 25.8x and forward P/E of 20.3x which means analysts see higher earnings in the future.

The company has a market cap of £162bn and a ROCE of -0.3x due to the pretax loss it made in its recent results.

AstraZeneca shares have a dividend yield of 2.2% and a cover of 1.9x which may mean higher dividend payouts in the future, or deeper investments in the company which may result in higher attributable profits to shareholders.

Given the company has numerous drugs in the pipeline to hedge any risks associated with the failure of one project, not to mention the array of medicine that Astra already has in the market, the dividend seems secure and could well grow.

In terms of AstraZeneca’s broker ratings, Jefferies raised AstraZeneca shares to a ‘hold’, Barclays raised their price target 12,000p and Berenberg upgraded also AstraZeneca’s target to 12,000p with a ‘buy’ rating.

These are fairly encouraging ratings for the AstraZeneca share price and suggest we could well see record all-time highs in the near future.