Ark’s major holdings have seen dramatic falls in recent weeks

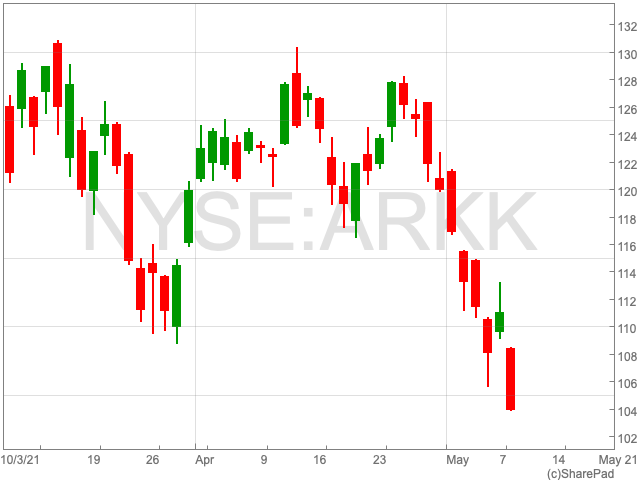

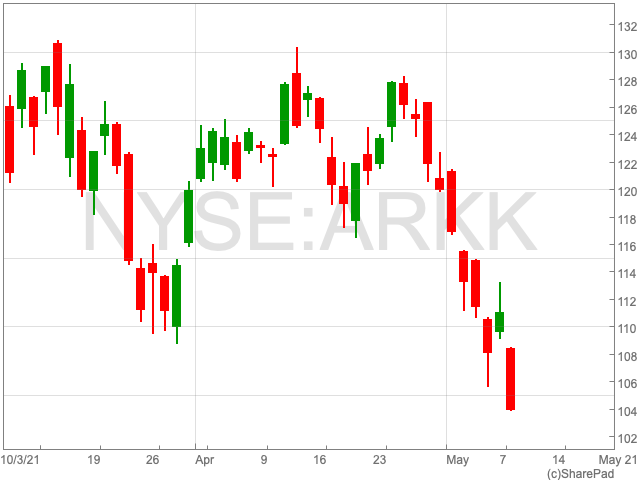

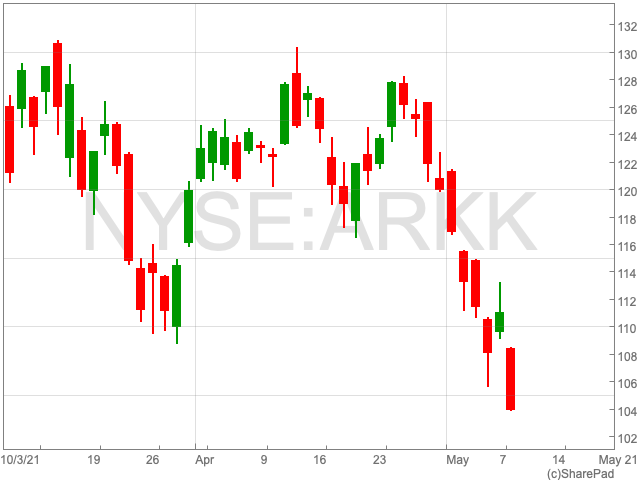

The Ark Innovation ETF is down to its lowest level since November and has lost 16.5% of its value since the beginning of the year.

Since February, when the $21bn fund hit an all-time-high, the fund has fallen by 33%.

The company’s major holdings have seen dramatic falls in recent weeks, including Tesla, which is down by 6.44% today alone.

Cathie Wood’s flagship fund aims for a thematic multi-cap exposure to innovation across sectors, while seeking long-term growth of capital. This has made it vulnerable to a broader slide of high-valued growth stocks. As the Financial Times reported, this has come about as inflationary pressures have lessened the appeal of businesses which will see profits arrive in the future.

This was reflected by a decline in the Nasdaq composite which features many tech stocks last night.

“The sector rotation today is violent,” Ted Mortonson, a technology sector strategist at Baird, told the Financial Times.

“From a performance anxiety on the upside — a fear of missing out — this is now fear of getting killed.”

The fund also broke below its 200-day moving average, a long term moving average that helps determine the overall health of a stock.

“The issue with ARKK and other speculative growth ETFs is that short-term rallies have been aggressively faded for three months now,” Frank Cappelleri, Instinet executive director, told CNBC. “The ETF will have to do more than just bounce for a few days to convince traders otherwise.”

“In other words, simply getting back above the 200-day moving average won’t mean much without upside follow through. That continues to be the biggest concern,” Cappelleri added.