Eve Sleep has enjoyed an interesting 2022 so far, with the announcement of a potentially lucrative deal with DFS and reports of steady financial results in 2021.

The company reported a revenue uptick of 11% to £26.6 million against £25.2 million in 2020. Eve Sleep announced an increase in gross profit to £14.7 million compared to £14.4 million in 2020.

The firm announced that Q1 2020 was its strongest quarter due to rising lockdown restrictions, with a normalisation in its comparatives by the start of May the same year.

Eve Sleep reported that January and February trading were softer than in 2020, but the year overall represented a 6% uptick in 2021.

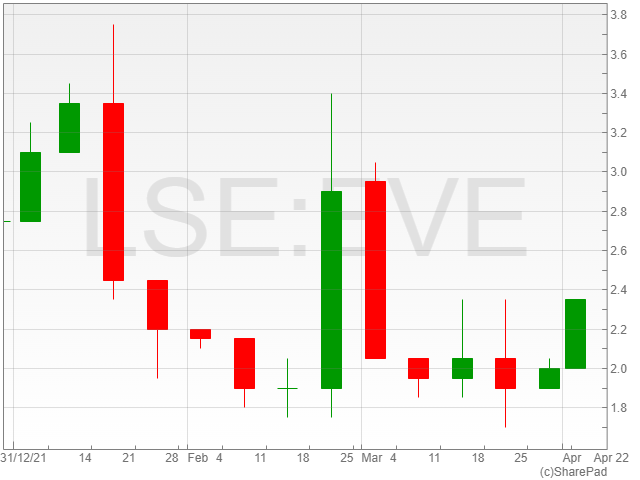

However, despite steady growth, the AIM listed company has so far fallen 24.5% year-to-date.

The firm attributed its increased £3.4 million pre-tax loss to higher marketing investment in France.

Eve Sleep shares fell 25% on 19 January 2022 to 2.6p on the back of reported delivery and customer service issues ahead of its final results for 2021, including strain on its delivery chain over the Christmas trading period, leading to customer service problems.

DFS Partnership

However, Eve Sleep saw its shares surge 95% in late February after it announced its partnership to sell its range of mattresses on the DFS site with a later rollout to its showrooms, with the share price rising to 2.9p on the day of the announcement.

However, it appears that the DFS partnership was only a temporary break in Eve Sleep’s shares continual downward spiral, with the price largely giving up all its gains since.

Sleep Wellness

Eve Sleep has also highlighted its ambition to break into the relatively untapped market of digital sleep wellness services.

“Our push into sleep wellness space will continue at pace in 2022, including the launch of our first digital services,” said eve Sleep CEO Cheryl Calverley.

“Sleep wellness is a large, fragmented and growing market, where we have a substantial lead over our more mattress focused competitors.”

“There is a real opportunity to create the world’s first digital sleep wellness retailer.”

Potential trouble ahead

However, the company noted growing geopolitical uncertainty as the Russian invaded Ukraine, and said that despite its unchanged goals to capitalise on its momentum in 2022, the firm’s situation remained subject to conflict-linked volatility in its supply chain.

It’s worth highlighting that 40% of the group’s revenue in 2021 came from its premium range; with inflation hitting new highs at a 30-year record of 6.2% and the energy price cap rising 54% in April, it’s possible that consumers will be less-inclined to spend cash on higher-end offerings from Eve Sleep if the tsunami of expenses coming up in 2022 empty their wallets beyond the cost of a new fancy mattress.

Eve Sleep’s rise to 2.9p on the DFS partnership announcement did not keep the attention of investor for as long as the company probably hoped for, as the shares have fallen back to stand at 2.1p at the time of writing.