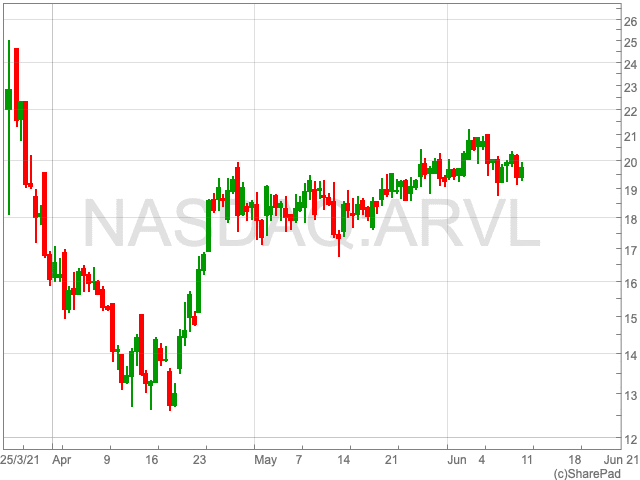

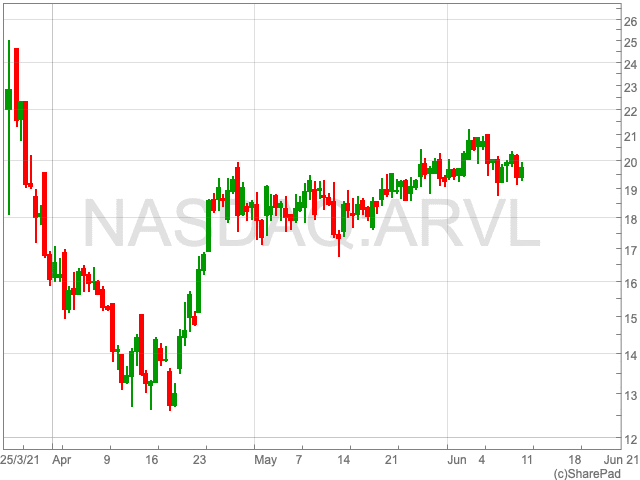

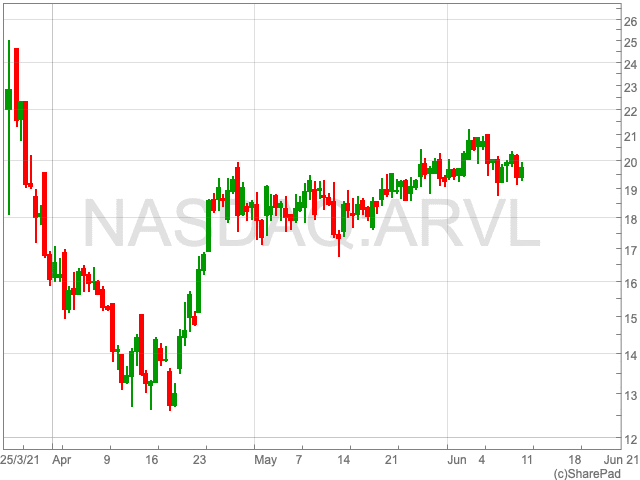

Arrival Share Price

The Arrival share price (NASDAQ:ARVL) crept above $20 this week following weeks of steady gains since the middle of April. It is the first time it has looked like getting back to $22, its level when the electric vehicle manufacturer made its stock market debut in March. Between then and now there has been a steady stream of positive news from the company, as well as wider macro-trends, that suggest its future looks bright. However, investors remain curious about its ability to compete in what is an intensely competitive and increasingly saturated market.

Partnership with Here

The electric vehicles manufacturer confirmed in May that it has established a partnership with Here Technologies, a digital mapping company, to install both location and cloud services in its vehicles.

Arrival says that the technology will improve the performance of its vehicles, thereby reducing its carbon emissions. Tesla and BMW are onboarding similar technologies despite the high costs, as the industry increasingly tightens emissions standards in its major markets.

Here’s capabilities include route calculation, location search and turn-by-turn navigation, Arrival said.

It is the latest partnership from Arrival that serves to show the company’s adaptability and forward-mindedness. Another is its cooperation with Hitachi.

Hitachi

Arrival has joined Hitachi Europe in aiming to deliver new bus and infrastructure solutions across Europe. The partnership’s goal is to merge Arrival’s first-rate products with Hitachi’s digital and operational strengths.

“As governments look to phase out petrol and diesel vehicles in the next decade, providing the wide range of necessary solutions and technologies in an integrated, streamlined and operationally-manageable way will be vital for bus operators and municipalities across Europe,” said Mike Nugent, Head of EV, at Hitachi Europe.

“Arrival’s vehicles already provide a much lower total cost of ownership for customers, and when incorporated into Hitachi’s business model we can see an even more compelling business case for companies to transition their fleets to electric more rapidly,” Hamish Phillips, Head of Sales, UK, at Arriva added.

Hitachi and Arrival have shown intent to create an ecosystem of solutions across the electric vehicle landscape. This could make it easier for customers to navigate the inevitable transition away from fossil fuel vehicles. It appears to be yet another important step in Arrival’s wider plan of gaining market share across vehicle types and geographic boundaries.

Outlook

These deals, in addition to backing from Hyundai and Kia Motors, and orders from UPS and Uber, is shining a pretty bright light on the prospects of the British company. However, the electric vehicle maker’s sales forecasts are ambitious, at $1bn in 2022, and $5bn in 2023, and may have been factored into the Arrival share price. Nonetheless, the company is still early on in its development. While it will have to perform outstandingly well to outperform expectations, the early indicators suggest it is capable of doing so.