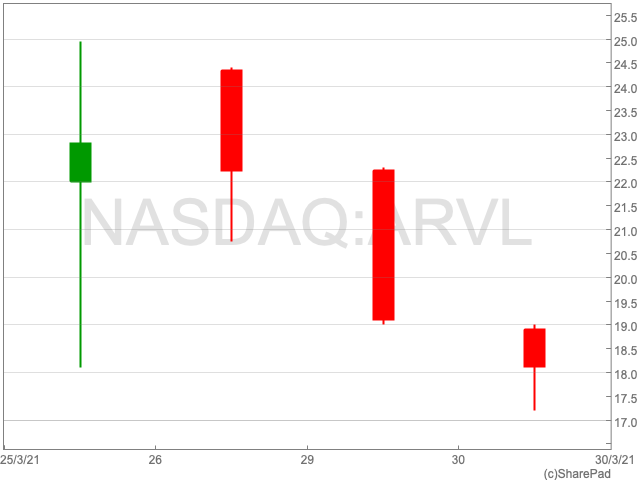

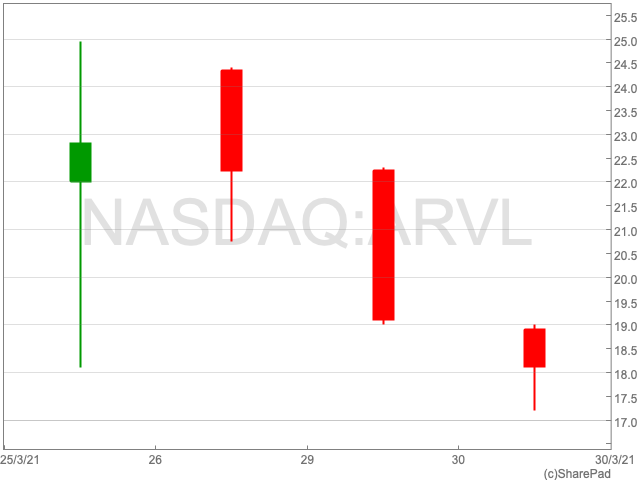

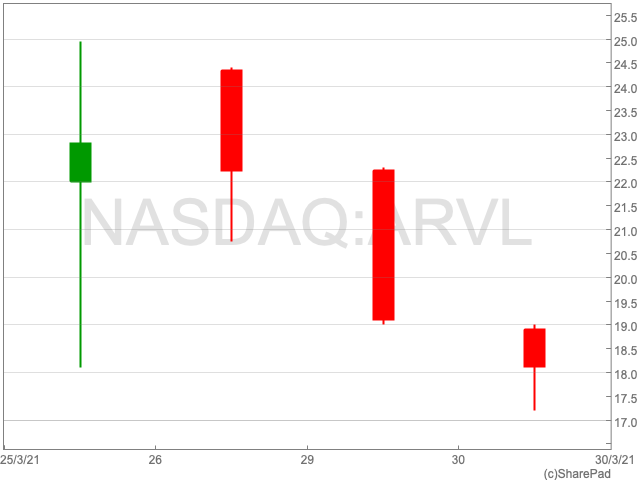

Arrival Share Price

Arrival (NASDAQ:ARVL), a British manufacturer of electric commercial vehicles, made its stock market debut at $22 per share on 25 March, raising around $660m, which valued the company at $13.6bn (£9.5bn). Since then it has come down to $18.12 per share. This followed Arrival completing its merger with SPAC company CIIG on Thursday 25 March. Arrival has said its listing is the biggest by a UK tech company in history.

Outlook

Arrival is expecting to record $1bn in revenue in 2022, increasing to $14billion by 2024, while aiming to become profitable in 2023. While the electric vehicles company has not met all of its pre-orders, it has established $1.2 billion worth of orders from United Parcel Service.

In order to meet the orders, Arrival confirmed it is constructing an additional micro-factory in Charlotte, North Carolina. President of Arrival, Avinash Rugoobur, said that the vertically integrated micro-factories would require less space and investment than traditional manufacturing bases, thereby lowering the company’s long-term cost base.

Electric Vehicles

Founder and chief executive Denis Sverdlov – a former deputy telecoms minister of Russia – said: “We believe that all vehicles will soon be electric, because it is better for people, the planet and business.”

“Arrival’s invention of a unique new method to design and produce vehicles using local Microfactories makes it possible to build highly desirable yet affordable electric vehicles – designed for your city and made in your city,” Sverdlov added.

In February Arrival began trials of its zero-emission Bus with First Bus, one of the UK’s largest transport operators. The trials, which will see Arrival buses navigating existing First Bus routes in the UK, will begin this Autumn. The new partnership comes just seven months after First Bus announced their commitment to purchase no diesel buses after 2022 and to operate a fully zero- emission fleet by 2035.

In addition, earlier in March the company unveiled specs, images and video of the next phase in the development of its electric van which will be starting public road trials with key customers this summer. Arrival believes it has set a new standard for commercial vehicles by introducing a fully electric van that excels across both payload (1975kg) and cargo volume (2.4m3 per metre in length) at a price comparable with fossil fuel vehicles, and with a substantially lower Total Cost of Ownership (TCO).

While the company is clearly making inroads in the growing industry of electric commercial vehicles, it has been ambitiously priced. Therefore investors may be more bullish if the stock comes down a bit more.

“If it comes down below $17.50, you can buy it hand over fist, because this one has the best claim to be the son of Tesla — or daughter, to break the tyranny of that awful cliche,” said Jim Cramer, host of CNBC’s Mad Money.

“We’re still in the early innings of this story, but it’s much more compelling than some of these other small-time electric-vehicle start-ups,” Cramer added.